Panic in the cryptomarket

The day 13 June was dubbed 'Bloody Monday' due to the panic that struck the cryptocurrency market after another stablecoin lost its peg to the US dollar, the largest crypto exchange by volume froze withdrawals to Bitcoin and bankruptcy threatened a number of projects. However, the real troubles are yet to come.

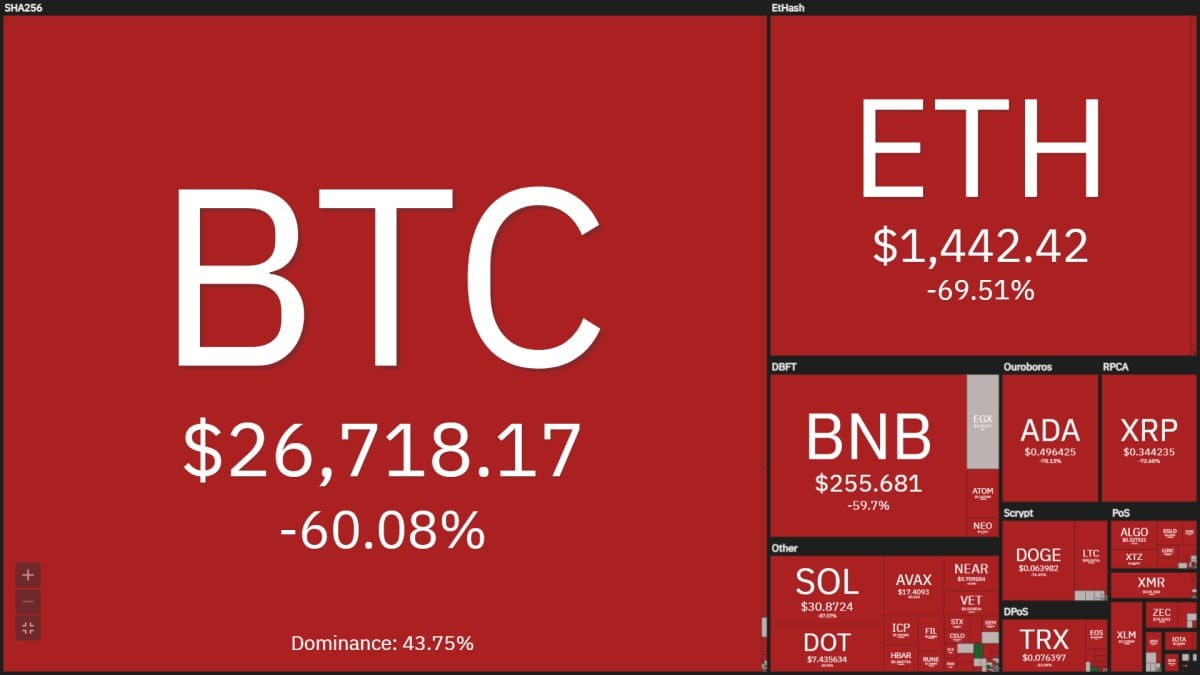

Bitcoin has already decreased from November highs by 60%, while Ethereum has dropped by 70%. Altcoins traditionally have a harder time dealing with bearish sentiment. This is true in terms of the preferences of both crypto traders and institutional investors. Since the beginning of the year, investments in Ethereum crypto funds have fallen by $387 million, while the inflow to Bitcoin funds is still positive with $451 million.

Due to the panic in the crypto market, a number of projects saw a large outflow of investments, and crypto exchanges experienced increased activity. On 12 June, the Celsius project announced the suspension of withdrawals, and on 13 June, Binance froze Bitcoin withdrawals. These events only added fuel to the fire, which is why the CEL token lost 50% in a day, and Bitcoin fell by 18%. Later, the head of Binance announced that the problem had been taken care of and that transactions had resumed.

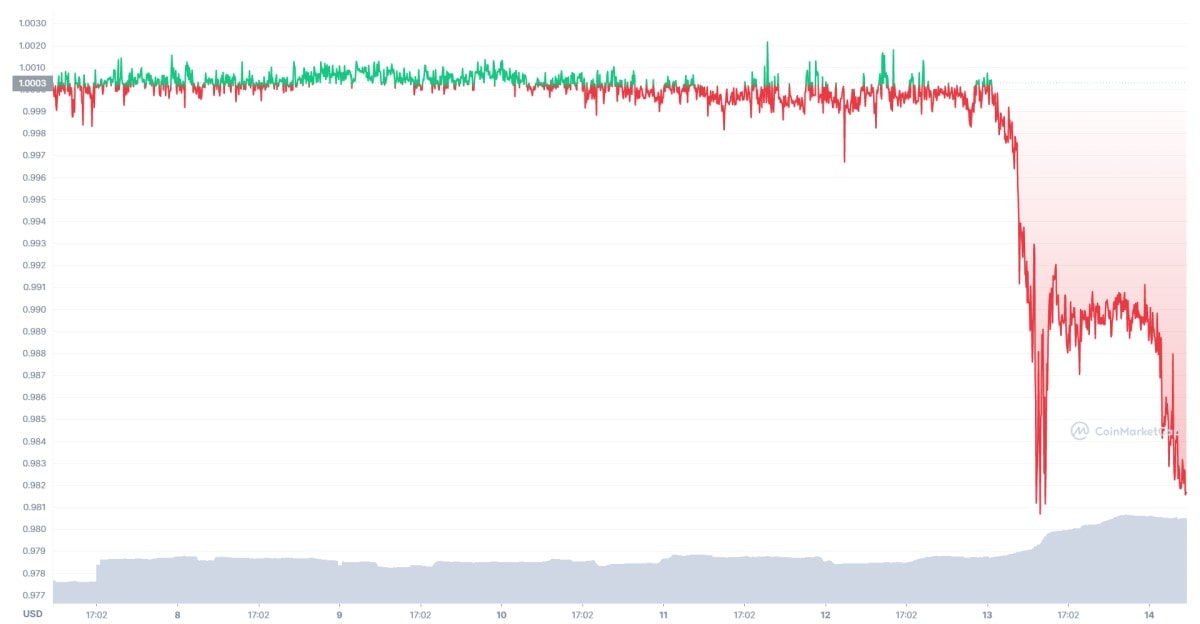

The Tron network's USDD stablecoin is an imprint of the infamous UST from the Terra Project. Because it only emerged in early May, USDD has a small capitalisation. However, it has already faced a liquidity crisis and lost its peg to the US dollar. At the KuCoin crypto exchange, USDD's exchange rate fell to $0.91 and has yet to recover, which threatens the market with the loss of another algorithmic stablecoin.

The fall in the crypto market's capitalisation is a stress test that will weed out weak companies and projects focused on instant profits. Public mining companies have already transitioned from accumulating to selling Bitcoin due to a shortage of funds to cover operating costs. In the near future, a series of mergers and acquisitions is expected in this sector.

The largest public hodler, Microstrategy, is in no better of a situation. For three years, the company bought Bitcoin following an increase in value, starting at $12,000. The company's assets currently number 130,000 BTC, while its unrealised loss is $1 billion. The last purchases were made on credit, which will result in Microstrategy needing to increase its bank deposit.

However, the fall of the crypto market was not news for the companies. The US Federal Reserve's pending monetary policy tightening became known at the end of 2021 when Jerome Powell stopped considering inflation a "transitory" problem. Following the regulator's reversal, all risky assets fell, including cryptocurrencies and stock markets.

It's worth remembering that since 2020, the main investment force in the crypto market has been institutional investors (companies with investments of $1 million and more), most of whom are American residents. This also explains why the Fed exerts such a strong influence on the crypto market.

Tomorrow, the Fed will hold another meeting where it will raise its benchmark interest rate yet again. Most experts expect a 0.5% increase, but inflation, which has risen to 8.6%, could encourage the regulator to take bolder steps. In this case, the pressure on Bitcoin will increase.

StormGain Analysis Group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.