Cryptocurrency recognition on the rise: from Belarus to the NYSE

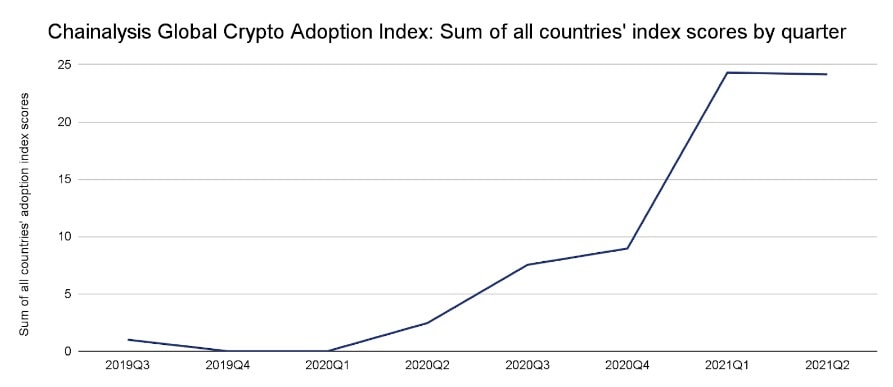

The media is positively febrile with reports of the Federal Reserve's impending monetary tightening, with a correction forecast for the entire financial sector, including stocks and crypto. However, because of its relative youth, the cryptocurrency market's level of adoption will prove a more influential factor than the strength of the US dollar or cheap price of credit.

While the debate in Russia continues between the central bank and Ministry of Finance as to the status of cryptocurrencies, the Republic of Belarus is putting the finishing touches on a legal and regulatory framework for the circulation of crypto assets. As such, a government decree dated 14/02/2022 provides for the creation of a registry of virtual wallets used for criminal activities.

"Belarus is seamlessly developing a legal and regulatory framework for activities associated with digital assets, and in contrast to many other governments, it permits the free circulation of digital currencies. At the same time, this requires constant monitoring of the situation and, where necessary, supplementation and clarification of regulatory standards".

The cryptocurrency sector's emergence from the shadows began on 21 December 2017 with the signature of Decree No. 8 "On the development of the digital economy". Several licensed cryptocurrency exchanges currently operate in Belarus, while the tax holiday on these assets has been extended to 1 January 2023.

Also in 2017, JPMorgan CEO Jamie Dimon called Bitcoin "a fraud". However, just one year later, the bank began testing its own crypto platform before releasing JPMCoin shortly thereafter. In 2022, JPMorgan became the first credit institution to open an office in the Decentraland metaverse. "In time, the virtual real estate market could start seeing services much like in the physical world, including credit, mortgages and rental agreements," said a recent JPMorgan report.

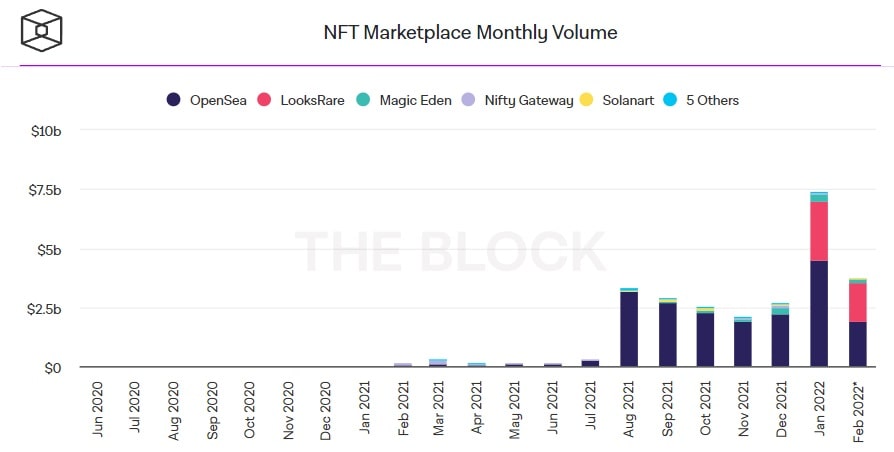

The New York Stock Exchange sees just as much potential for development in the crypto industry, too. On 10 February, the NYSE sent an application to the US Patent Office to register a trademark for an online NFT marketplace. It would appear that the exchange is planning to launch a competitor to OpenSea, Rarible and Magic Eden. The NYSE's interest has no doubt been influenced by the phenomenal growth of the NFT market from $33 million in 2020 to $12.5 billion in 2021.

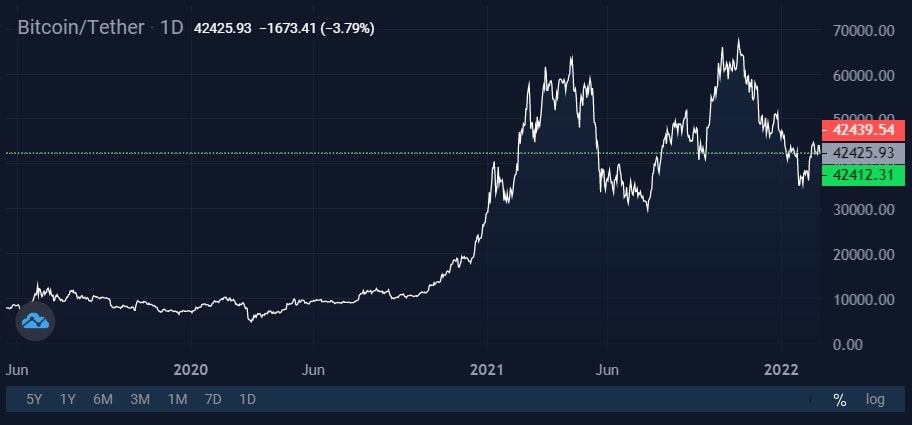

Bitcoin had a bullish year in 2021, and net investment inflows into crypto funds reached $9.3 billion (a 36% YoY increase). All that happened despite the ban on crypto transactions and mining in China (the world Bitcoin hashrate leader). After all these trials and tribulations, the Fed's rate hikes are unlikely to pose a significant threat to the cryptocurrency market.

StormGain analytical group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.