Crypto winter continues as regulators criticise digital assets

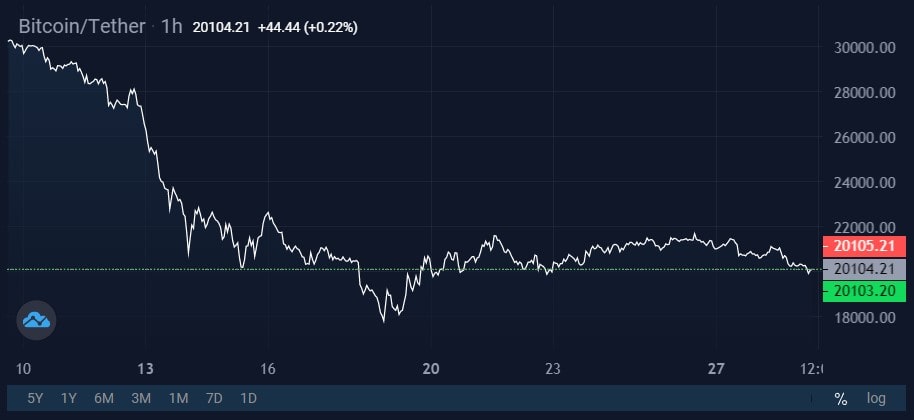

Bitcoin (BTC) rejected the $21K support level on Monday, following US equities in a sell-off that lowered the original cryptocurrency's price by 2.8% over the last 24 hours. The wider crypto market followed suit, with Ether (ETH) dropping by over 2% and Ripple (XRP) losing over 4%. Although Bitcoin bulls are setting their sights on a $21K BTC price this month, the first crypto remains below its 200-week moving average and seems likely to close the month below this metric.

The crypto market crash, especially the dramatic meltdown of Terraform Labs and the TerraUSD and Luna cryptocurrencies, has led lawmakers around the world to point the finger at the flaws of the digital asset market, especially when stablecoins turn out to be not so stable.

Citing the Terra collapse, US Treasury Secretary Janet Yellen urged Congress to enact a "comprehensive framework" to regulate stablecoins. The SEC is reportedly investigating TerraUSD's marketing, with chairman Gary Gensler warning that crypto projects promising sky-high returns should be treated with scepticism.

A recent article by Yifan He, chair of China's Blockchain Service Network, condemned private cryptocurrencies as Ponzi schemes, although he supported cash-backed stablecoins as legitimate money. Unsurprisingly, this echoes the Chinese government's own plans to develop a digital yuan CBDC while cracking down on other cryptos.

Swiss National Bank (SNB) deputy head Thomas Muser also called out the entire concept of DeFi, saying that the whole ecosystem would collapse if it had to comply with the same financial regulations as institutional finance.

Singapore regulator Sopnendu Mohanty, chief fintech officer of the Monetary Authority of Singapore, promised to be "brutal and unrelentingly hard" on any misbehaviour from crypto companies.

While new regulations could limit some of the get-rich-quick potential of new crypto projects, it may be essential in the long term to prevent another TerraUSD fiasco.

StormGain Analysis Team

(crypto trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.