Bearish Bitcoin metrics

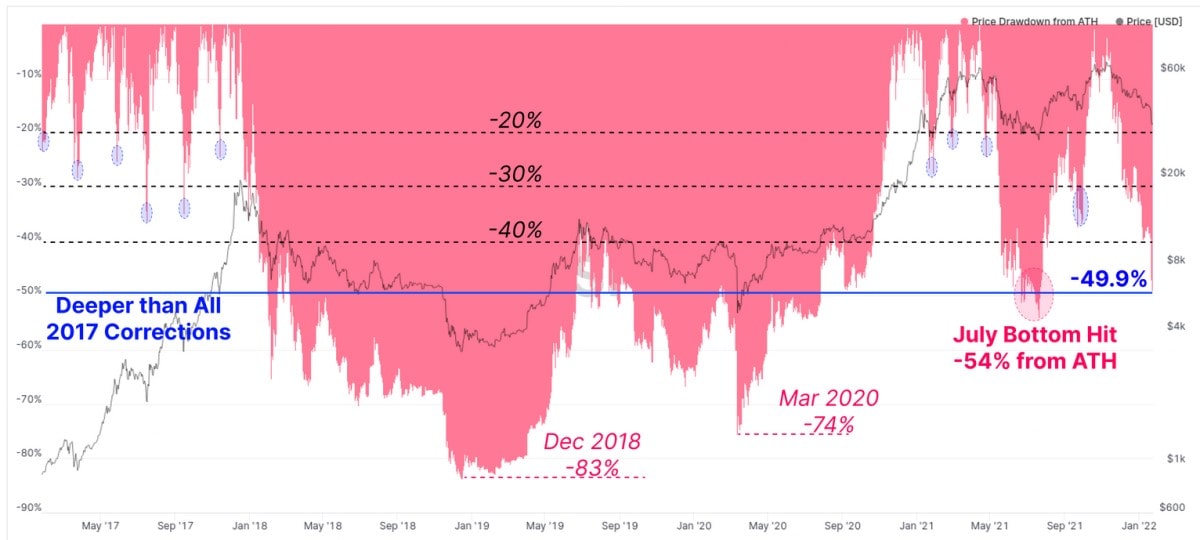

The cryptocurrency market has already corrected by 45% from all-time highs as investors took $2.5 billion in net losses in the last week alone. Bitcoin has bombed 50% from its recent peak, with the lion's share of the sell-off attributable to short-term holders.

However, Bitcoin's latest correction is far from its most dramatic. Indeed, in July of last year, it declined by 54%, and in 2018, it fell by 83%.

And once again, it was short-term holders (those holding for 155 days or less) who were hit the hardest, either selling close to the price they paid or taking losses. By increasing the volume of coins on the market, they actually served to strengthen the bearish trend. Currently, this investor group controls 18.3% of total supply, and virtually all of them are down on their initial investment at present (light red section of the chart).

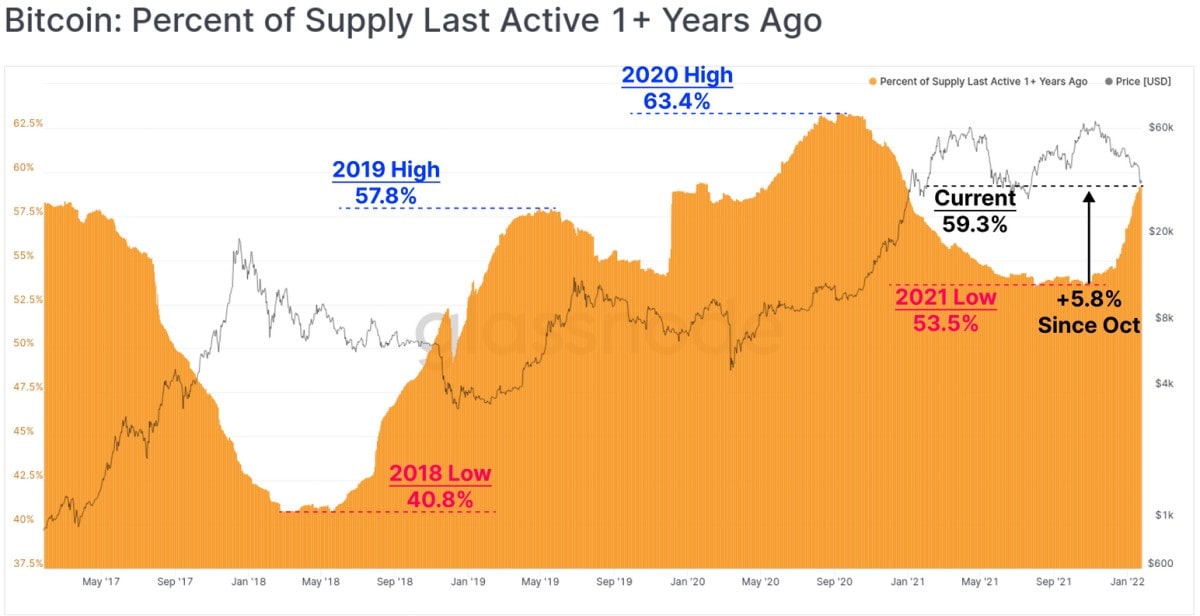

They are counterbalanced by long-term 'HODLers' who stopped the sell-off brought about by Bitcoin's reaching a new all-time high. In this group, only 6.1% of coins held currently represent a loss. What's more, the total volume of coins that have been dormant for more than a year has risen to 5.8%. Once again, we can see a difference in the behaviour of short-term holders and HODLers during this cryptocurrency market correction.

We previously explained that the current intrinsic cost of mining 1 BTC is $34,000. As prices approach this level, the vast majority of miners will hoard coins and wait for the next bullish phase. As short-term holders calm down and market supply falls, prices should start to rise, provided no additional political factors come to the fore.

Beyond the 'Russian threat' against Bitcoin, there is a further risk in the form of IMF pressure on El Salvador. El Salvador famously recognised Bitcoin as legal tender last year despite the IMF's negative opinion of the move and the poor state of the economy of the country, whose YoY budget deficit stands at around 5% of GDP. El Salvador is banking on the IMF providing it with a $1.3 billion loan, which it needs to restructure its external debt. In a report released yesterday, the IMF called upon El Salvador to restrict the scope of the law on Bitcoin and remove its status as an official payment method, hinting that this would be a necessary step to receive a loan. If El Salvador relents, this will provoke a further correction.

StormGain analytics group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.