Fundamental Factors Are in Favour of Bitcoin Growing in Q4

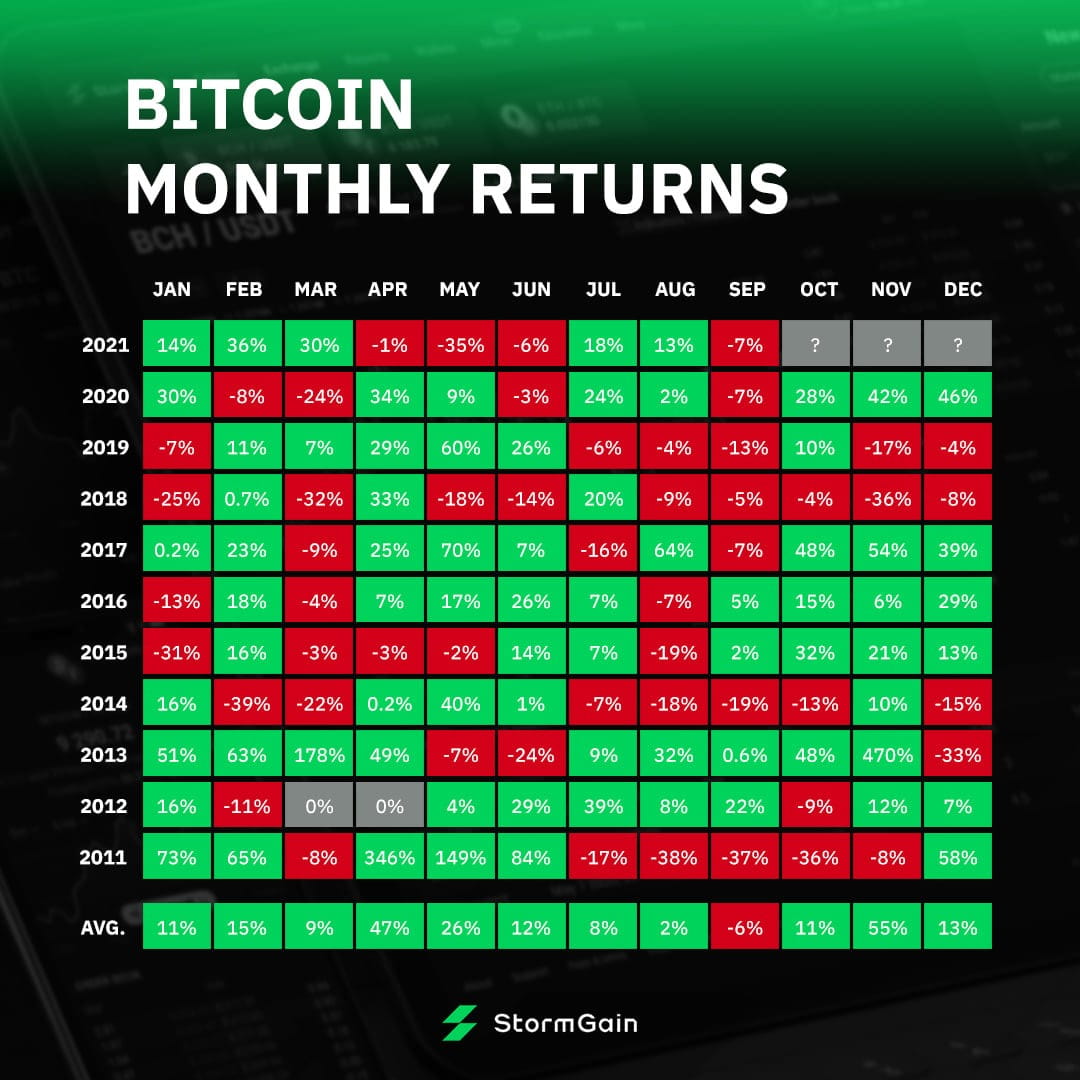

Statistics are straightforward things. While Bitcoin normally goes down in September, from October to December, it grows by double-digit figures. Last October, for example, the coin grew by 28% and by over 40% in November and December.

Institutional demand for Bitcoin is on the rise again. According to data from CoinShares, last week, all investment products related to it received over $226 million, and the investment grew by 227%. This positivity is linked with the backing of SEC Chairman Gary Gensler, who has given to the launch of a Bitcoin ETF, an exchange-traded fund that allows investment companies to work with cryptocurrency on a stock exchange. Earlier this year, this instrument was approved for Canada’s Toronto Stock Exchange. In the United States, similar applications are being held with a watchdog agency.

US Federal Reserve Chairman Jerome Powell recently said that the regulator is reluctant to restrict Bitcoin in any way. This has placated investors who fear a repeat of the Chinese scenario in which the government came down harshly against cryptocurrency trading and mining. A growing number of investors have been calling the cryptocurrency ‘digital gold’ due to its built-in revaluation mechanism. JPMorgan spoke last year already about investors’ preferences for Bitcoin over gold.

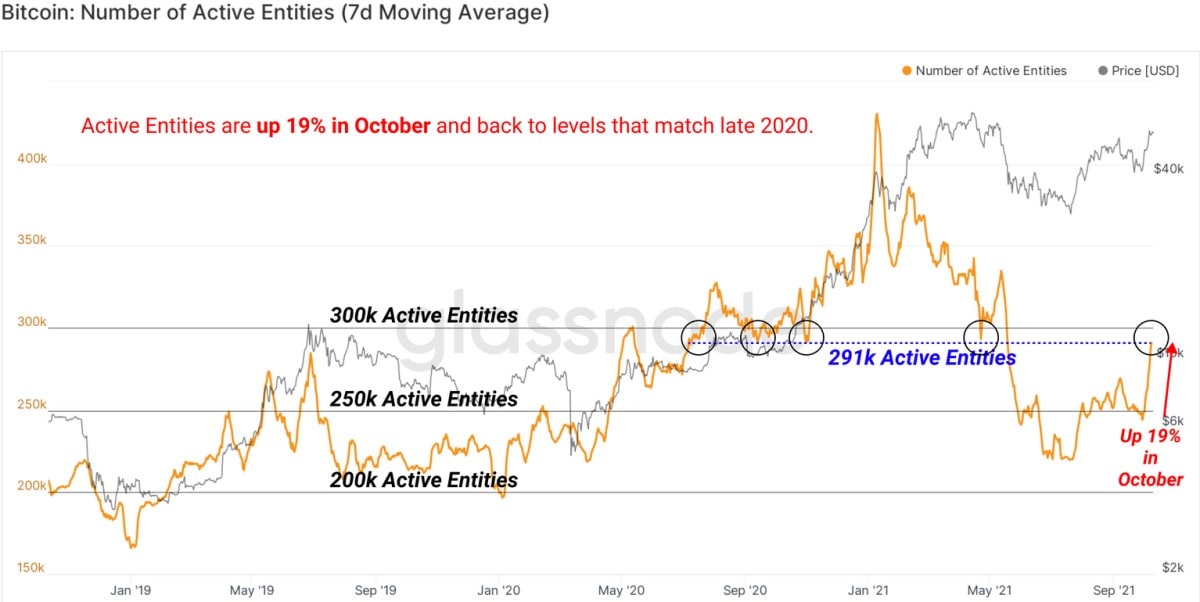

With the growth of institutional demand, the average transaction size has grown from 0.9 BTC in August to 1.3 BTC in September. The number of daily active market participants grew by 19% last week to 291,000.

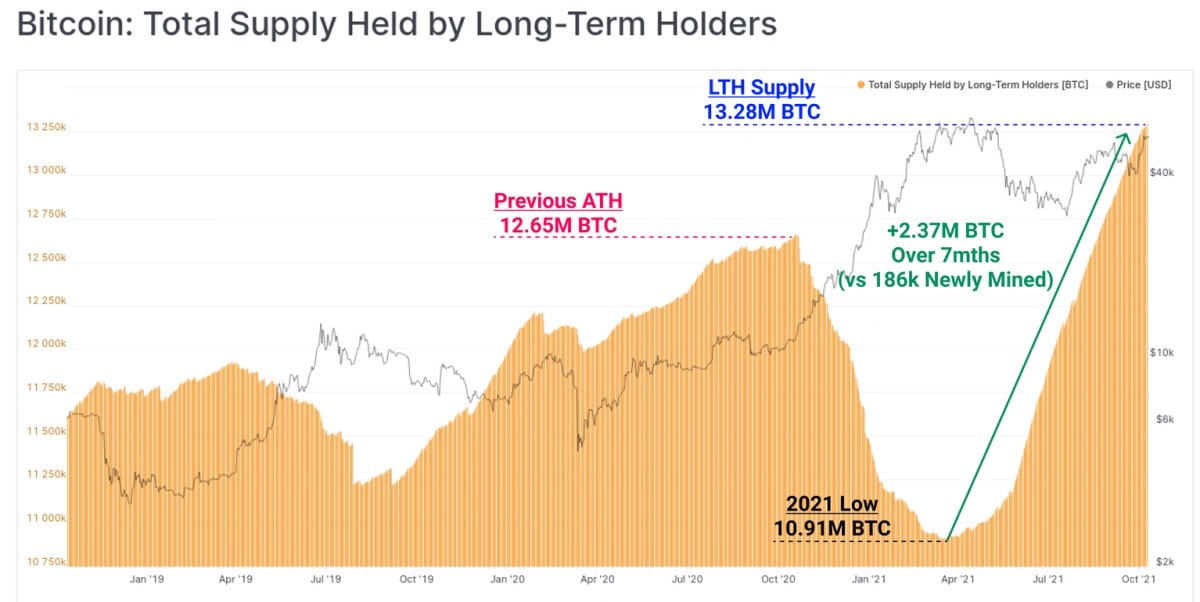

Another bullish factor is Bitcoin’s retention in wallets in anticipation of its continued growth. In the past 7 months, holders have reserved over 2 million BTC, while only 186,000 BTC have been mined, and the total number of coins held by long-term holders (LTH) has reached 13.3 million BTC.

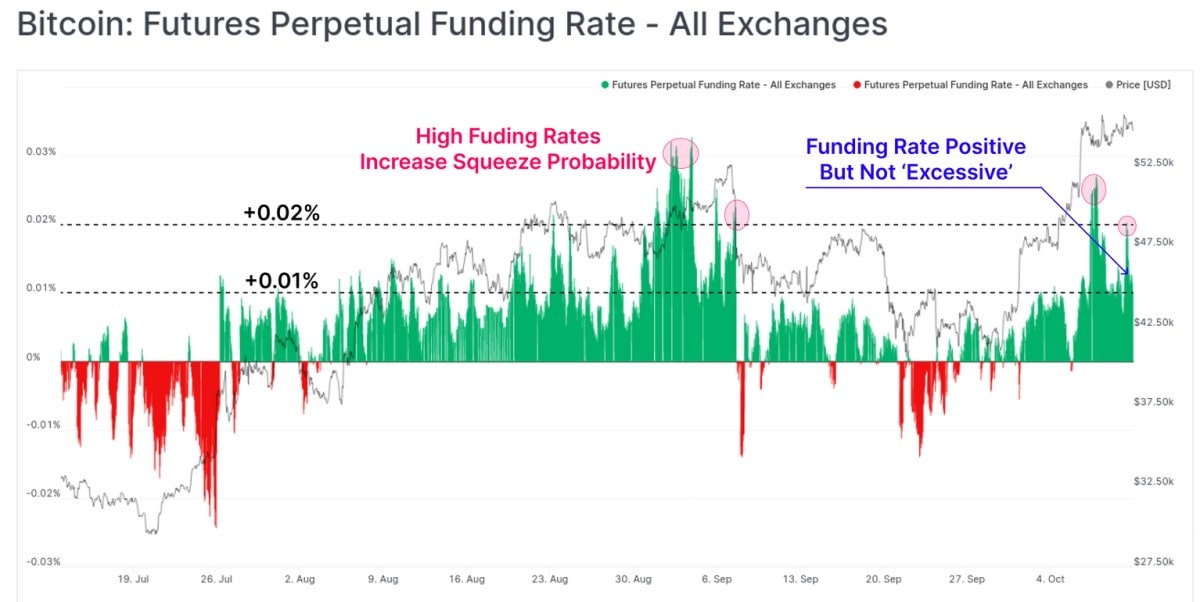

But big capital isn’t the only party expecting Bitcoin to grow. Judging by the growing funding rate of perpetual futures contracts, traders are again turning to leverage to buy more coins.

Metrics, statistics and fundamental factors are unanimously signalling that the last quarter of 2021 will be positive for Bitcoin.

The StormGain Analytical Group

(a platform for trading, exchanging and safeguarding cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.