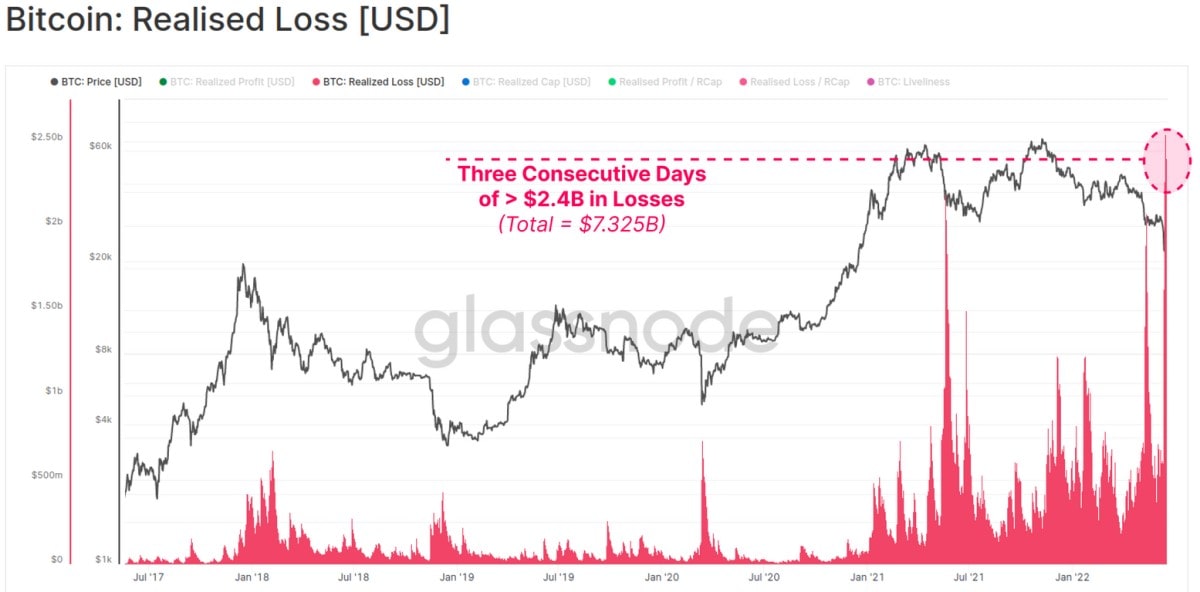

Bitcoin: largest realised loss and outflow from ETFs

Bitcoin's 70% drop from its all-time high, the expectation of further tightening of the Fed's monetary policy and a recession in the United States have led to a number of new lows. The world's first exchange-traded investment fund (ETF), which was launched in Canada, saw the withdrawal of half of its investments in just a day. The fund's assets decreased from 47,800 BTC down to 23,300 BTC.

Realised losses are the difference between the purchase price and the subsequent sale of the coin along the chain. They also reached an all-time high of $2.4 billion per day and $7.3 billion over three days.

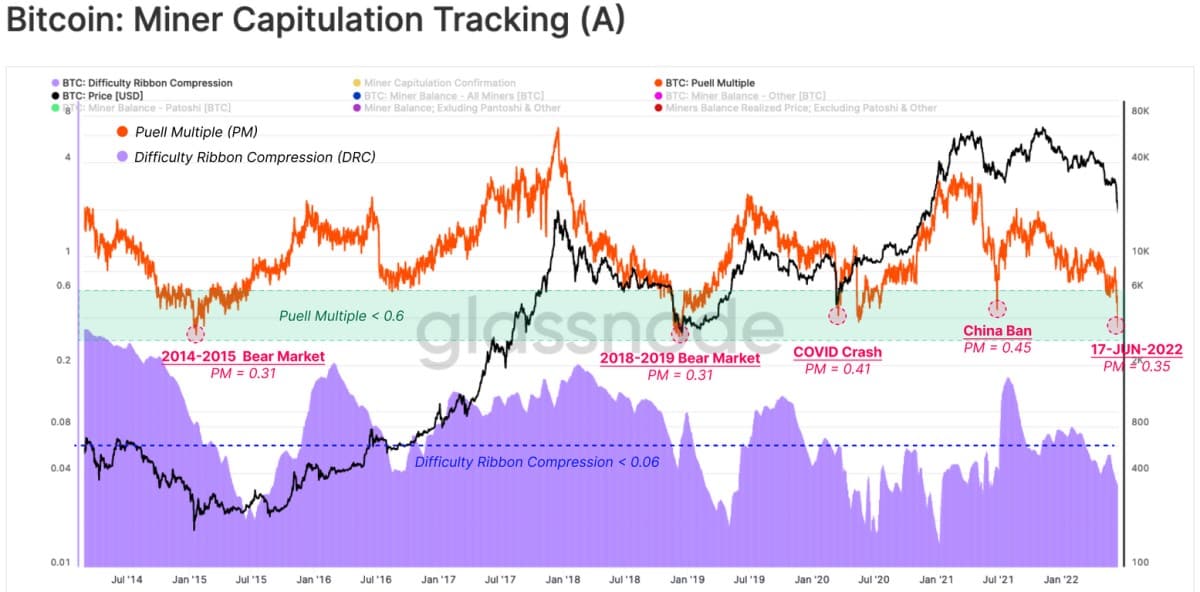

Miners are in agony. In recent years, they've expanded production capabilities by attracting external investment. Now, their current combined revenues are 65% lower than the annual average (the Puell Multiple). The situation was only worse at the end of 2018 when Bitcoin fell by 85%.

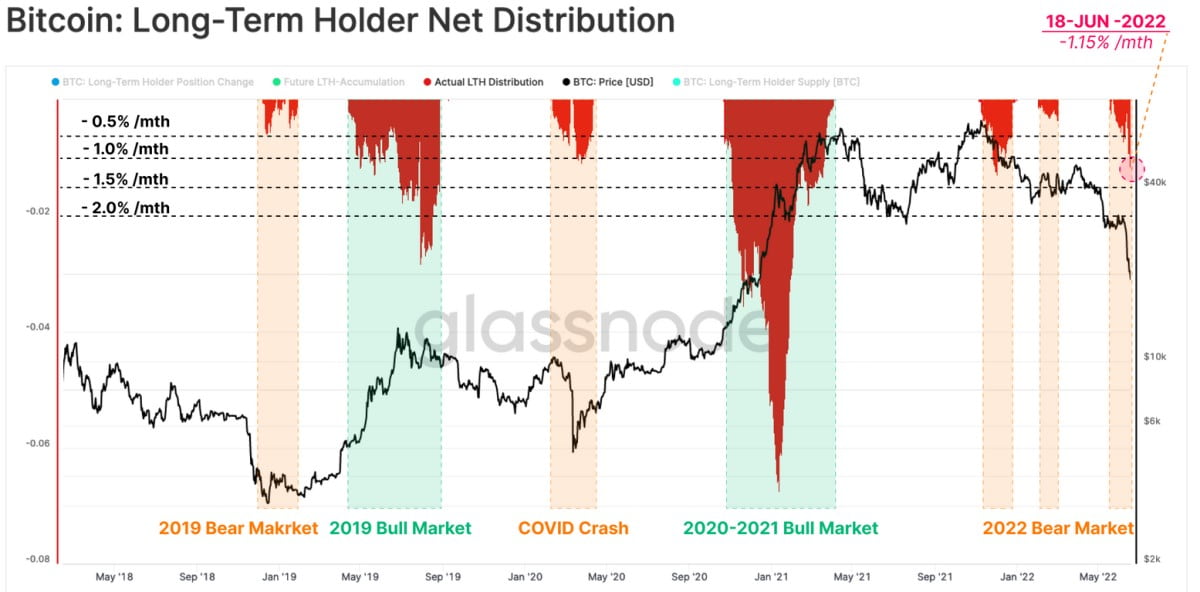

Under pressure from negative trends, long-term holders (LTH) have reduced their cumulative inventories by 1.3% or 178,000 BTC over the past week. The speed at which they are parting with their coins exceeds that seen in 2018-19, but it is negligible compared to the sales arranged during bull sprints. Despite unrealised losses, LTHs mostly maintain their Bitcoin.

The main panic is seen in the DeFi sector, where the unbalanced decisions of a number of projects have led to events such as the complete ruin of depositors, the freezing of clients' funds or the rewriting of a smart contract to sell off the assets of a whale investor.

Due to the reallocation of coins, the presence of synthetic cryptocurrencies (for example, stETH) and the love of excessive margin trading, the cryptocurrency market is currently experiencing an immense amount of volatility and outflow.

On the other hand, without any of these elements, capitalisation growth and overall investment attractiveness would not be so significant. It's hoped investors will be more cautious and that investment products will be more balanced in the next bull cycle.

StormGain Analysis Group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.