ETF Shows High Demand for Bitcoin Futures

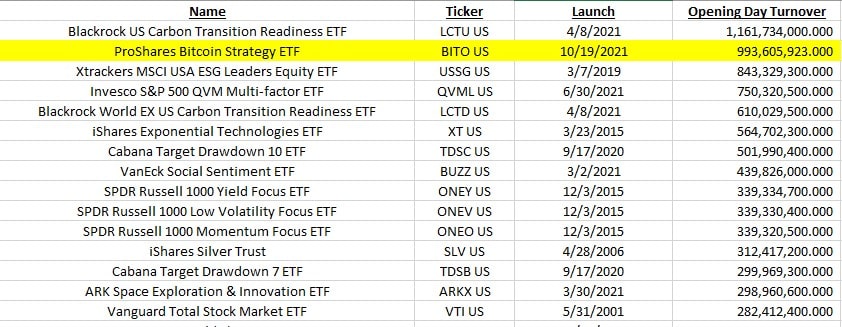

On 19 October, the first exchange-traded fund (ETF) for Bitcoin futures was launched in the USA. Applications for this type of instruments have been coming to the regulator since 2013; however, the SEC has only now allowed large investors to access them. The ETF is traded on the New York Stock Exchange, and its debut has become second by daily turnover in US history.

The company ProShares has been bestowed with the honour of being the first to launch an ETF for a cryptocurrency instrument. The daily turnover reached $1 billion on the first day, which placed the new ETF second after industry giant Blackrock’s “low carbon fund”.

Interest in the ETF has been so high that, in the very first day of trading, the fund went from starting capital of $20 million to $570 million, and the stock went up by 5%. According to ProShares CEO Michael Sapir, the increased interest in the fund has been linked with the ability to invest in Bitcoin for those who have got a broker account for trading stock instruments and are worried by the prospect of setting up a cryptocurrency wallet.

The news about the launch of the first ETF for a cryptocurrency instrument on the territory of the USA broke before the testing of Bitcoin’s ATH. It increased the possibility of a breakthrough beyond $65,000.

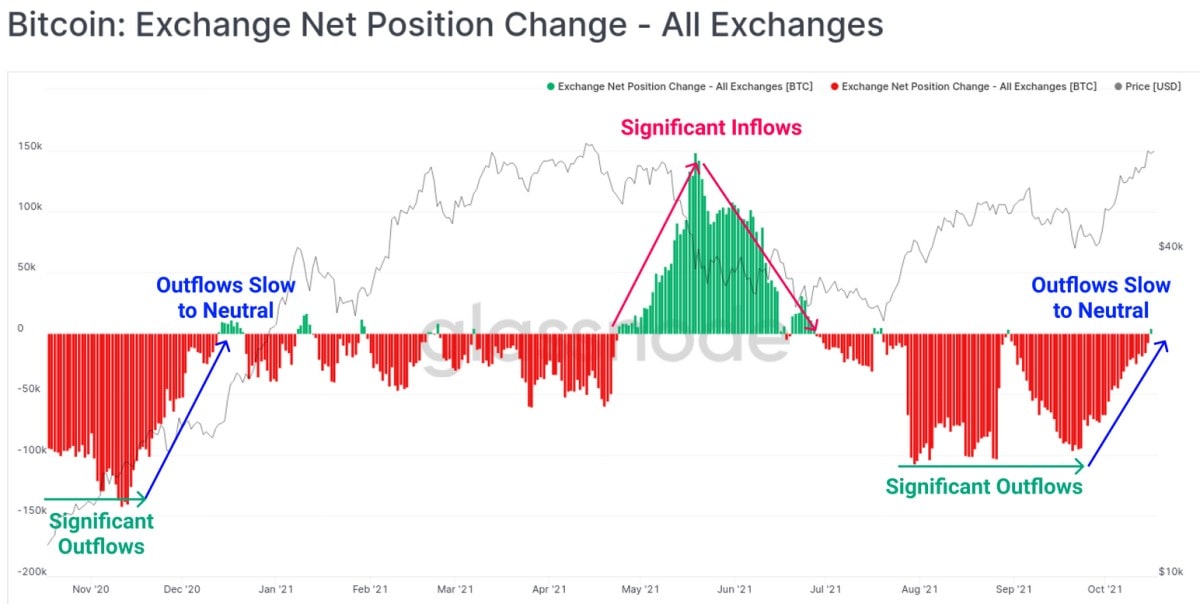

However, with the acquisition of the ATH price, the selling pressure grows from those who invested in cryptocurrency during a corrective spell and want to lock in a part of the profit. According to the Glassnode metrics, after Bitcoin has been accumulating in wallets during the past four months, an influx of coins to exchanges is being registered. It will keep the bulls in check for a little while; however, the influx of investment capital will lead the price to new ATH’s.

ProShares is far from being the sole company in the list of applications for a SEC approval. This week already, a Bitcoin futures ETF has been launched by the company Valkyrie. But the biggest expectations of the cryptocurrency community are still linked with an approval for an ETF for spot Bitcoin: the regulator has got over 50 such application. This week they have become one step closer to approval.

The StormGain Analytical Group

(a platform for trading, exchanging and safeguarding cryptocurrencies)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.