Bitcoin: Good news and bad news

Crypto enthusiasts are celebrating an interim victory over excessive industry regulation, but yesterday was packed with more than just positive news. The SEC took the extremely rare step in its court case against Binance, which hints at far-reaching negative consequences for the industry.

SEC vs spot ETFs

The regulator has been long criticised for its unjustified tough enforcement. This applies to giving all altcoins the status of a security in verbal statements and the refusal to allow Bitcoin spot ETFs. The latter circumstance looks particularly strange: while refusing to launch spot funds, the SEC permits Bitcoin futures ETFs to operate.

The largest Bitcoin trust fund, Grayscale, which has raised $17 billion in investments from institutional investors, was refused by the SEC to convert the fund into a spot ETF in mid-June 2022 and immediately appealed. Yesterday, the US Court of Appeals for the District of Columbia Circuit ruled that the SEC "acted arbitrarily and capriciously" and that the regulator needs to reconsider Grayscale's application.

Cryptocurrencies, Grayscale and mining stocks skyrocketed on this news.

The Judiciary Committee noted the SEC's lack of clear reasoning since the regulator cited that "the Bitcoin market is subject to fraud and manipulation" as the only reason for the application's rejection. But those same risks also apply to futures ETFs. For the regulatory approach to be equal, the SEC must either allow all types of cryptocurrency funds or ban them.

Some experts have already predicted that Grayscale will win since the SEC will have a hard time finding a new suitable argument to ban the fund's conversion. This means that the launch of spot ETFs will be potentially approved. The regulator now has eight applications, with the deadline for reviewing them expiring in early 2024.

SEC vs Binance

Amid the joy of Grayscale's victory, the news of the SEC's submission to the court of 37 sealed materials with evidence of Binance's violation of US (and possibly international) laws went unnoticed. For a regulator that deals with administrative rather than criminal cases, submitting sealed documents is an extraordinary decision.

According to former SEC Head John Reid Stark, the Department of Justice will soon join the prosecution against Binance. Sealed materials are necessary for supporting the investigation, keeping confidential informants secret or avoiding compromising an upcoming operation to arrest suspects.

The US Department of Justice will likely accuse it of laundering funds received through illegal means and violating international sanctions. It's noteworthy that the day before secret information was passed to the SEC, the crypto exchange limited Russians' access to the P2P service and announced a possible complete withdrawal from Russia.

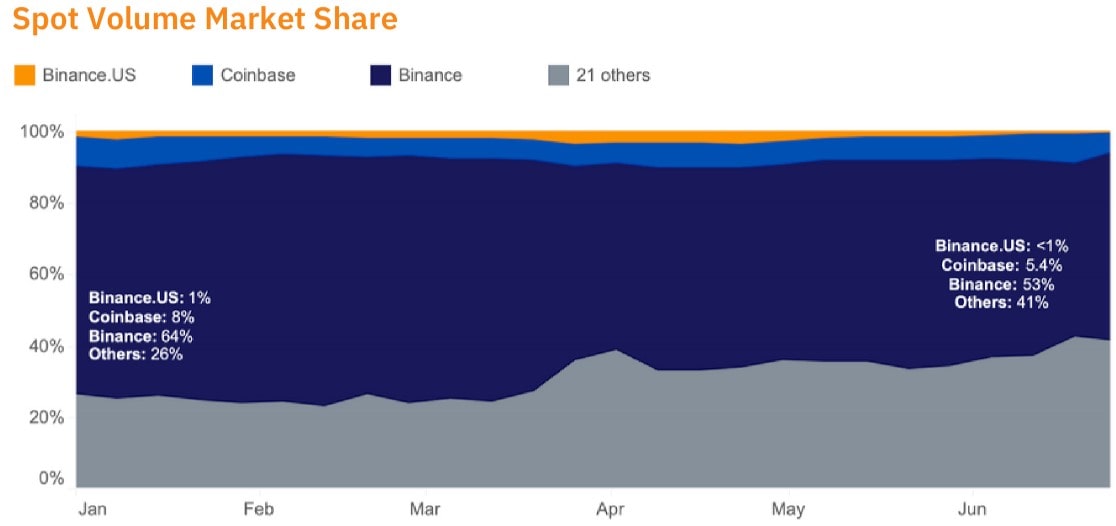

Despite the difficulties that Binance has encountered in 2023, it remains the largest international player in the spot trading market, with a market share of 53%. If big accusations are made against it, the market's reaction could be extremely negative.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.