Ethereum hard fork: Mining profits under threat

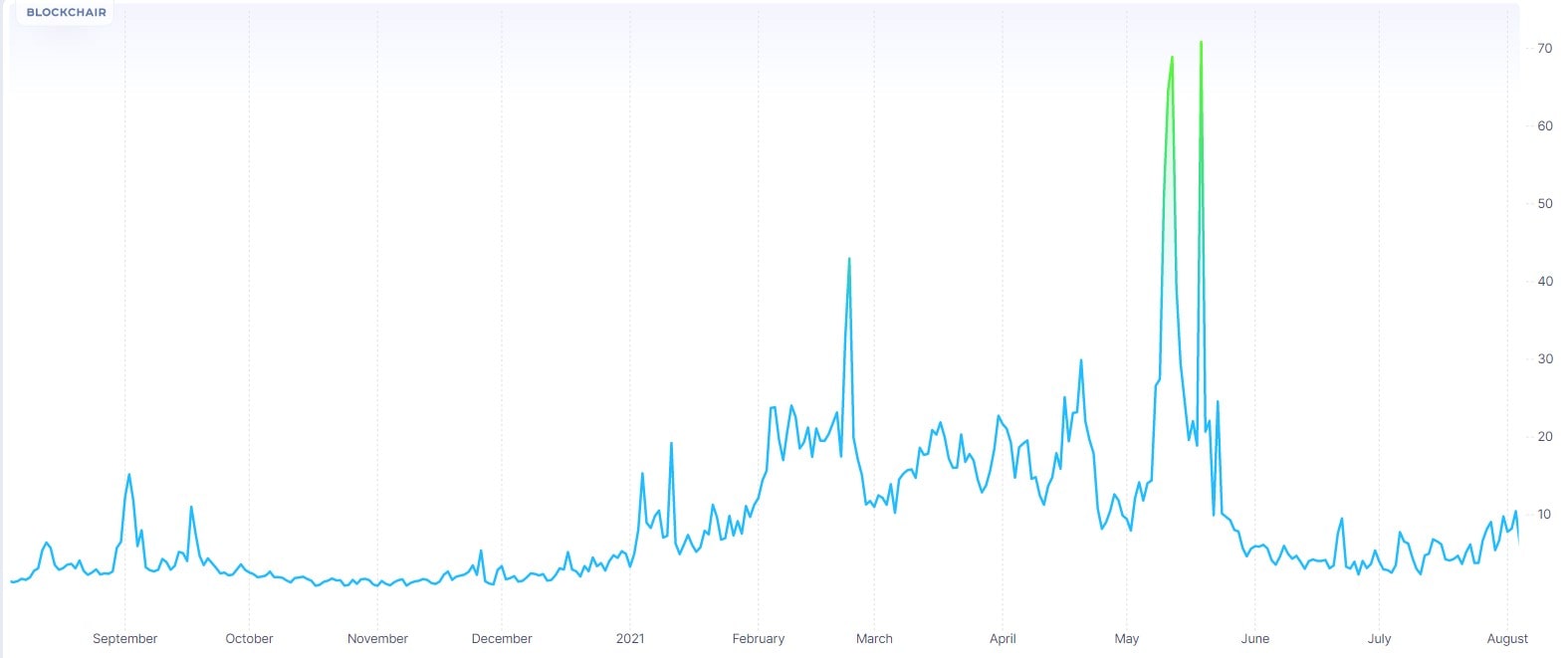

On 5 August, the Ethereum network’s London update will take place, which is expected to change the order in which transaction costs are determined. Before the update, the network used the auction mechanism through which miners would first add the transactions with the highest rewards to a block. This leads to the excessive growth of transaction fees if volume increases and, consequently, delays on the network. Furthermore, fee amounts don’t depend on the transaction’s amount, which makes small transfers impractical. Currently, the average commission value is around $6; in May, it hit a record $69. The hard fork is meant to reduce volatility and bring down costs.

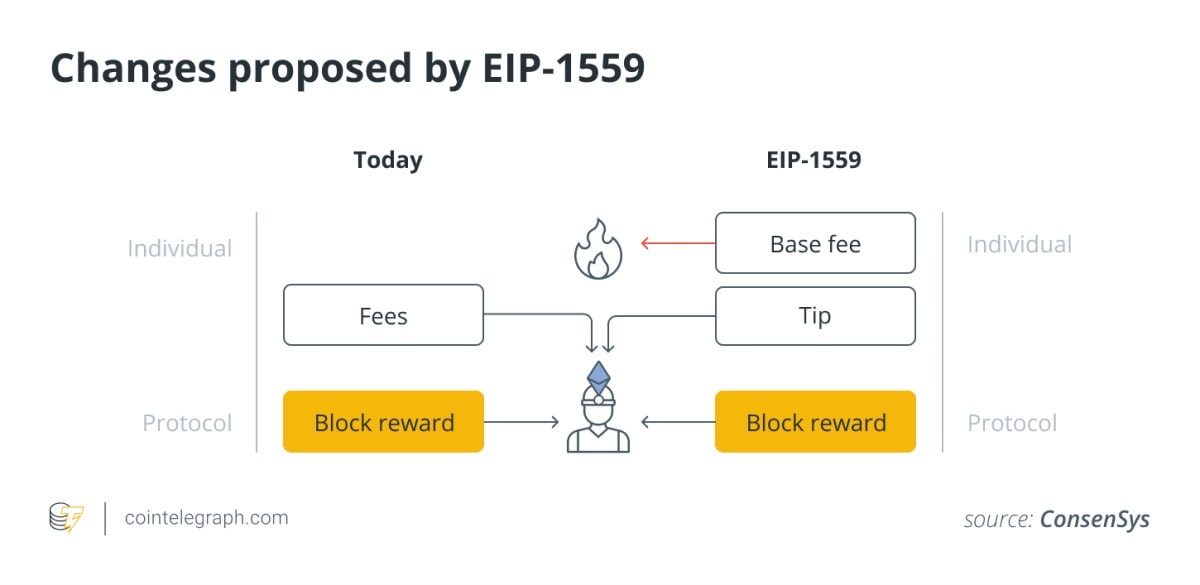

After the update, there will be a base fee for a transaction that will be adjusted by the network algorithm depending on the network load. The users can pay more than the base fee to make their transactions go faster and set a limit on the fee.

After a block is completed, a deflationary mechanism is launched. The base rate is burnt, and the miner gets income from signing the block and collecting tips on top of the base fee.

Various estimates believe this change could lead to a 20%-50% reduction in mining profitability, which has led to discontent among some miners. However, the developers have reminded them of a few things. First, rewards in the Bitcoin network get halved every four years. Second, Ethereum is preparing to transition to a proof-of-stake protocol and completely abandon mining. In addition to that, the deflationary mechanism stipulates that the coin’s price will grow, which means that the reduction in profit from processing transactions is compensated by the increased reward for signing blocks.

In reality, it’s hard to assess the impact that the London hard fork will have on commissions as users will continue to pay for priority. Consequently, the loss from the burn of the base fee can be compensated by the growth in tips, while the profit from mining will remain at its current level or even increase since there is no set maximum amount for paying for priority.

The deflationary mechanism may also raise a lot of questions. After all, if the reward amount for signing a block outstrips the income from processing transactions, the reward will become inflationary, and mining pools will be incentivised to add empty blocks. Users will have to substantially increase their tips to have their transactions included in a block.

As such, there is a risk that the hard fork will not produce the expected improvements. The situation will radically improve only with the transition to Ethereum 2.0, which is promised for December 2021. In this hard fork, at least, the difficulty bomb is scheduled for this date. After that, miners will have to look for other coins to make a profit, and the fees will become reasonable.

The StormGain Analytics Group

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.