Metrics: Bitcoin keeps growing despite lacklustre user activity

Bitcoin’s price has risen by 40% to around $50,000 without high speculative activity amidst a background of plunging trading volumes and a low number of transactions. Is this indicative of a looming correction?

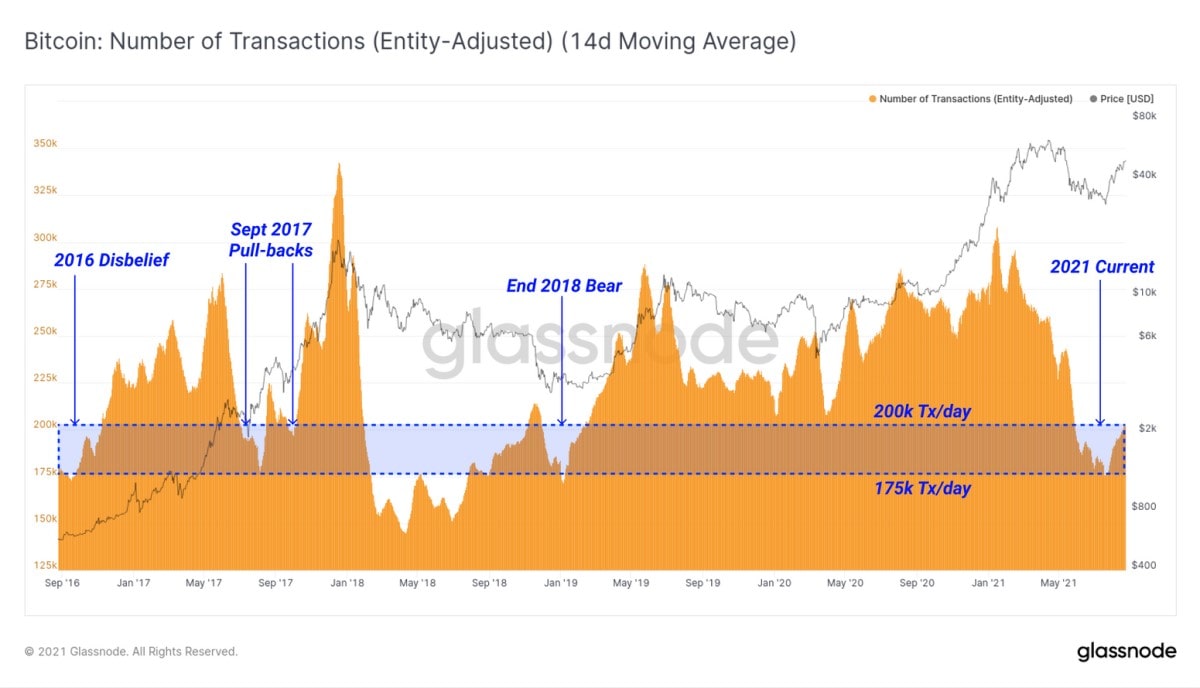

Bitcoin transactions are around five-year lows, which was last observed together with an 85% drop in prices from the highs of 2017.

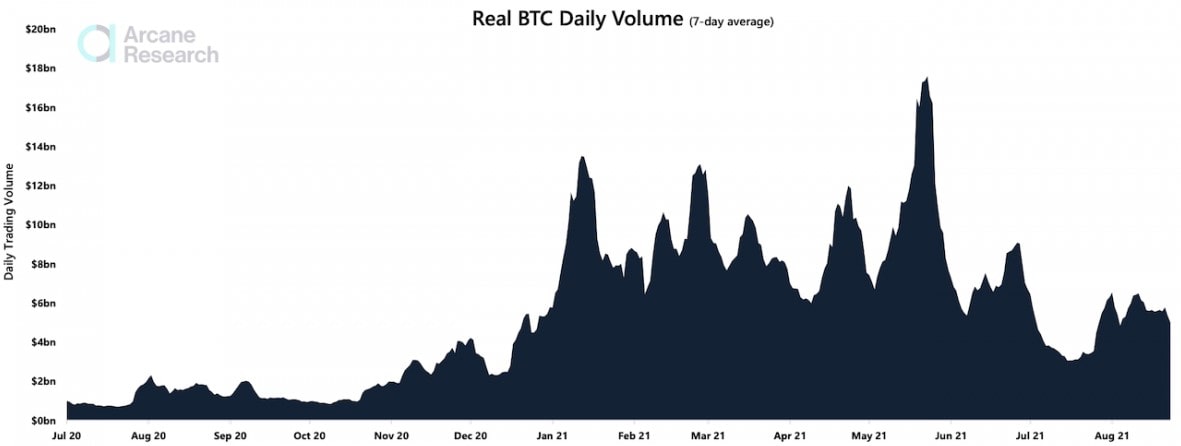

In addition to the lower number of transactions, trading volume has also dropped, which Arcana Research views as a bearish signal. The recent price growth has not correlated with vast interest.

However, several objective reasons can explain this. Firstly, the number of transactions has fallen because of pressure from Chinese regulators. Some exchanges are changing their registration, others are refusing to accept Chinese citizens’ funds, and miners have simply been prohibited from working in some provinces. Secondly, the world’s largest crypto exchange, Binance, has become a subject of public discontent in many countries. Because of regulatory pressure, the exchange has lowered its leverage from 1:100 to 1:20, leading to a slump in trading volume.

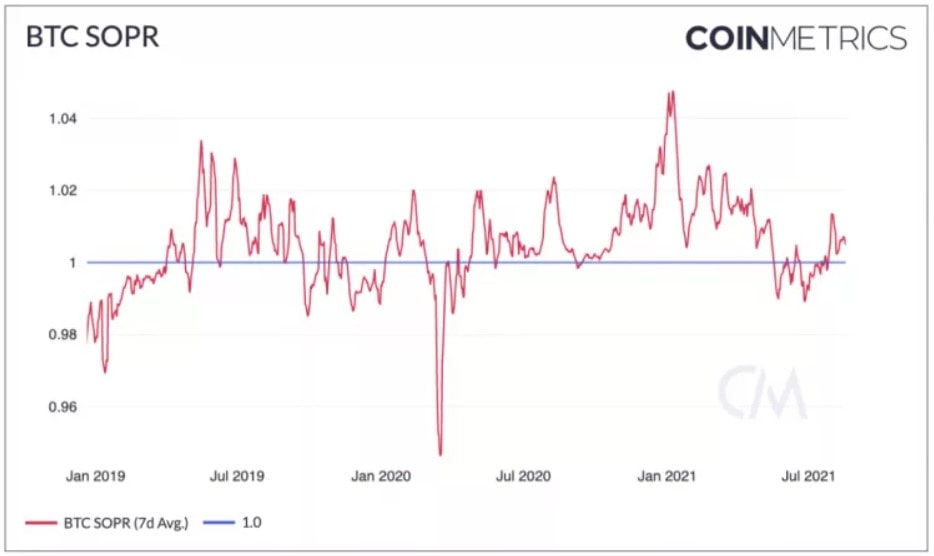

Meanwhile, the Fear and Greed indicator is showing that market optimism has gone last. SOPR (Spent Output Profit Ratio) indicates the same thing: most traders are once again making profit from selling their coins

While traders took a break and are not showing much activity, institutional investors continue their hunt for bitcoin. For example, MicroStrategy bought $177 million worth of BTC at an average price of $45,000 per coin and currently owns 108,992 BTC. Citigroup has followed in Goldman Sachs’ footsteps, submitting an application to regulatory bodies for access to Bitcoin futures on the Chicago Mercantile Exchange.

Currently, activity on the network does not indicate an impending correction. The drop in volume is related to regulatory pressure and reduced trading leverage. Meanwhile, holders and institutional investors are continuing to accumulate.

The StormGain Analytical Group

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.