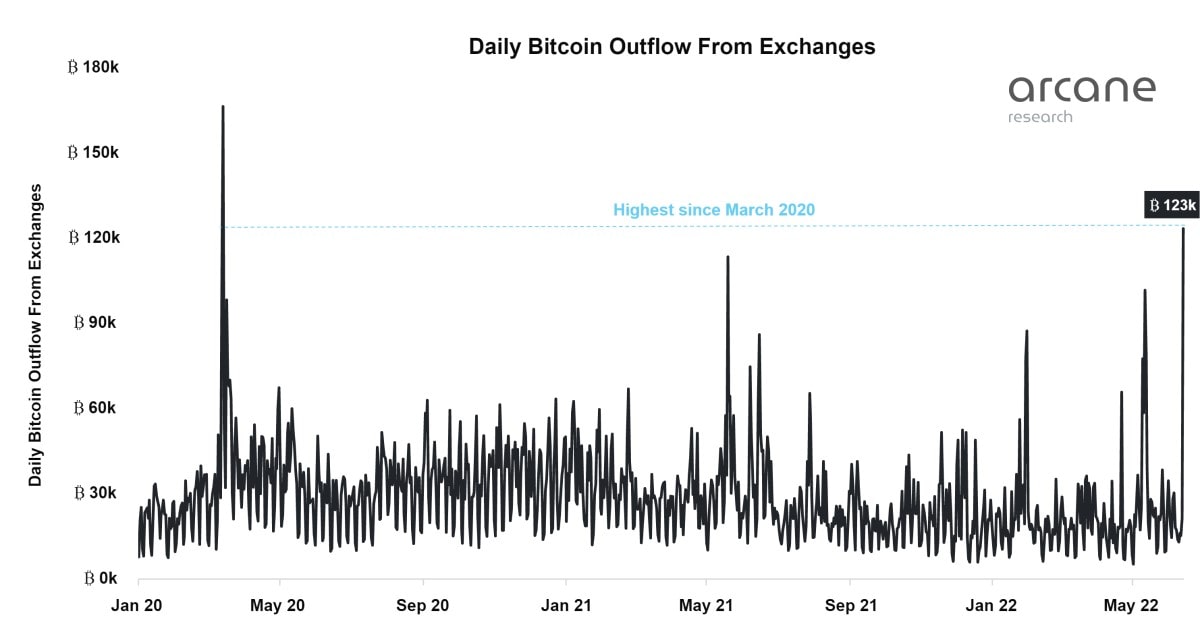

Bitcoin outflow from crypto exchanges at a two-year high

The freeze on Bitcoin withdrawals by the largest crypto exchange by trading volume, the crisis among a number of DeFi projects and the crypto market's drop in capitalisation to below $1 trillion led to the largest one-day Bitcoin outflow since March 2020. On 13 June, 123,000 BTC was withdrawn from crypto exchanges.

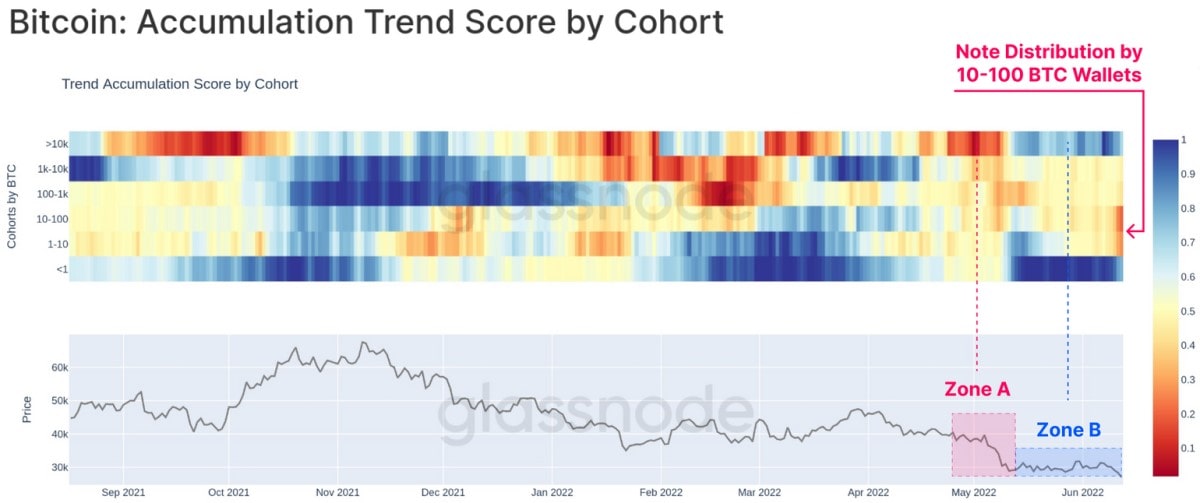

Blue whales (>10,000 BTC), who actively got rid of coins in May (Zone A), transitioned to accumulating Bitcoin in June (Zone B). Shrimp (<1 BTC) are more active; this group has bought half of the coins mined since November. If they were the prevailing force in the market, Bitcoin wouldn't have traded so low.

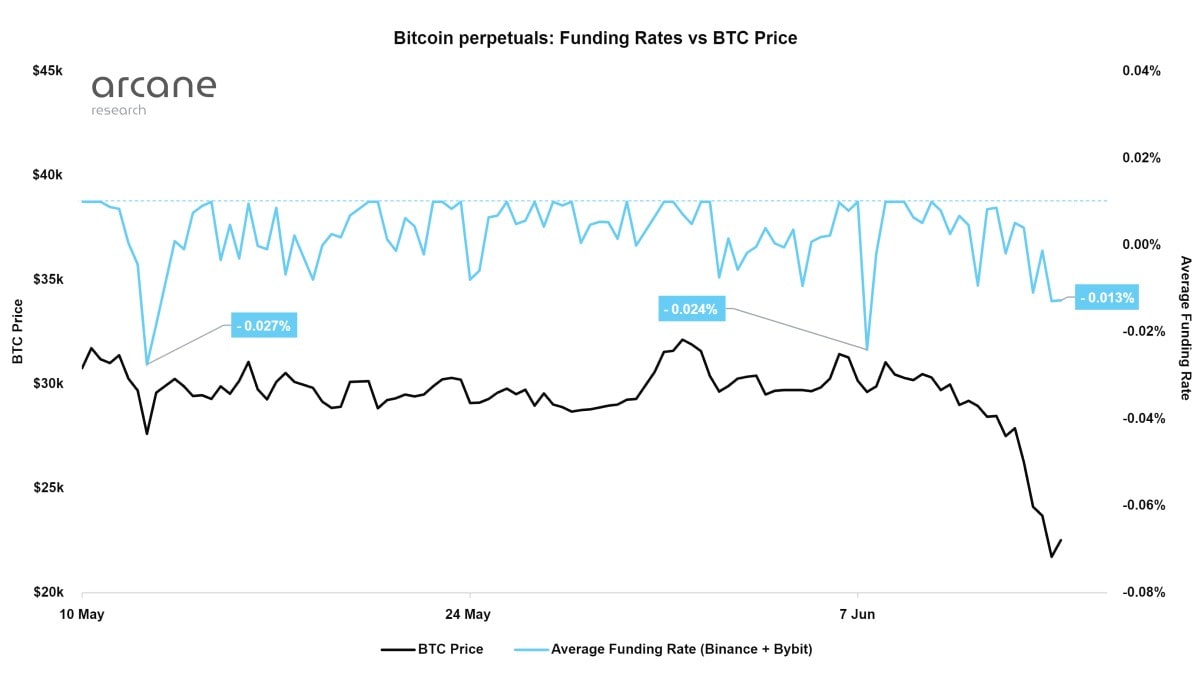

However, the market remains dominated by bears, as evidenced by the negative financing rate on futures contracts. The more sellers there are in the market, the further negative the rate becomes. At the same time, buyers receive a premium for playing the long game.

Today's interest rate hike by the US Federal Reserve above the expected 0.5% will delight bears, as it is likely to cause another downward wave among lower-risk assets.

At the same time, Bitcoin is already trading below its realised price, which historically indicates an imminent low. The realised price is the cost of buying all Bitcoin divided by the total number available. The realised price differs from the market price because many coins remain motionless after acquisition. Now, the ratio of the market price to the realised price is 0.92. The last time such a decline was observed was in March 2020.

Billionaire and CEO of Galaxy Investment, Mike Novogratz, said this week that cryptocurrencies are much closer to the bottom than the American stock market. In his opinion, Bitcoin will remain around $20,000, while stocks are likely to fall by another 15%-20%.

He was supported by former Goldman Sachs hedge fund manager Raoul Pal, who told his million followers that Bitcoin would reach its bottom within the next five weeks.

StormGain Analysis Group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.