In June, institutional investors poured funds into altcoins

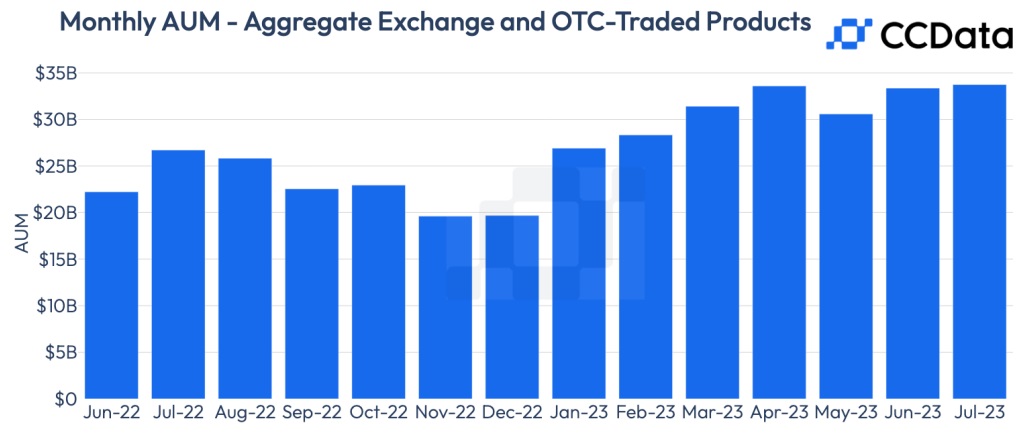

Institutional investors, aka companies with investments over $1 million, are showing increasing interest in cryptocurrencies. For 2023, assets under management (AUM) in various exchange-traded funds rose 71.5% to $33.7 billion.

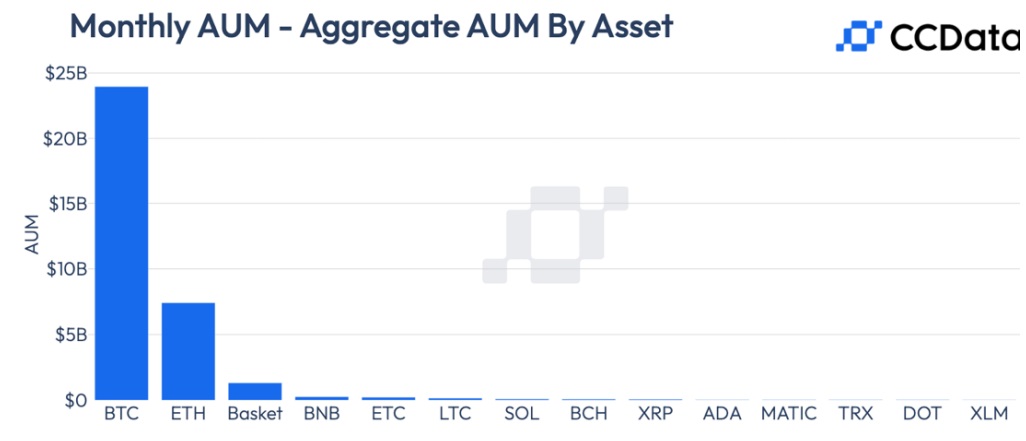

Bitcoin and Ethereum faced a significant inflow of 70.7% and 22.0%, correspondingly. At the same time, investments in other altcoins were obscured by the SEC's unfriendly stance and its labelling of a wide range of cryptocurrencies as securities.

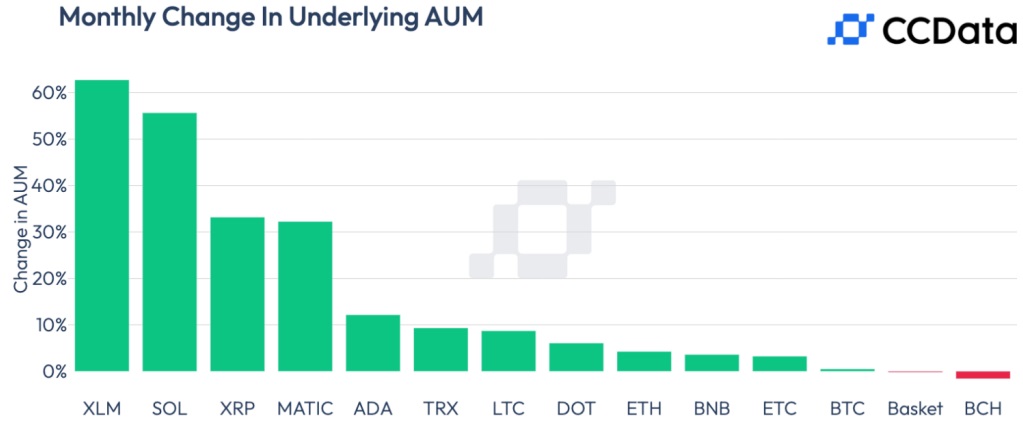

That changed in July after a judge ruled in the SEC's litigation against Ripple that buying/selling coins on cryptocurrency exchanges isn't a securities transaction. This led to a surge in interest in altcoins, where Stellar's XLM overtook everyone in terms of monthly growth rate with a 62.7% gain.

The price also showed an impressive 40% increase, reaching $0.16 per coin.

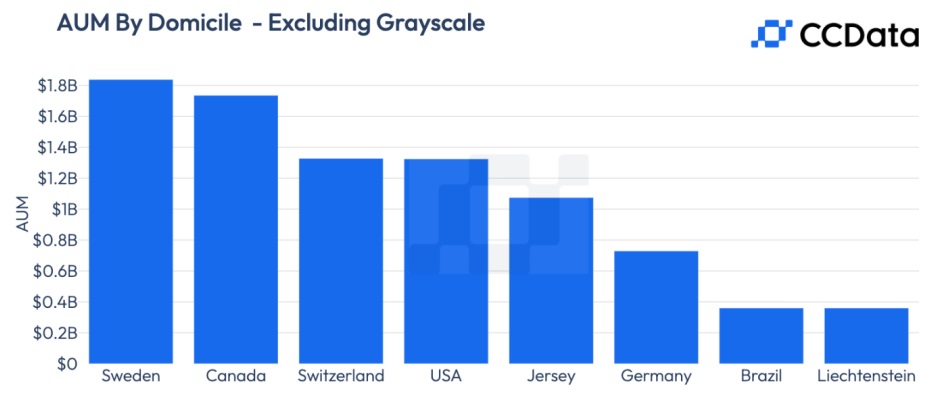

In addition to the bursting interest in altcoins, the change in the geographic affiliation of institutional investors is also deserving of attention. Setting aside Grayscale trusts, which hold a 74.1% market share, Europe's increased interest in cryptocurrencies comes to light. Sweden, Switzerland and Germany grew AUM to $3.9 billion in July, accounting for 11.5% of the total volume.

This is also fuelled by the adoption of a full-fledged MiCA regulation on cryptocurrencies that will come into force in 2024. In contrast, in the US, the SEC's confusing stance, court battles and the lack of a Bitcoin spot ETFs are cutting investments.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.