Fiasco of the year: UST's stablecoin reserves are depleted as LUNA plummets by 90%

Up until very recently, Terra was one of the most promising projects around. Its stablecoin sat in third place in the relevant rankings with a market cap of $18 billion, while only Ethereum had a bigger share of the DeFi market. Terra's balancer coin LUNA was also the only Top 10 cryptocurrency to hit a new all-time high in 2022. However, its decline proved so earthshattering that it even attracted the attention of US Treasury Secretary Janet Yellen.

Terra's stated aim is to create a bridge between the traditional financial system and cryptocurrencies. In service of this goal, it launched several stablecoins, including the USD-pegged project UST. An algorithm that arbitrates between UST and LUNA (a free-floating coin) is responsible for maintaining the exchange rate at 1:1. This means that UST is considered a decentralised algorithmic stablecoin. We have written about the advantages and disadvantages of this approach on more than one occasion, including in our previous article.

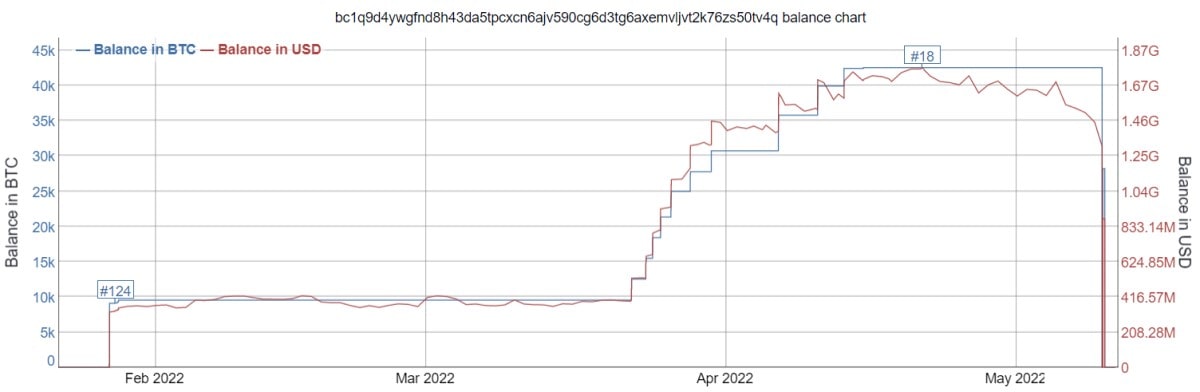

In order to strengthen the stablecoin's position further, Terra announced that, in the future, UST would be tied to its own cryptocurrency reserves. After accumulating $3 billion in reserves, half of which consisted of Bitcoin, Terra transferred funds to market makers on 9 May to try to stabilise UST's falling exchange rate.

The initial reasons for UST's decline to $0.98 and lower thereafter included the sell-off on the wider cryptocurrency market and an attack by an unknown seller who offloaded stablecoin worth $300 million on 8 May. This was accompanied by social media discussion of UST's vulnerabilities, which sparked panic and significant pressure from other market participants. At one point, market makers tried to steady UST's exchange rate by selling Bitcoin and other crypto assets, but that wasn't enough to save the day.

Currently, it's not known for sure whether Terra exhausted all of its reserves trying to maintain the UST exchange rate or whether it decided to stop its stabilisation efforts to preserve those same reserves. Once the reserves were out of the game, the biggest hit was taken by the project's balancer coin, LUNA, which is down 90% on the weekly chart.

UST's staking yield reached 20%, which translated to a rise in the number of investors and locked value, despite the cryptocurrency market's general decline in 2022. However, the drop in UST's exchange rate has made further staking unattractive, and as investors fled from the stablecoin, its total locked value in DeFi fell by 50% in the span of just a few days. UST is currently trading at around $0.82, which would suggest that the situation has still not normalised and LUNA's decline is likely to continue.

Investor Lyn Alden equated the UST-Bitcoin tie to an attempt by developing countries to save their economies by burning through their gold reserves, hinting at the natural end result of such a move. Meanwhile, on 10 May, Janet Yellon called on Congress to expedite the process of developing a bill to regulate stablecoins, citing UST as a case in point.

In an attempt to salvage the situation, Terra is looking to bring in an additional $1 billion in investment, while the project's developer, Do Kwon, wrote on Tuesday that a recovery plan will soon be presented. However, the project's reputation is already in tatters, and the likelihood of it returning to previous all-time highs is extremely low.

StormGain analytical group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.