Major investors flee Bitcoin

Since 2020, institutional investors (companies with holdings above $1 million) have become the leading investing power in the cryptocurrency market. ETFs tracking the Bitcoin spot and futures markets started to emerge while the number of public mining companies and investment funds soared. Even Western countries' state pension funds weren't too timid to buy Bitcoin.

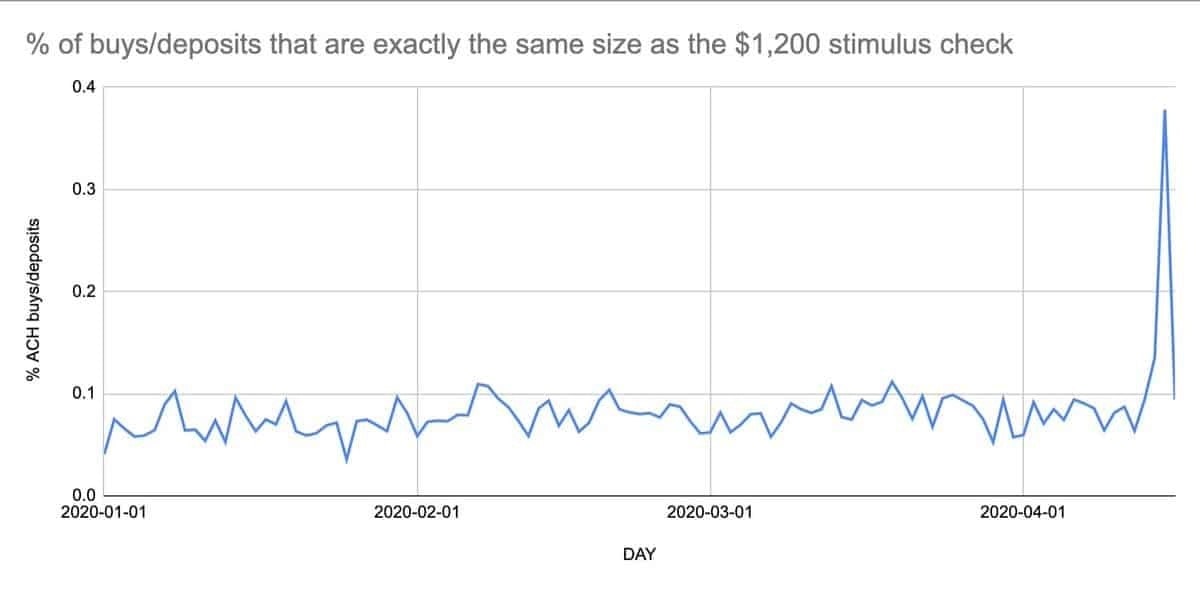

This was mainly a result of active dollar printing by the Fed in a bid to backstop federal support programmes for citizens and businesses. Then, in April 2020, US-based crypto exchange Coinbase recorded a 400% increase in deposits equal to $1,200, the amount received by Americans in stimulus checks. At that time, Bitcoin was priced at $7,000.

More than a third of all dollars in circulation were printed over the last two years, while the Fed's balance sheet has doubled to reach $9 trillion. Investors put money in all sectors of the economy, from real estate to cryptocurrencies, which led to inflation in the US significantly above the Fed's target level.

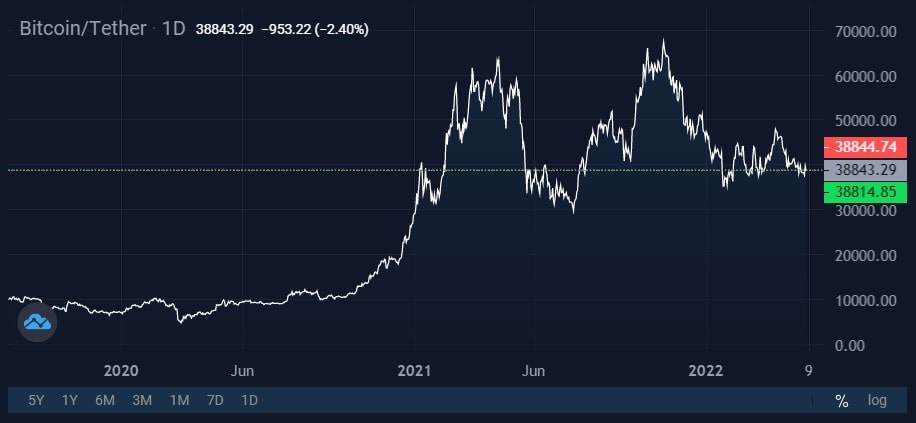

Now, in an effort to cool markets, the Fed has been forced to do a complete policy 180, raising its key rate and selling part of its bond holdings. This will inevitably lead to a decline across most risk assets. The stock market (S&P 500 Index) has already dropped by 13% YTD.

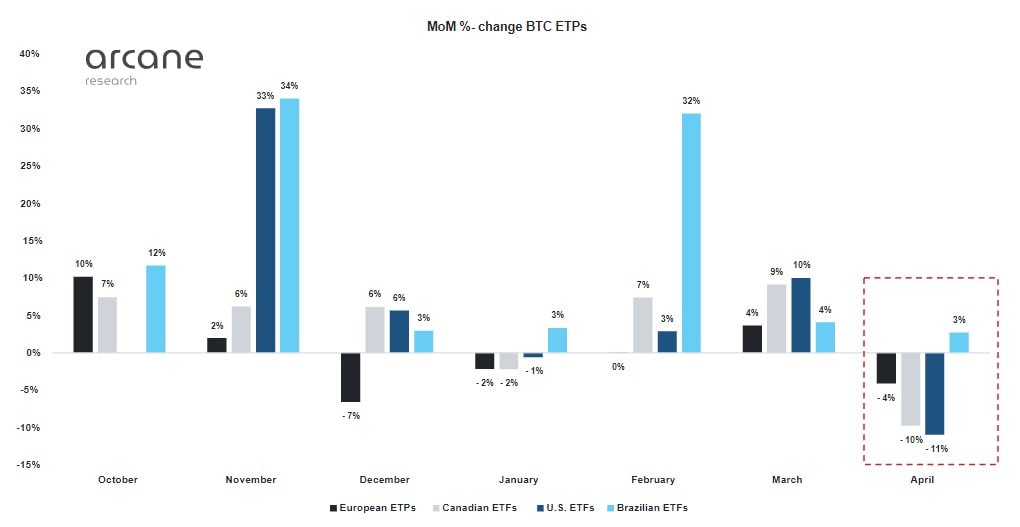

There's no way these trends won't spread to the crypto market, too. Consequently, net capital outflows from cryptocurrency funds reached an all-time high of 14,327 BTC. US investors are fleeing at a higher rate than in any other region, with investment holdings down 11% over the past month.

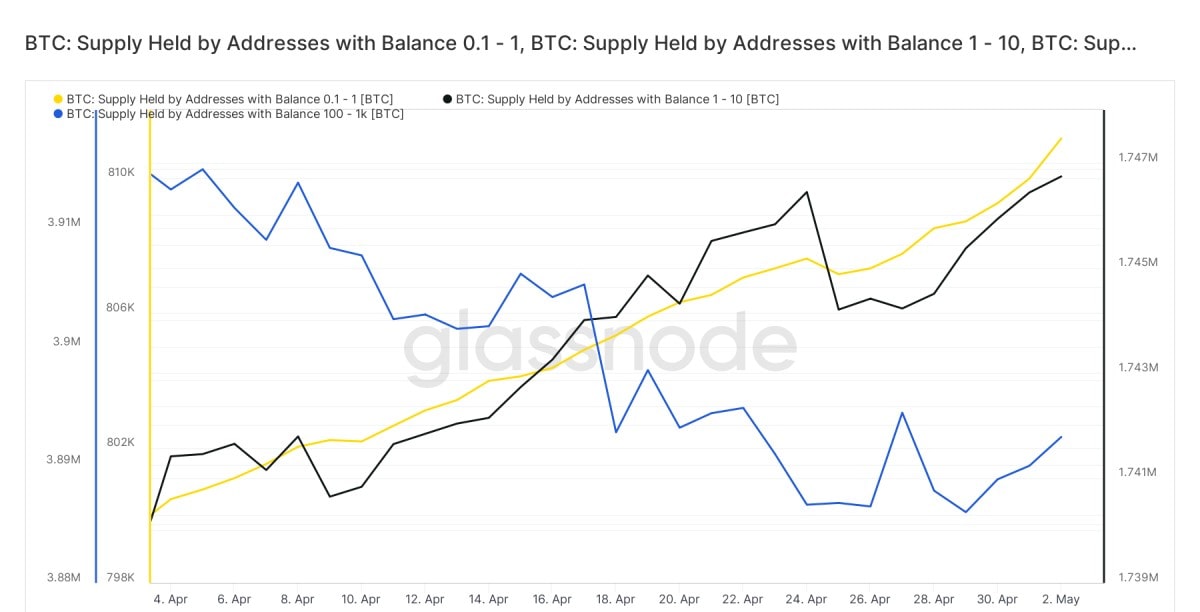

Much like the stock market, Bitcoin is trading at a discount this year. However, as volatility has lessened, the declines are definitely less severe. This is partly due to the activity of smaller investors who continue to show faith in the coin's strength. Investors with wallets holding between 0.1 BTC to 10 BTC just doubled their positions in April to increase their total combined holdings to 2.5 million BTC.

If small players were a driving force on the Bitcoin market, we would currently be seeing rising prices instead of an ongoing correction.

However, the major market movers continue to be institutional investors, whose strategies are built on following the Fed's lead. The regulator announced a single 0.5% interest rate hike at its meeting this week. A sharp interest rate hike coupled with the upcoming balance sheet shedding by the Fed will likely lead to even larger capital outflows from Bitcoin.

StormGain analytical group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.