Coming soon: Bitcoin at $1.5 million

Bitcoin's 40% rise in January has renewed talk of the imminent end to the bear cycle. Some metrics hint at the cryptocurrency's return to its primary trend, and media investors are once again competing in their price forecasts.

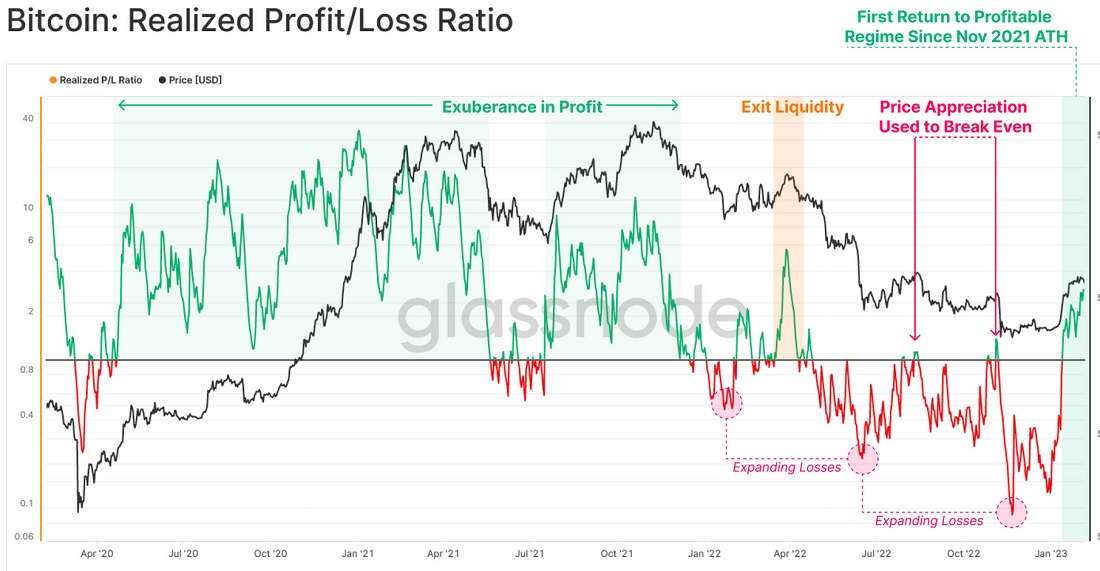

The May fall that began with the collapse of the Terra project (LUNA) led to the ratio of realised profits against realised losses falling into the red zone. In other words, more market participants recorded losses from trading activity (N bought and sold BTC). The situation changed dramatically last month when Bitcoin rose above $20,000.

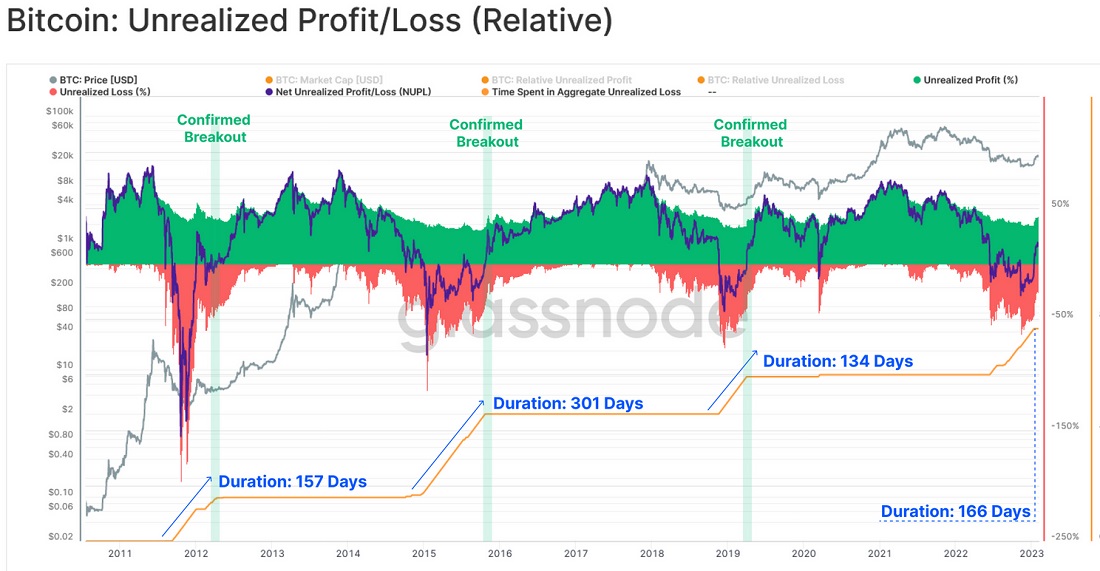

Another metric hinting at the end of the bear cycle is the net unrealised profit to unrealised loss ratio. The indicator shows the result moving to addresses for coins that were kept there (N bought but didn't sell BTC). The average holder was once again in the black.

If we look at cycles when the average holder went under water and splashed back up to the top, the current phase will be comparable to bearish markets from past years. The 2022 bottom took 166 days to pass, while the 2018 bottom took 134 days.

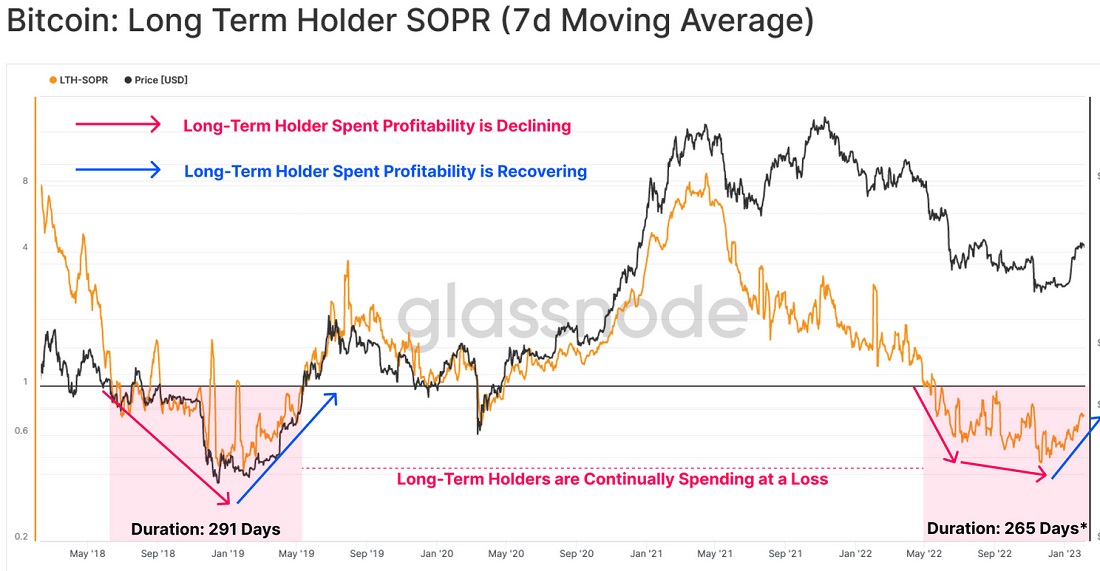

But not all metrics indicate that we've reached the turning point. And while short-term holders have entered profitable territory, long-term holders (those who've held coins for six months or longer) remain in the red zone. In the last bear phase, it took them 291 days to return to black, while the current one has been going for 265 days now.

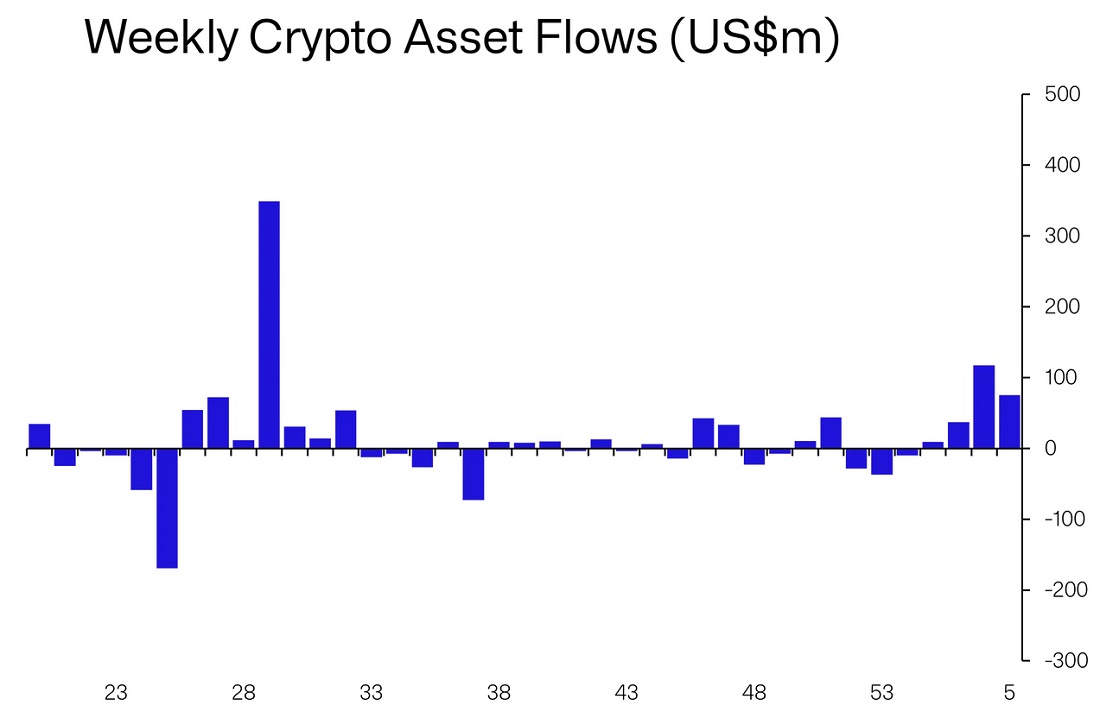

At the same time, estimates of the cryptocurrency's prospects have improved significantly. In the past two weeks, institutional investors using exchange funds have invested $184 million in Bitcoin's growth. This is the best figure for the past six months.

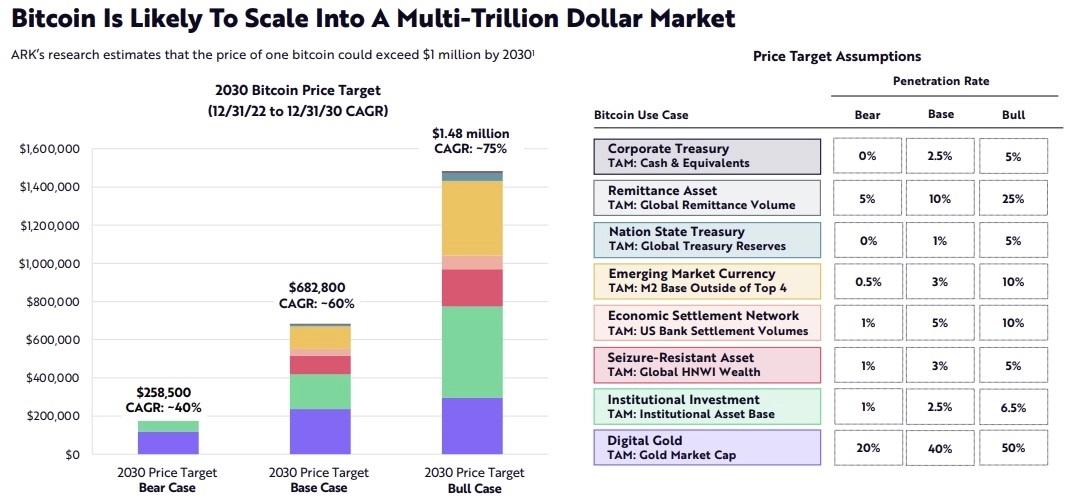

Recently, analysts at Ark Invest shocked the world with their prediction that Bitcoin would continue to rise through 2030.

Their pessimistic scenario assumes a rise to $259,000, while their optimistic one suggests the cryptocurrency will reach $1.5 million per coin. When explaining their high estimate, CEO Cathie Wood called Bitcoin a "defence against wealth confiscation", hinting at rising inflation caused by regulators' unbridled monetary policy.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.