Collateralised financing: the mortgage crisis of 2008 and the crypto crisis of 2022.

History is repeating itself. The 2008 global financial crisis was caused by the spread in the United States of CDOs (collateralised debt obligations) that promised increased returns. The same instrument led to the fall of the crypto market, where the decentralised finance sector promised an increased yield on investments. The problem is that the scheme only works in a growing market.

CDOs

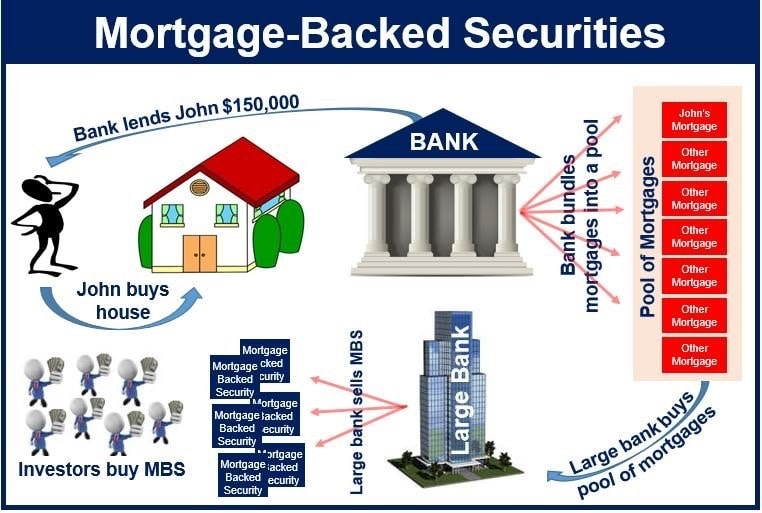

CDOs are securities (collateralised debt obligations) issued by various financial institutions. During the American construction boom of 2003-2007, mortgage CDOs (including mortgage-backed securities or MBS) flourished the most. There were many different forms and combinations of CDOs. We'll take a look at their underlying basis to understand the process.

A bank issues mortgages as a lender. Mortgage recipients generate profits for the lender when they repay the mortgage. At the same time, the bank issues CDOs that include these loans as an investment strategy that promises to share part of the profits with investors.

When conditions are balanced, the scheme looks like it works. However, in practice, housing prices rapidly increase, followed by rising interest rates on loans. At the same time, to maximise profits, banks reduce the requirements for borrowers, offering loans to low-income clients and sometimes completely neglecting to check their financial health.

Since CDOs are securities, they were traded on the market and used as collateral. Later, synthetic CDOs appeared, and the connections between the financial and real-estate sectors became increasingly finer.

By the end of 2007, the housing market had had enough. Sales dropped, and some customers were unable to make their mortgage payments on time. In turn, banks faced a crisis that instantly escalated from merely a mortgage crisis to a full-on financial one. All financial instruments tied to CDOs collapsed.

DeFi

The decentralised finance sector has much in common with CDOs. Investors put money in cryptocurrency with the expectation of receiving guaranteed returns for holding a position (staking). At the same time, in exchange for the invested cryptocurrency, a number of platforms offer their version of CDOs in the form of tokens for trading or use as collateral.

For example, Ethereum can be staked directly when creating a node, but doing so is more expensive (32 ETH must be deposited), and the coin will be 'frozen' before switching to the proof-of-stake algorithm.

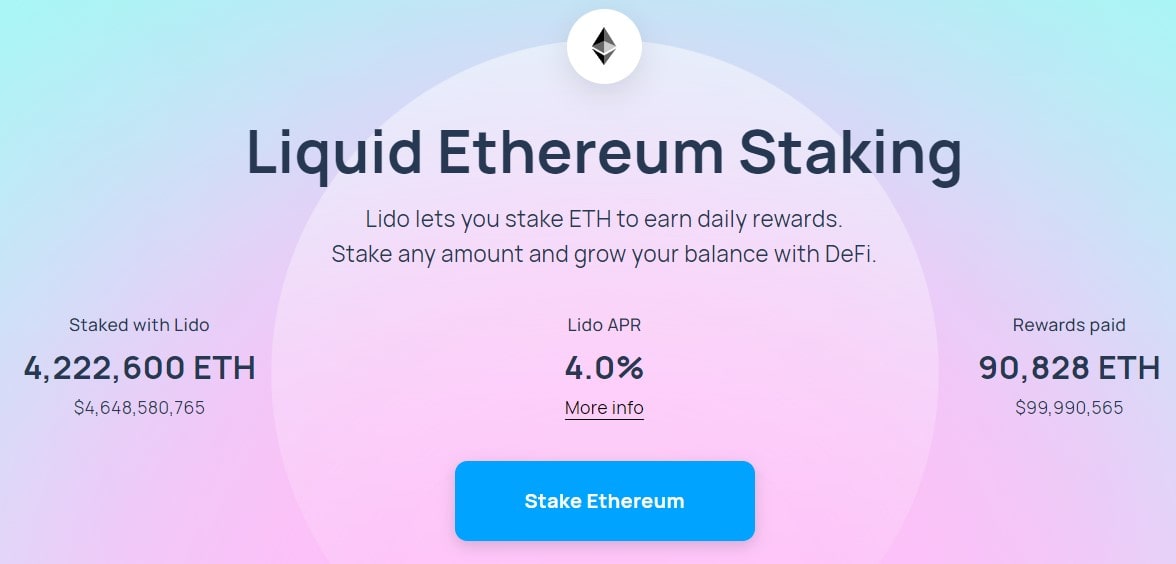

At the same time, Lido offers the opportunity to stake any amount of ETH in exchange for stETH tokens. These tokens can be used in other stakes as collateral and converted back to ETH.

When the market was growing, everyone loved the usability of stETH. The token was bought by ordinary users and investment crypto funds alike. However, when the market fell, a liquidity crisis arose. As a result, stETH's rate no longer corresponds to its parent cryptocurrency, and fewer funds remain in the pools that provide the possibility of exchange. On Curve, for example, 491,000 stETH is now worth only 110,000 ETH.

Celsius and Three Arrows Capital (3AC), both verging on bankruptcy, also invested in stETH and used the token for staking. By reinvesting the coins, they promised investors increased returns. For example, back in September, Celsius promised up to 17% in annual yield. Now the company has blocked customers from withdrawing funds, which has already drawn the attention of a number of regulators in the United States.

3AC is hastily selling some of its crypto assets in order to increase the collateral for open positions. According to the Financial Times, as the result of a margin call, 3AC has already lost part of its positions, at least $400 million.

StormGain Analysis Group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.