Aave prepares to launch a crypto-based stablecoin

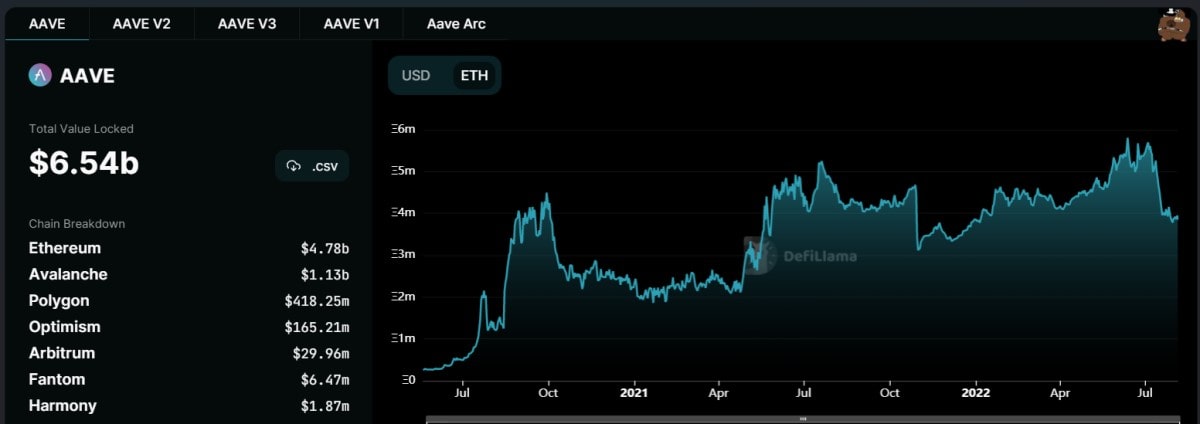

After the collapse of UST, an increasing number of protocols are claiming that they will offer a real decentralised and reliable stablecoin. One such protocol is Aave, which has the third-largest platform in the decentralized finance (DeFi) sector.

Aave is a decentralised financial platform that allows users to lend, borrow, and earn interest on crypto assets. Thanks to smart contracts, payments are made automatically without intermediaries. With this stablecoin, the platform will be able to expand its range of services and increase liquidity.

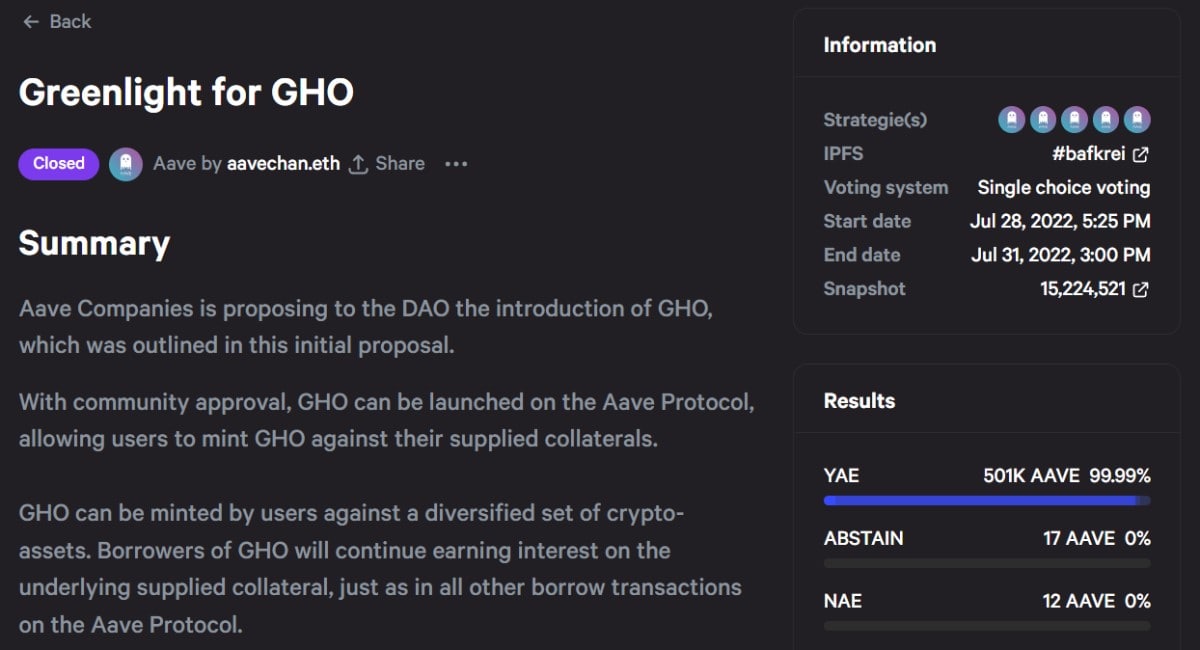

Stablecoin GHO will be available on the Ethereum network and pegged to the US dollar. It will be decentralised just like UST, but it will also be over-collateralised. On July 31, the community almost unanimously decided to give the green light to create a stablecoin called GHO.

Despite the news, the Aave coin price hardly changed, and many users were skeptical about that the launch of another algorithmic stablecoin would be a success. The memories of the collapse of the third largest stablecoin with a capitalisation of $19 billion is still fresh.

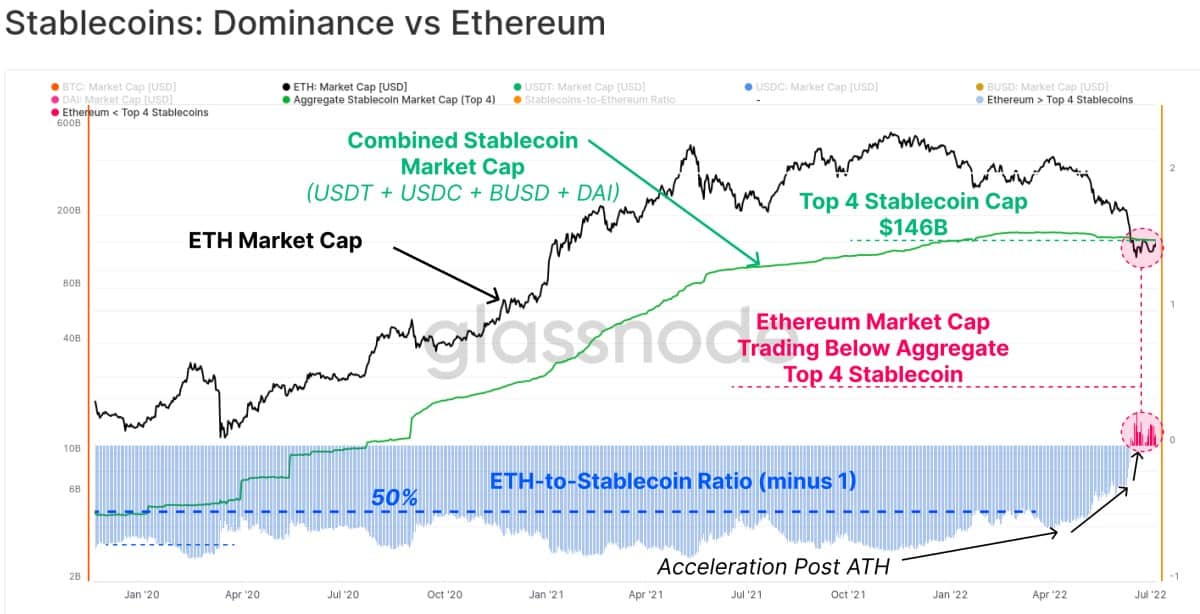

At the same time, the market for stablecoins shows excellent stability relative to the market capitalisation of leading cryptocurrencies. For the first time in history, the aggregate capitalisation of the top four stablecoins have overtaken Ethereum. Before 2022, the aggregate top four stablecoin cap had previously topped out at 50% of Ethereum’s market cap.

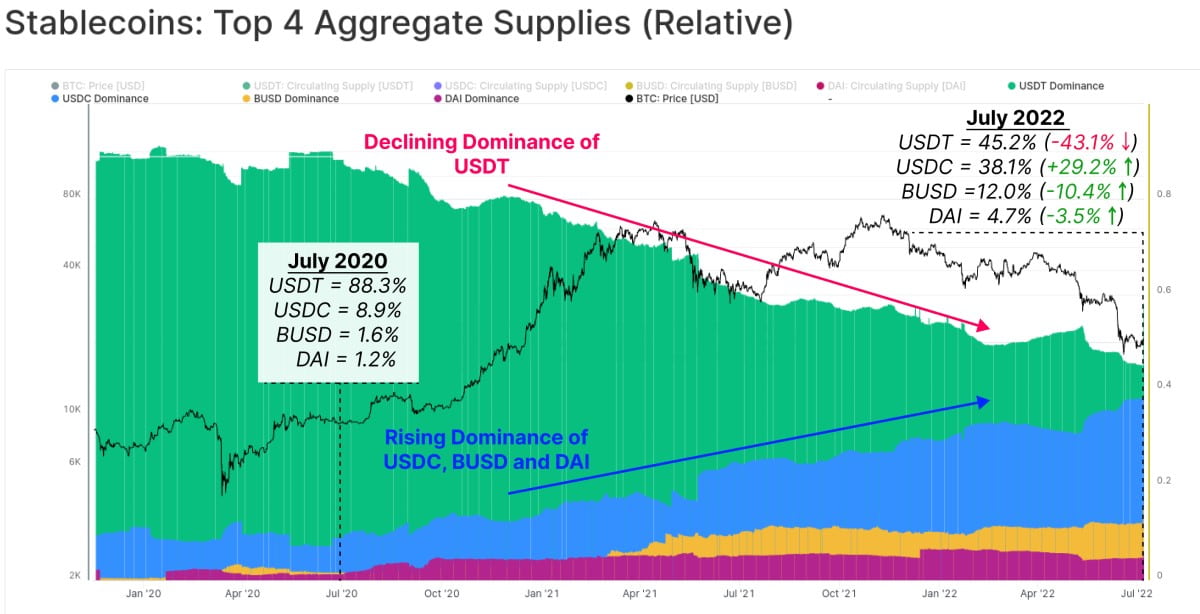

The growing market share of the DAI stablecoin cryptocurrency proves that all is not yet lost for algorithmic stablecoins. The coin was launched back in 2017 and is over-collateralised. That means for every $1 of Dai in existence, there is collateral worth at least $1.3 in a maker vault. And in the case of a drop in the collateral margin, there will be a reverse forced conversion.

Over the past two years, due to the questionable quality of the reserves backing Tether, its market share has fallen from 88.3% to 45.2%. During the same time, the DAI's market share rose from 1.2% to 4.7%. If Aave can release a product that meets the needs of the market, the internal coin is likely to grow in price. A community vote on the parameters of the stablecoin is coming soon.

StormGain Analytics Team

(crypto trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.