Not at rock-bottom yet: metrics foreshadow the fall of Bitcoin

Margin trading is gaining momentum, and investment funds are seeing an inflow of investments in Bitcoin. However, faith in the strength of the current support can be deceptive, as a number of indicators predict a decrease to the $20,000-$25,000 zone.

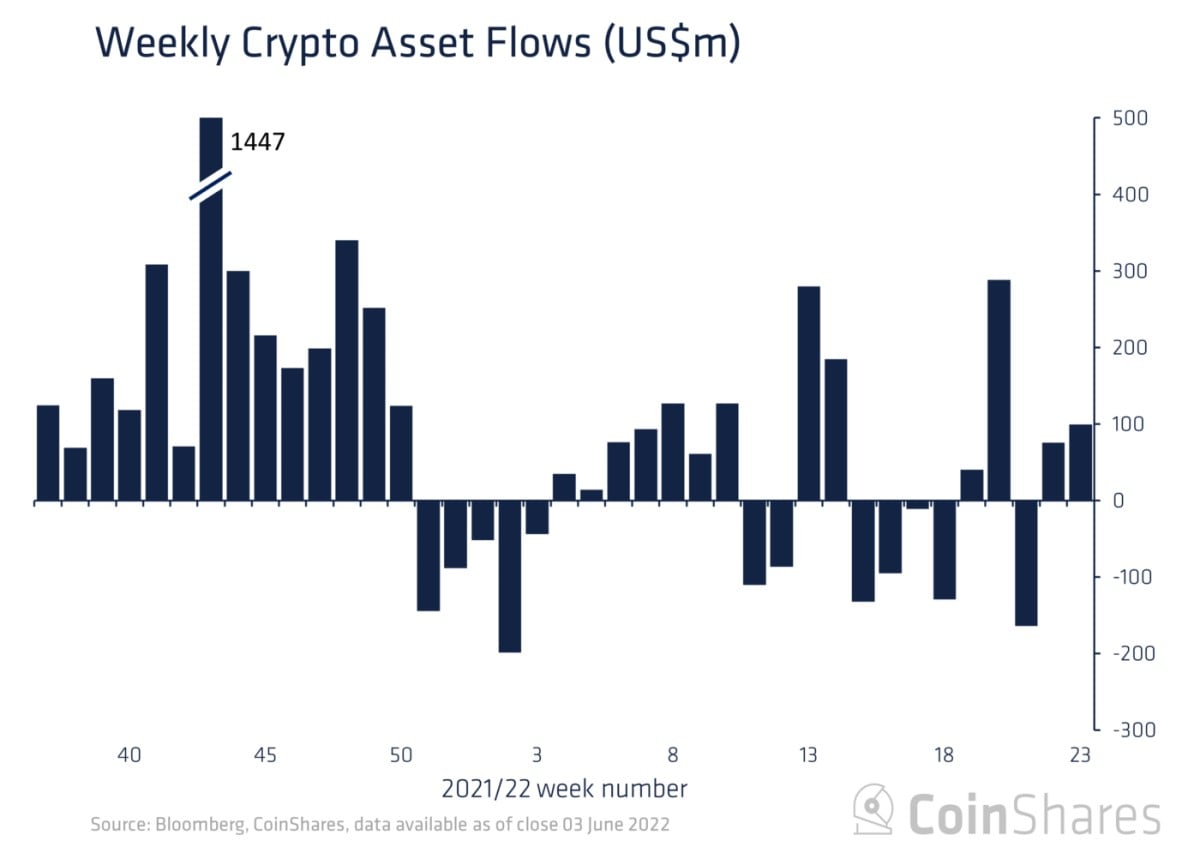

The fall of Bitcoin by 55% from its historical high and the subsequent consolidation around the level of $29,000 gave some hope for an early recovery. This was reflected in the growth of weekly investments in Bitcoin funds to $126 million ($100 million for all cryptocurrencies), and the net inflow in 2022 amounted to $506 million.

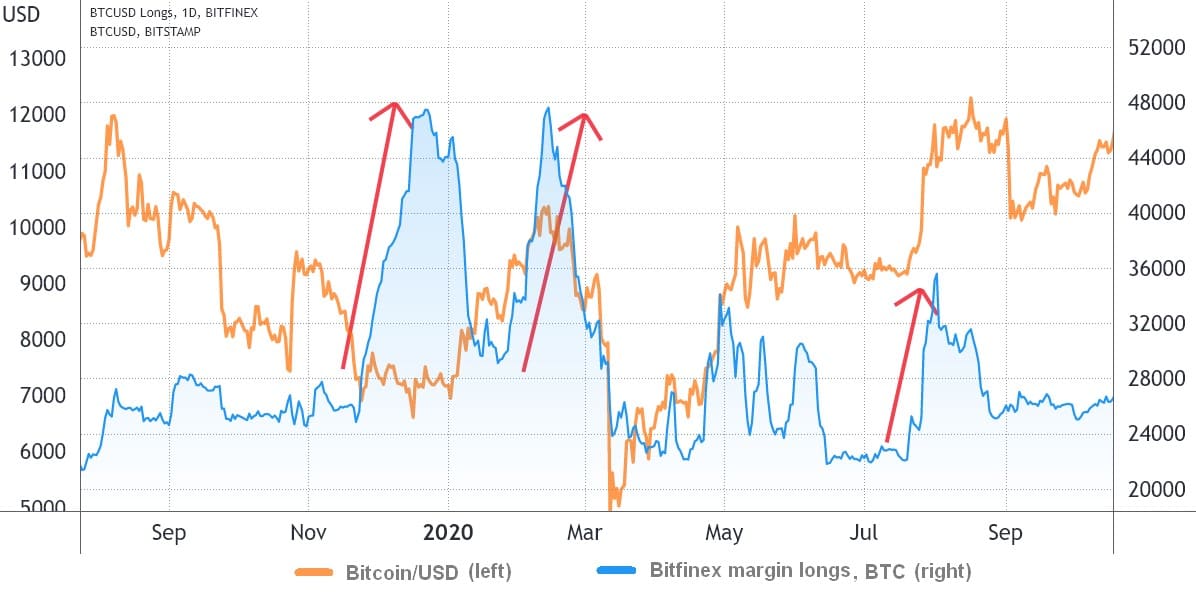

Activity can be seen not by both institutional traders and margin traders using leverage. Since mid-May, the largest cumulative position was recorded on Bitfinex: over 90,000 contracts for the purchase of Bitcoin. The previous peak of 55,000 contracts was seen in mid-2021.

Such volumes could not occur without whales. However, this does not mean that the group is an anomaly. In 2021, traders swiftly bought at lows to then subsequently sell at a profit, but in 2020, they failed to do that, instead suffering losses.

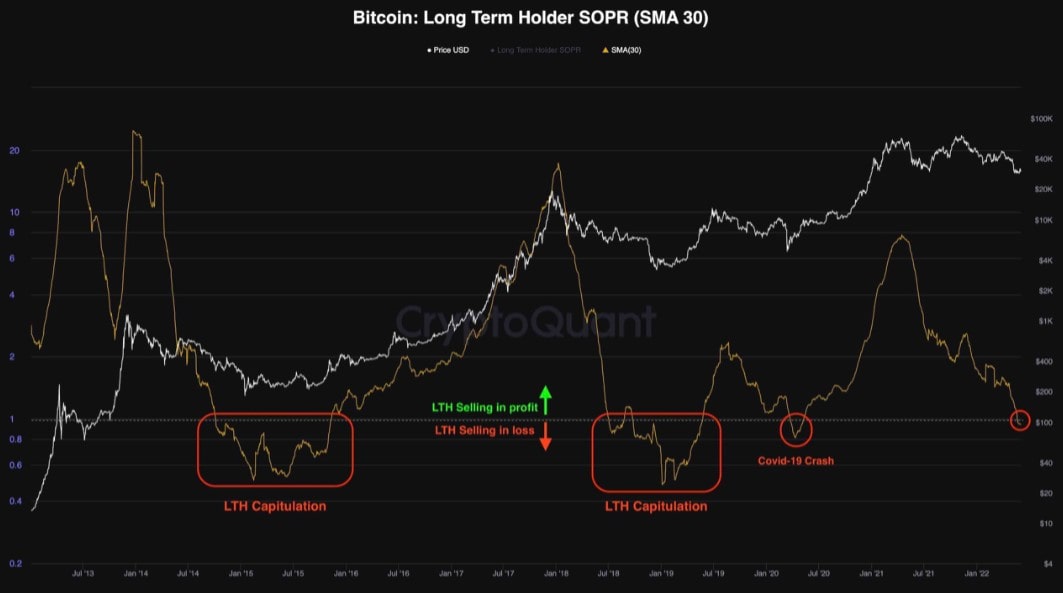

Unlike margin traders, long-term holders (LTHs) are not as optimistic. Many of them are already getting rid of coins at a loss. As noted by CryptoQuant, the capitulation of LTH foreshadows a fall, and the next few months will open up the possibility of investment for wait-and-see investors.

However, before the window of opportunity opens, the price will test the next level. According to LookIntoBitcoin, the current "realised price" of Bitcoin is $23,600. The realised price is obtained by dividing the average cost of all Bitcoin (using the purchase price) by the total amount in circulation.

The fall of Bitcoin to the $20,000-$25,000 zone is likely to coincide with the US Federal Reserve's decision regarding its next key interest rate hike. The Fed is anticipated to increase the interest rate by another 0.5% at the regulator's meeting that will be held in the middle of next week. Raising the rate leads to an increase in the cost of borrowing and a decrease in the speed of money supply turnover, which is likely to lead to a strengthening of the American currency against most risky assets.

StormGain Analysis Group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.