Bitcoin could hit $200,000 due to higher global liquidity

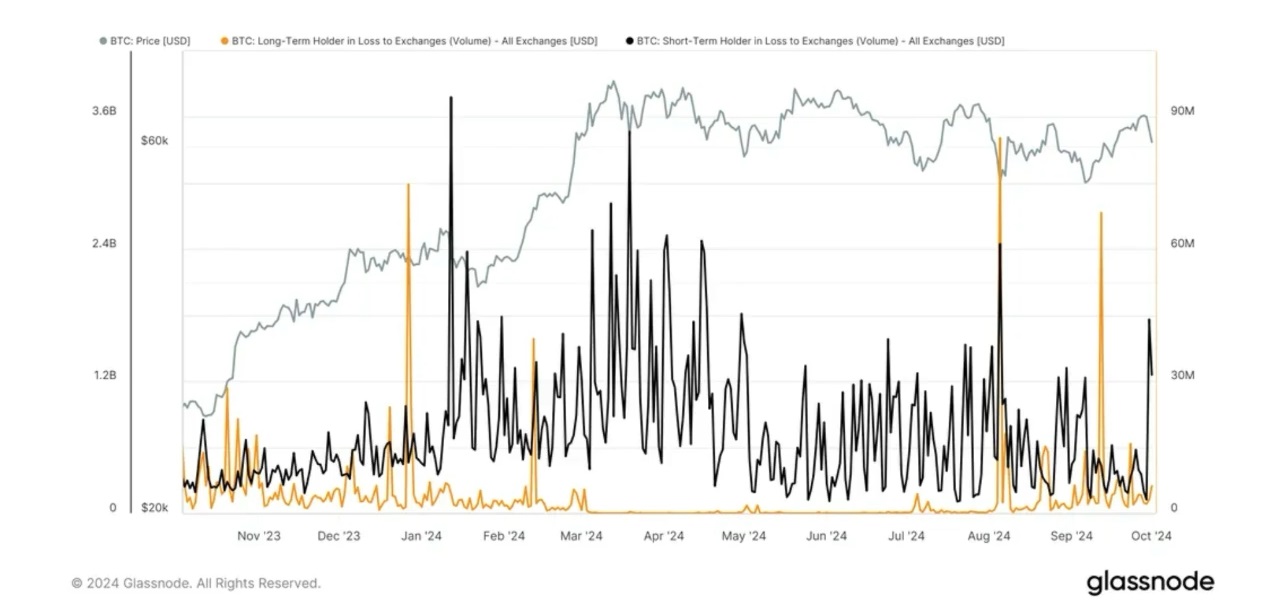

For the past seven months, Bitcoin has been hovering around $60,000, which is why short-term holders (STH) are once again losing their nerve. Over the past two days, they have sent $4 billion to crypto exchanges, $3 billion of which are coins with losses.

This is the most STH have sent since 5 August, when Bitcoin fell 17% in one day to reach $49,000.

Unlike them, long-term holders (LTH) have increased their reserves since March despite seeing higher unrealised losses.

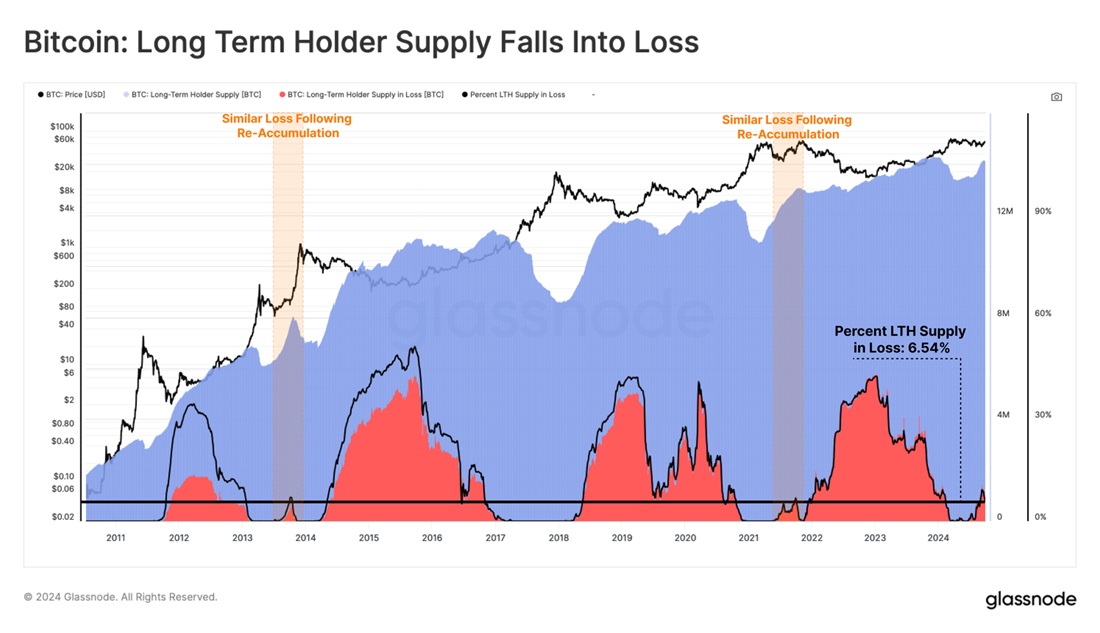

The difference in their assessment lies in the planning horizon. While STH look for immediate profit, LTH have an eye on long-term trends. The long-term is where Bitcoin still holds all the cards. Let's first take a look at price fluctuations. They replicate previous cycles that originate from local lows with amazing accuracy. In other words, statistics point to the cryptocurrency soon returning to upward movement.

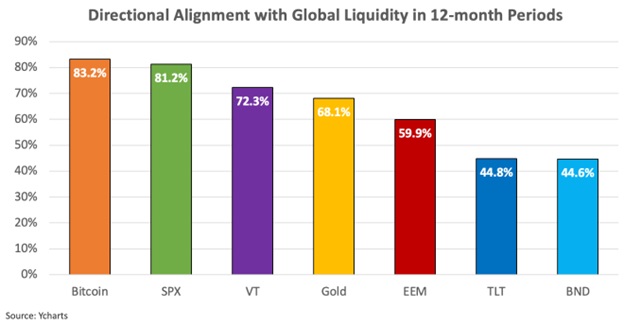

Bitcoin's dependence on the influx of global liquidity is one of the most important macroeconomic factors for this. In a report commissioned by Lyn Alden, Sam Callahan lays out the correlation of global monetary supply M2 with major financial instruments. It turns out that Bitcoin tracks liquidity with the most precision. Its price goes up when the amount of money in the world increases, and it falls when liquidity shrinks.

Bitcoin has an 83.2% correlation compared to 81.2% for the S&P 500 and 68.1% for the gold.

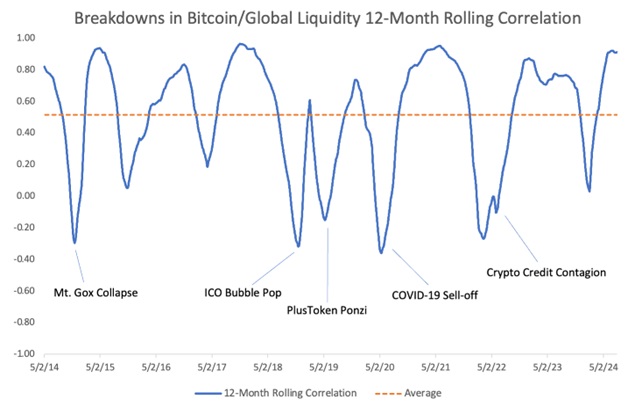

An important attribute for assessing the correlation is the choice of intervals. The longer the period under consideration is, the higher the correlation is. This is due to Bitcoin's high volatility and microeconomic factors' impact on its price. The chart below shows events that negatively affected the correlation.

Since we know one of the main catalysts for this, we just need to superimpose the chart for the projected growth of global liquidity on a chart showing Bitcoin's price.

By the look of it, Bitcoin could expect a huge boost toward the end of the year. When looking at the last chart, the forecast from CleanSpark, one of the largest publicly traded miners, that Bitcoin will reach $200,000 in the next bull cycle doesn't seem so far-fetched.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.