LUNA2 bursts at the seams: users dump new coins

The Terra project (LUNA) recently had a market capitalisation of $40 billion, and its UST stablecoin was among the top three. Because a large team of developers were working on the project, the brand was recognisable, and the community was cohesive, validators decided to restart Terra. However, even former investors are starting to believe less and less in its success, and new accusations against its leader Do Kwon are appearing.

Most members and independent experts called for the company to buy up and burn LUNA to recover its value. But validators voted to create a new branch from the genesis block, renaming the old coin Luna Classic (LUNC) and dropping support for the stablecoin.

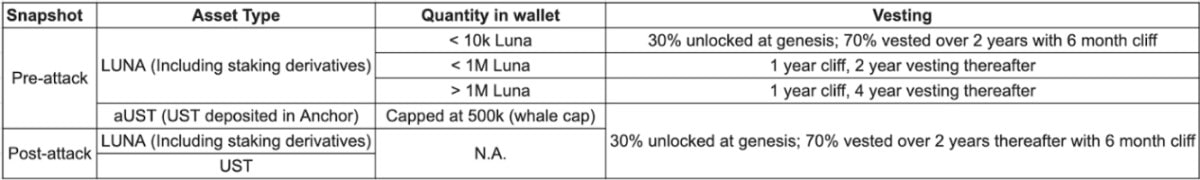

The new LUNA (or LUNA2) are to be distributed to LUNC and UST holders, provided they have two screenshots confirming their ownership before and after the crash. In the first stage, investors will receive 30% of the recorded volume. Then, they'll receive subsequent funds in six months to four years.

A number of cryptocurrency exchanges supported the emergence of a new branch, and the price of the coin reached $12 on the day of listing. This was the last positive news for the project. After the distribution, most investors decided that a bird in the hand was worth two in the bush and is worth being compensated for at least part of their losses.

Just yesterday, out of $4 million in trading volume, $2.5 million amounted to positions for sale. The dominance of bears is also indicated by the funding rate, which remains deeply negative. At the same time, the pressure from them continues to increase.

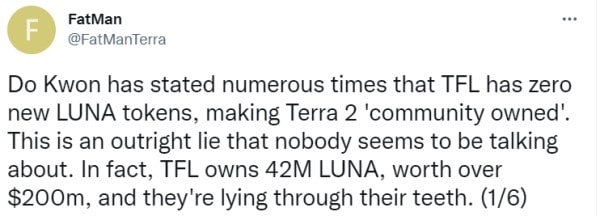

Do Kwon is accused of adding fuel to the fire, with claims that he manipulated the numbers when validators voted. According to a member of the network, Do Kwon used a shadow wallet so that the option with the appearance of a new branch won the day. In accordance with the distribution programme, he received at least 42 million LUNA2 or $126 million at current prices. In this case, Kwon may be one of the key bears on the market.

Kwon's possession of LUNA2 contradicts an earlier statement that the parent company, Terraform Labs (TFL), does not own LUNA2, but rather Terra's management is now fully concentrated in community hands.

In addition to investigations by crypto users, South Korean police are looking into the matter. They already have one suspect from TFL who tried to withdraw funds from the company's crypto fund to add to his own wallet. At the moment, the transfer is frozen, but the amount and name of the suspect have not been disclosed in order not to reveal details of an ongoing investigation. Before Terra collapsed, the crypto fund totalled $3 billion.

The emergence of new charges does not add to the investment appeal of Terra's already shaken reputation. Following its predecessor, LUNA2 will most likely continue to hit new lows.

StormGain Analysis Group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.