Russia Becomes the Third-Largest Bitcoin Miner

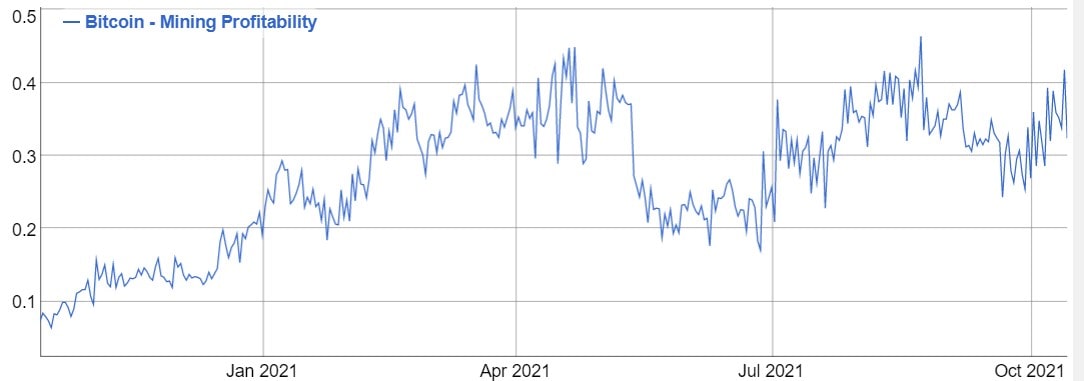

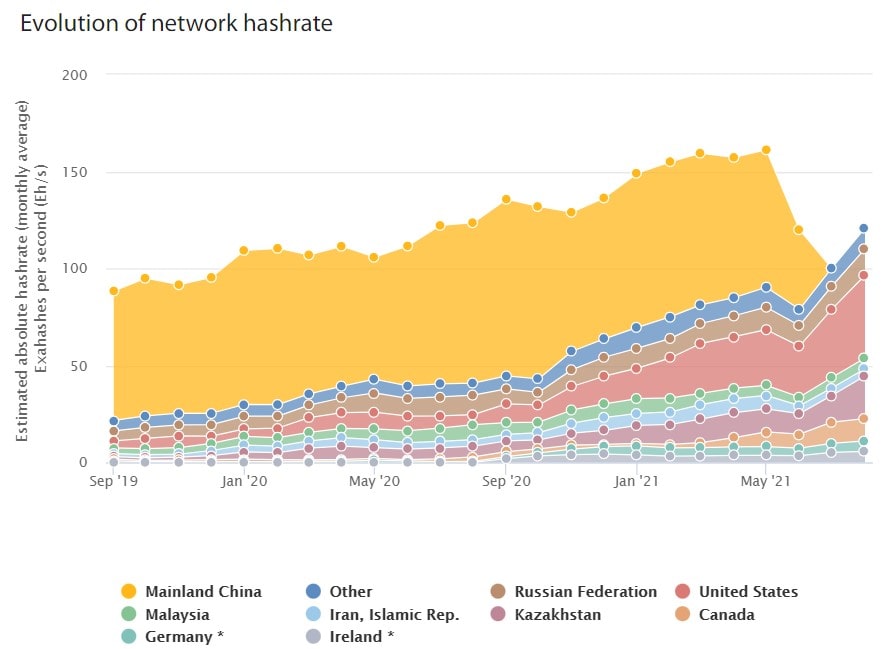

China’s ban on working with cryptocurrencies for financial organisations and suppression of cryptocurrency mining in the country caused a 50% drop in Bitcoin’s hashrate in June. As Chinese miners assembled their rigs to move them elsewhere, cryptocurrency miners in other countries ramped up their hashing power thanks to reduced mining costs.

Back in 2020, China was the leader in Bitcoin mining, providing 50% to 60% of the world’s hashrate. In the United States, then-Director of National Intelligence John Ratcliffe wrote a request to the SEC Chairman to not restrict the operations of American cryptocurrency miners so as not to give an edge to their Asian opponent. However, China has gone its own way.

According to Cambridge University, China is not currently participating in mining. The top three countries are the United States (35.4% of Bitcoin’s hashrate), Kazakhstan (18.1%) and Russia (11.2%).

Kazakhstan started to develop regulations on cryptocurrencies and mining before Russia. Starting from 2022, miners will pay an additional commission of 1 tenge for each used kWh. Estimates calculate that this could add an additional 5 billion tenges or $11.7 million to the country’s treasury next year.

Now, Russia is concerned about the increased load on the electrical grid because of the newly arrived Chinese rigs to the Irkutsk Region. According to Governor Igor Kobzev, the annual consumption of electricity has grown by 159% and is related to underground mining. In order to solve the problem, the governor suggests diversifying the rates for the population depending on the volume of electricity consumed.

However, this is not a temporary problem; it will require structural solutions for mining to be pushed outside the grey economy. Bitcoin’s price has not yet overtaken its historical high, and institutional demand expressed in open interest is testing the ATH. The probability of the coin going past $65,000 is very high, and breaking through this important level will increase interest in mining.

The StormGain Analytical Group

(a platform for trading, exchanging and safeguarding cryptocurrencies)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.