Potential Approval of ETF Leaves No Chance for Bitcoin Bears

Since 2020, institutional demand has become one of the key motive forces driving Bitcoin demand: even pension funds are investing in it. However, many companies don’t want to work directly with cryptocurrency exchanges. As a result, they have to turn to derivative assets (e.g., Grayscale equities, which creates substantial commission costs.

A compromise solution is trading ETFs of investment funds that have become available on stock exchanges. At the beginning of this year, several Bitcoin ETFs were launched in Canada, where more than $2 billion are now under the management of the biggest funds.

When investing in Bitcoin ETFs, you don’t have to worry about the cold storage of cryptocurrency. In addition, orders on stock exchanges are protected by the law, just like orders for equities. A drawback here is the asset management fee, which varies from fund to fund somewhere between 0.40% and 1.00% a year.

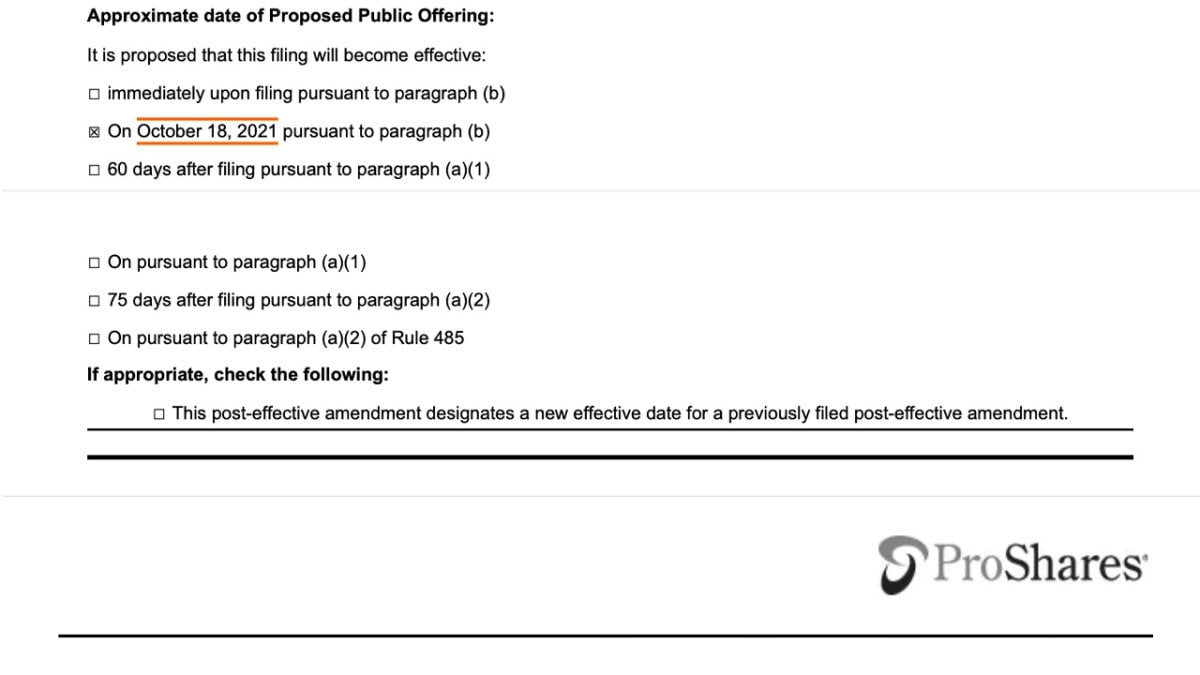

In the United States, applications for Bitcoin ETFs started being submitted in 2013, and only now are there explicit signs of an impending launch for one of them. As a regulator, the SEC doesn’t have to loudly declare the upcoming launch of a new exchange instrument. However, on Friday, the company ProShares sent an amended application to the SEC after making several changes required by the regulator. In the application, the declared fund launch was set for 18 October 2021.

The application has not been approved yet, and we are only talking about a Bitcoin futures ETF, not one for the spot instrument. However, this step could be important for recognising cryptocurrency as an investment instrument.

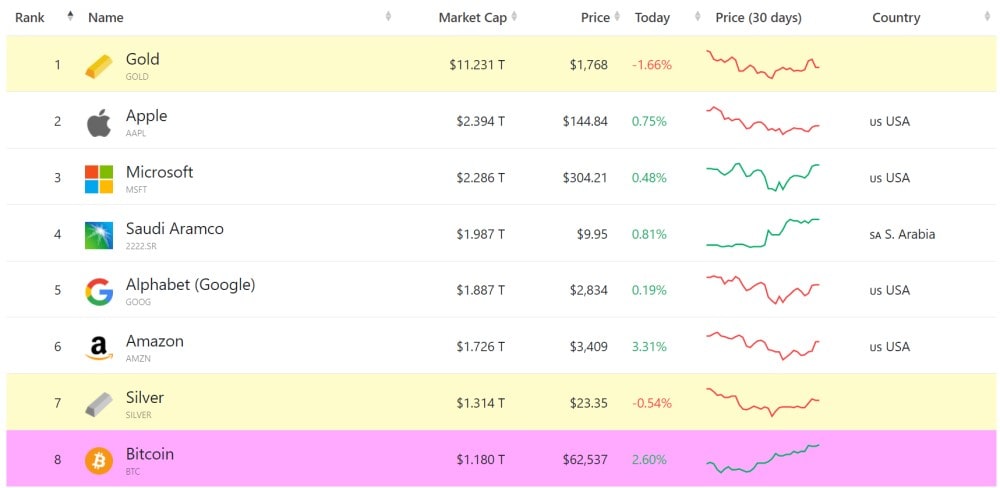

Bitcoin is close to reaching a new all-time high, and its capitalisation is above $1 trillion. In the very near future, the asset could become worth more than all the silver ever mined. The emergence of new exchange instruments will lead to an increase in demand for cryptocurrencies.

What do you think: is it better to invest in silver or Bitcoin?

The StormGain Analytical Group

(a platform for trading, exchanging and safeguarding cryptocurrencies)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.