Ethereum: The final test before the merge

Test networks continue to rehearse Ethereum's move to a proof-of-stake algorithm. On 6 July, the merge of two chains was tested in Sepolia, and now it's dress rehearsal time in Goerli. If you don't look at the temporary disabling of a third of the validators who hadn't installed the latest updates, the test was a success.

Ethereum's final transition to PoS is a step closer. Still, the anticipated move date has traditionally been pushed back: The complexity bomb has been delayed for another two months, and the project website has extended the timeline to Q4.

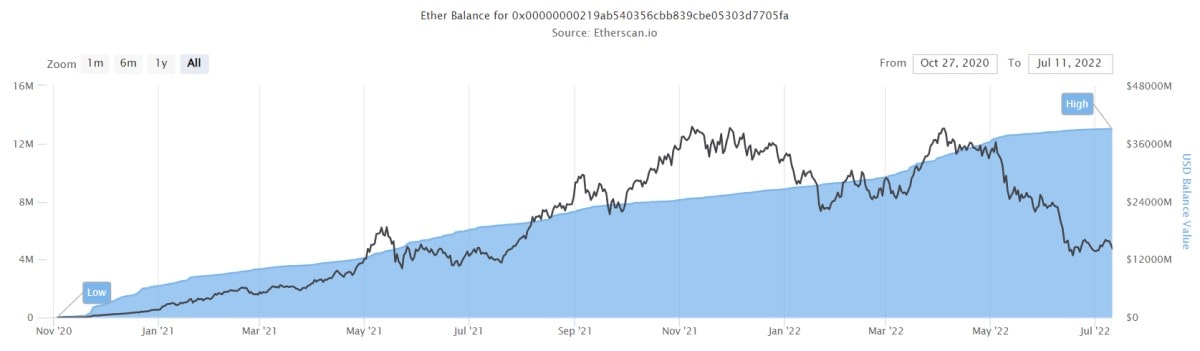

Meanwhile, 74,000 users have already staked 13 million ETH for passive income. The amount now equals $14bn or 11% of the network's total capitalisation.

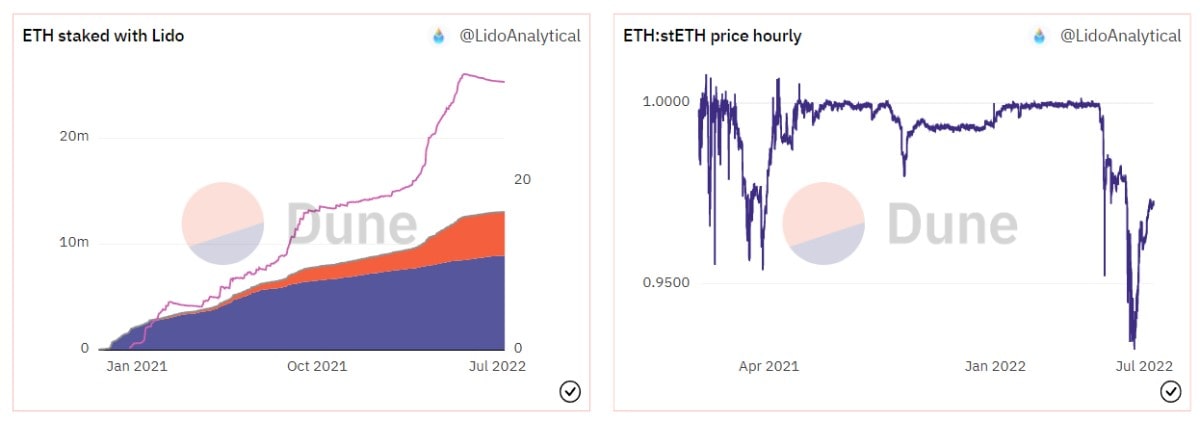

Because stacking coins involves freezing them until the network actually moves, and because you have to stack them in blocks of 32 ETH to generate revenue, third-party services have become very popular. Lido is a leader among them. It significantly lowers the entry threshold for passive income and currently offers a 4% annual return for staking. Moreover, the service provides stETH instead of ETH, which can be used in staking or exchanged for other coins.

Lido's convenience has led to the service currently providing 32% of total frozen ETH. However, it does have a lot of borrowed funds since Lido used a number of investment projects, including the infamous 3AC. The lack of liquidity caused stETH to drop against ETH.

Due to some projects' high interdependence, a further breakaway of stETH, which has a capitalisation of $4.5 billion, from ETH could lead to a chain of liquidations and further pressure on the cryptocurrency market.

For example, one stETH to ETH exchanger, Aave, announced in June three potential steps to mitigate risks: Freezing stETH transactions, increasing the liquidation threshold to 90% and suspending loans in ETH. And Curve's large pool of 465,000 stETH has only 172,000 ETH left.

Lido is a big market player, and its problems are hard to ignore. Ethereum's rapid transition to PoS and the subsequent unlocking of ETH 2.0 could save the situation because it could encourage developers to be more proactive.

StormGain Analytical Team

(crypto trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.