Goldman Sachs: Bitcoin the best asset of 2023

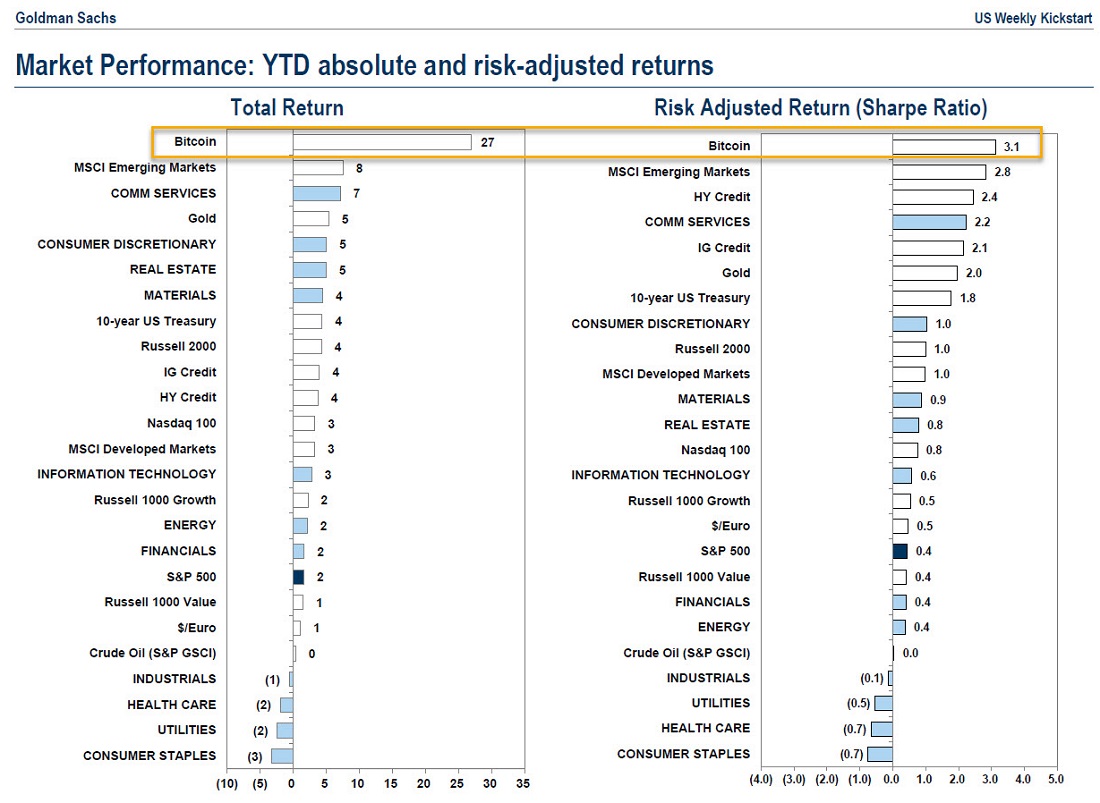

With Bitcoin rising by 40%, January 2023 could be the best month for the cryptocurrency in the past 10 years. Goldman Sachs, one of the biggest banks in the world, rated the cryptocurrency as the most profitable asset when adjusted for risk. Bitcoin has outperformed gold, the stock markets and the real estate sector by a significant margin.

Just a year ago, Goldman Sachs predicted Bitcoin would reach the $100,000 mark in the long term since the digital asset would eventually take a share from gold, which is seen as a safeguard against inflation.

Analysts from Pureprofile arrived at this same figure after conducting a study commissioned by Nickel Digital Asset Management. The experts interviewed included 200 institutional investors and asset managers from the US, the EU, Singapore, the UAE and Brazil. The respondents manage a combined $2.85 trillion in total assets.

The study found that 9 out of 10 investors predict that Bitcoin will see its price rise in 2023, and two-thirds of those surveyed agree that it could hit $100,000 in the long term. Of all respondents, 23% expect its price to rise above $30,000 by the end of this year.

Markus Thielen, an analyst at Matrixport, wrote in a note to his clients that the January bump was largely due to interest by US institutional investors. He added that organisations were buying both spot and futures contracts, which was reflected in the premium. He went on to add that Matrixport interprets this as a sign that hedge funds are buying up the long crypto market drop.

The Chicago Mercantile Exchange's (CME) Bitcoin Futures Open Interest chart also shows increased interest in the cryptocurrency. Movement on the chart significantly surpasses the price: January had a 77% increase, reaching $2.3 billion.

While the price's current rise is provoking a response in investor sentiment, market participants should exercise caution. The Federal Reserve has not yet abandoned its monetary policy tightening, and the risk of the global economy plunging into a recession remains. If traditional financial assets collapse, Bitcoin will have a hard time maintaining its positive movement.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.