Bitcoin's abysmal new low

The crypto news climate remains negative as institutional investors continue to pull out capital from digital assets. This is putting pressure on Bitcoin, which is just on the cusp of breaking one record that nobody will begrudge it: eight consecutive weeks of week-over-week declines.

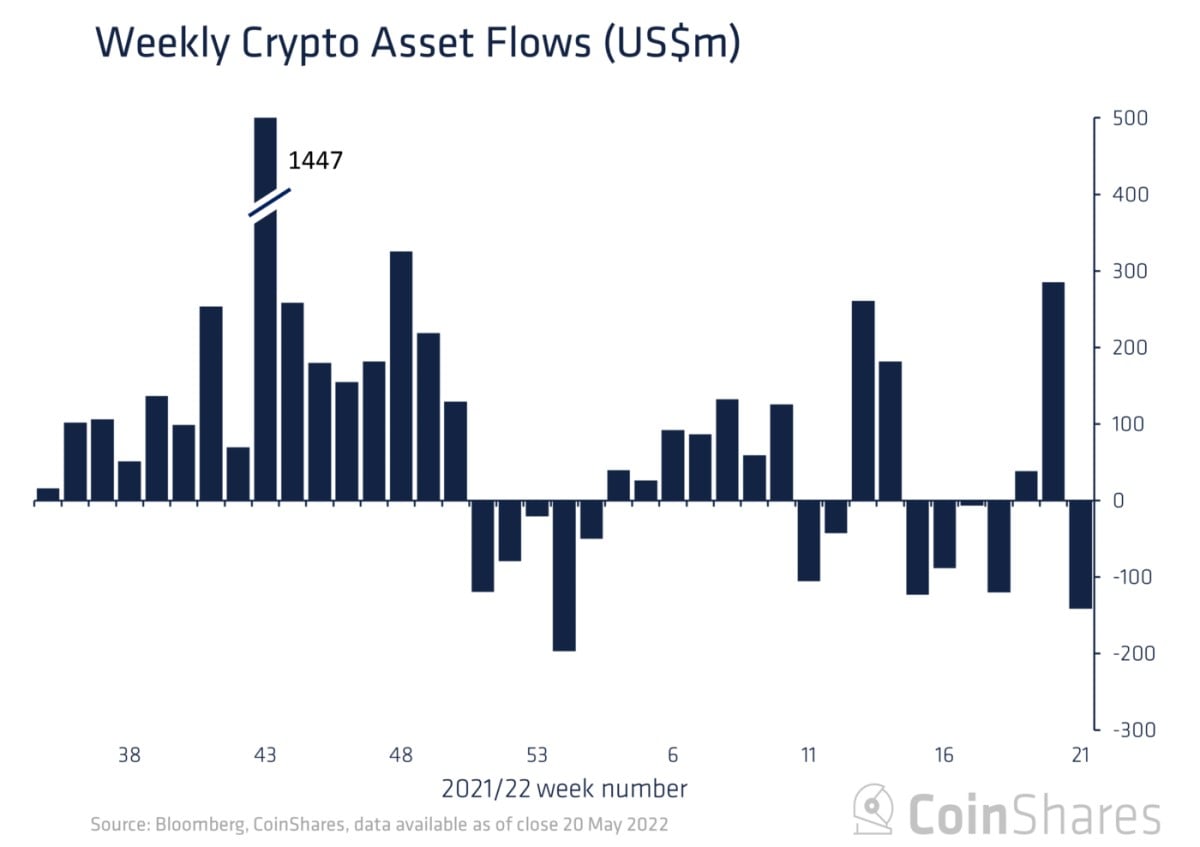

Capital outflows from cryptocurrency investment funds last week reached a peak unseen since July 2021 as $141 million was wiped off its value. The total amount of capital managed by funds has fallen to $38 billion.

Investors are withdrawing funds from high-risk assets as a result of the Fed's monetary tightening policies. We are seeing this trend repeated across a wide range of financial instruments, including the stock market, as a result of which the US dollar index hit a seven-year high.

Cryptocurrency exchanges are seeing strong outflows of Bitcoin alongside falls in transaction volumes. The total amount of funds held on crypto exchanges has similarly dropped to 2.5 million BTC, with Coinbase boasting the largest reserves with a 34% share of total funds.

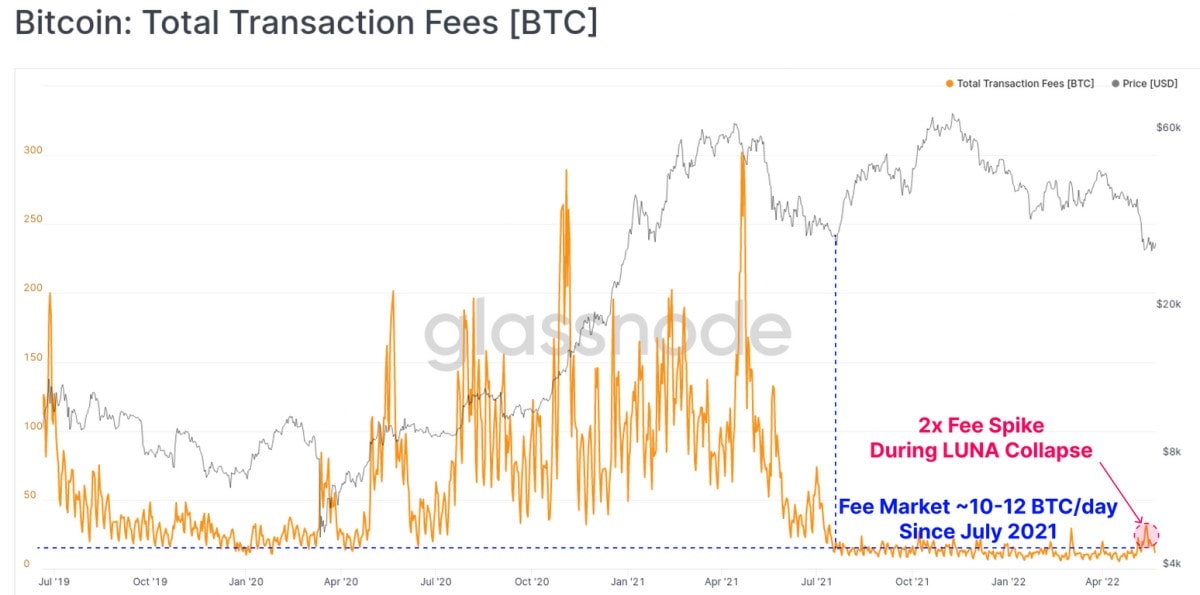

The low network activity is translating to a drop in commissions. Following the recent spike caused by the collapse of Terra (LUNA) and the rush to Bitcoin as a relative safe haven, total commission fees have now dipped to 10-12 BTC per day.

The key metrics indicate that market participants are cautious. Trading activity is on the wane, while Bitcoin is flowing out to cold wallets and options trades have seen the put/call ratio rise from 50% to 75%, suggesting that investors are seeking to hedge against the risk of future declines.

This general weakness in the cryptocurrency market will only intensify the negative opinion surrounding Bitcoin. Thus, on 22 May, ECB President Christine Lagarde stated that cryptocurrencies are not backed by anything that could provide them with some sort of stability. Then, on 23 May, Bank of England Chairman Andrew Bailey said that Bitcoin has no intrinsic value and is not suitable as a payment method.

Amid this kind of pressure, it's unsurprising that we're hearing more and more forecasts predicting a Bitcoin crash. Guggenheim Partners' Scott Minerd, for instance, has predicted a drop to $8000 and has compared crypto to the dot-com bubble of the early 2000s.

StormGain analytical group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.