Bitcoin mining difficulty hits new all-time high

The Chinese ban on mining in May 2021 sent the ASICs market into a veritable frenzy as the subsequent reduced network capacity led to a drop in calculation difficulty and a rise in profitability. Western companies cashed in on this development by making huge equipment orders. In October 2021, for instance, Marathon Digital took out a $100 million loan to buy a fleet of the latest S19 XP machines, which boast a capacity of 140 Th/s. The company's aim is to become the most powerful publicly-traded miner in the world within one year.

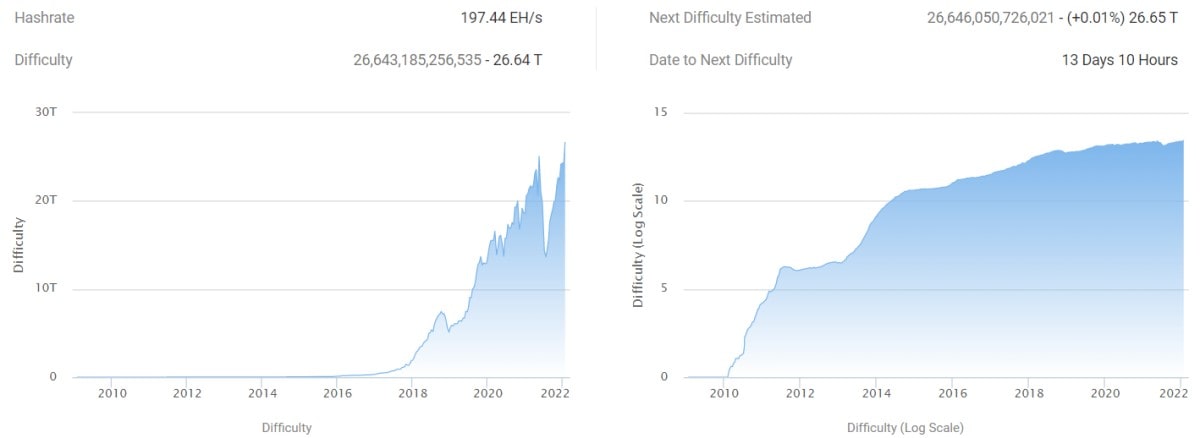

The growth in computational capacity led first to a record increase in the network's hashrate, followed by a similar jump in calculation difficulty. These two indicators are inextricably linked since the system is programmed to try and maintain a block creation speed of 10 minutes. On 21 January, Bitcoin mining shot up 9.3% in a single day.

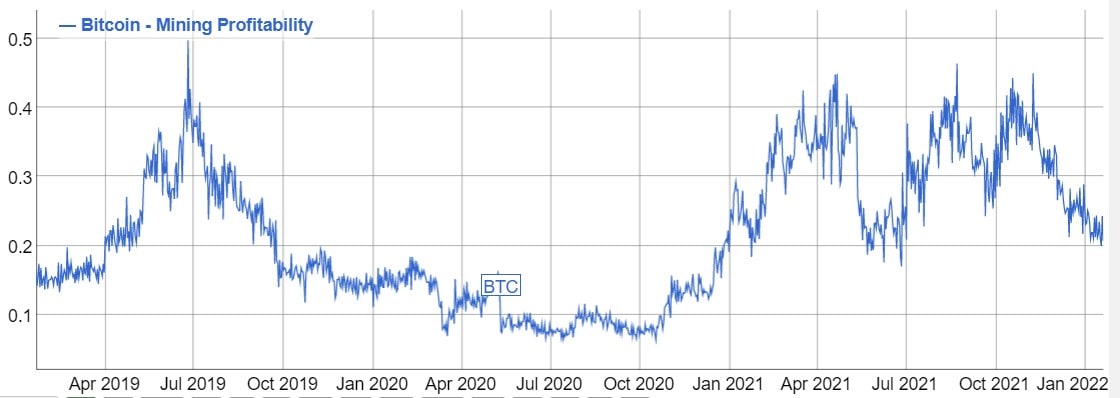

Despite the rise in difficulty, the profitability from one hashrate is two times higher than the all-time low. This is due to the relatively high price of Bitcoin and improvements in equipment. For example, the aforementioned ASIC S19 XP is estimated to guarantee an income of $18.50 at electricity prices of $0.10 per 1 kWh.

The current intrinsic cost of mining 1 BTC is estimated at $34,000, so a correction to $38,000 is no big inconvenience for miners with the latest equipment. However, it will induce an increasing number of market participants to shift their focus towards accumulating coins in anticipation of future price growth.

Reduced supply as a result of coin accumulation typically leads to price rises. That said, the crypto market (much like any other financial market) can experience periods of euphoria or panic. A potential ban on cryptocurrency transaction and mining in Russia — the third biggest contributor to the Bitcoin hashrate — could provoke a coin sell-off. In that case, we would see a repeat of last year's 'China scenario', which was characterised by a drop in network capacity followed by a prolonged Bitcoin correction.

StormGain analytics group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.