How the Fed is manipulating the cryptocurrency market

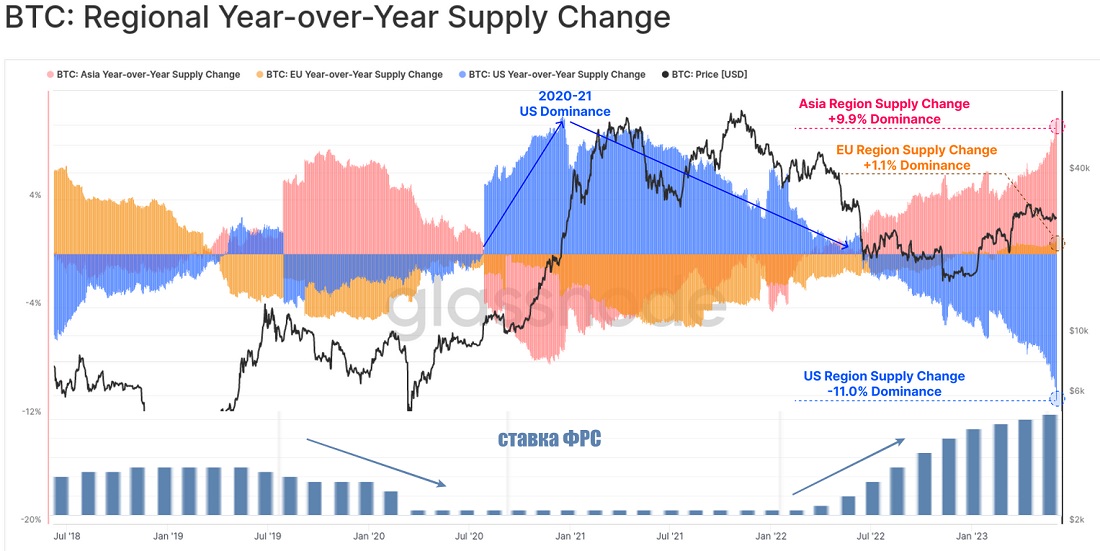

The cryptocurrency repressions by US regulators are leading to a shift in investment flows from the US to Asia. But the trend gained momentum a little earlier and has a direct correlation with the Fed's monetary policy.

The Covid-19 epidemic led to the emergence of easy money, as the zero key interest rates from March 2020 provided businesses with ultra-cheap loans that flowed into various sectors. The crypto industry has been no exception, with institutional investors investing $1 million or more from this year onwards becoming a key investment force.

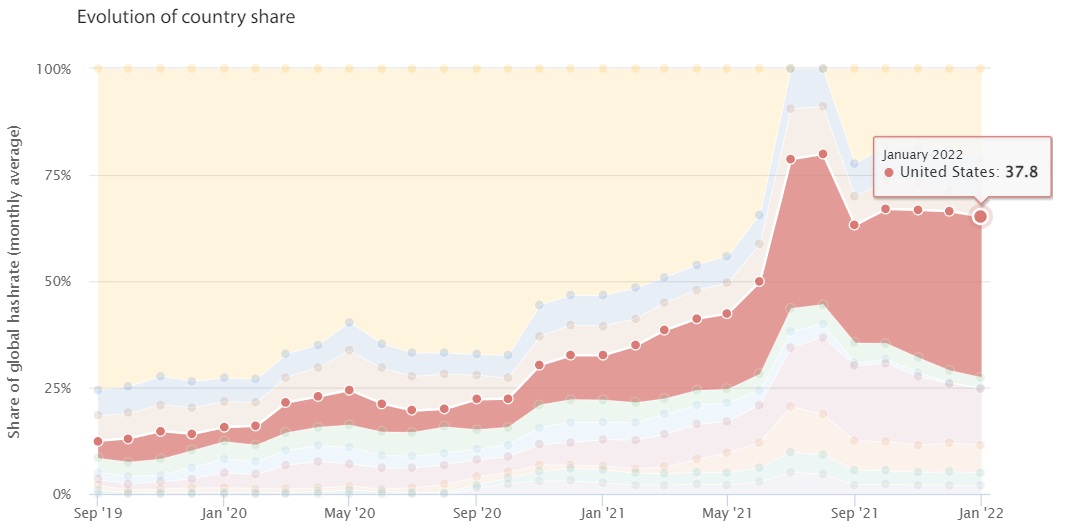

Investments were directed into crypto funds, mining and various products. In January 2020, the US share of Bitcoin mining was only 3.5%. Two years later, it was 37.8%. The country's computing power has increased 19-fold during this time.

In a fight against natural inflation, the Fed has turned the other way around, as it began to raise its key rate at a shocking pace in the second half of 2022. This was when an 11% drop in Bitcoin supply from the US was seen, with Asia stepping in to replace it.

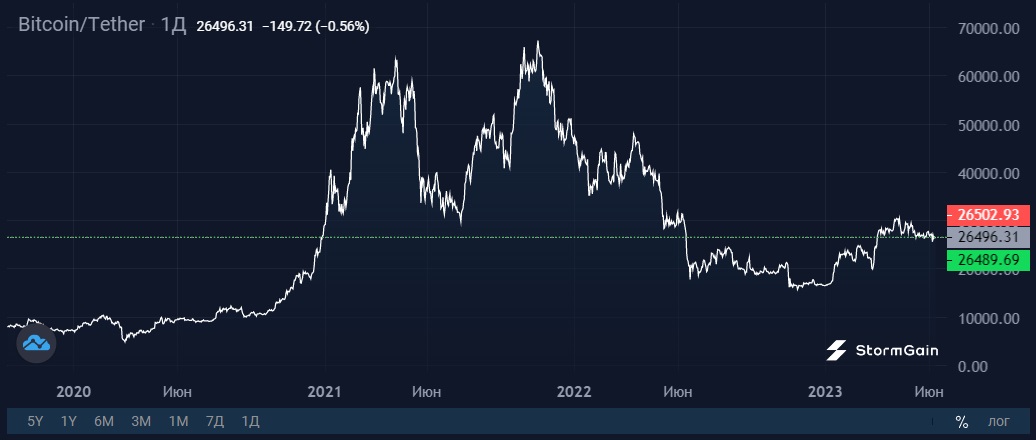

The cut to the easy money flow in 2022 affected projects with indirect financial management focused on attracting new participants. Terra (LUNA) was the first to get hit in May, followed by Celsius and FTX. The decline in confidence among market participants couldn't help but affect the overall capitalisation of the industry and the value of Bitcoin.

Now, US regulators are tightening the screws, calling the cryptocurrency market the 'Wild West' while ignoring their own discrepancies. For example, the SEC considers Ethereum to be a security, filing a lawsuit against Coinbase in relation to that. However, the CFTC calls the very same cryptocurrency a commodity and has brought charges against Binance.

The Fed's role in pumping up the financial bubble has also not been addressed. Back in mid-2020, Coinbase CEO Brian Armstrong noted a surge in deposits after Covid-19 payouts in the United States after every adult received $1,000 plus $500 per child in April 2020.

This raises the question: would investor losses have been so significant if the Fed hadn't printed dollars so aggressively and if the regulators had worked promptly with legislators to develop and adopt regulations governing all aspects of the industry?

Instead, SEC Chairman Gary Gensler responded yesterday to reporters, defending the agency's repressive policy: "They [companies] may have made a calculated economic decision to take the risk of enforcement as the cost of doing business."

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.