Do you want to buy Bitcoin? September’s not the best month

Since the start of the year, Bitcoin has grown by 72%, while the S&P 500 broad market index has only increased by 20%, and gold is showing a negative return. This fantastic investment performance is appealing to both crypto enthusiasts and institutional investors seeking a hedge against the growing inflation.

To support the United States’ economy, the Federal Reserve is printing dollars to buy back $120 billion in Treasury bonds every month. This has caused stock markets to rise rapidly compared to their usual 5% growth per year. Another result has been the devaluation of the national currency. In late August, we predicted Bitcoin would hit $50,000 because of remaining uncertainty around the Fed cutting short its bond-buying programme while many market actors have announced the date for winding down of the fiscal aid programme, which would strengthen the dollar.

Meanwhile, the situation could radically change if inflation is aggressive. Data for August will be released on 14 September, and the Fed has the power both to curtail its bond purchases and to hike the interest rate urgently (although the latter is unlikely).

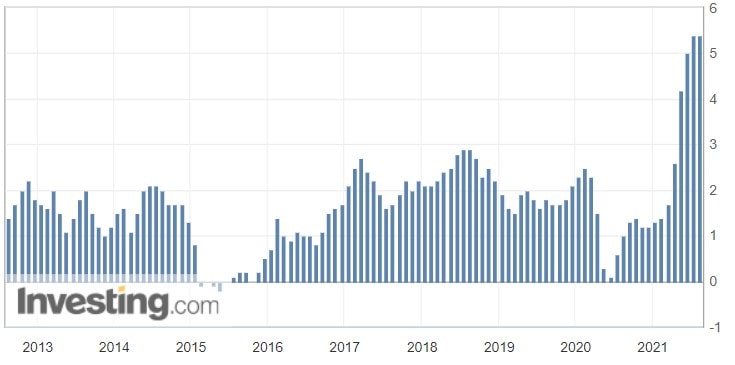

The data also tell us to remain cautious: in September, Bitcoin has only gone up two out of eight times, with the best result being 6%. The worst performances were seen in 2014 and 2019, when Bitcoin’s price fell by 19% and 13%, respectively.

Meanwhile, in the last six days, Bitcoin has already risen by 10%, which is above average.

JPMorgan believes that the trend seen over the last two months is due to aggressive investors switching from the stock market to cryptocurrencies. NFTs are of particular interest, which has allowed Ethereum, Cardano and Solana to show the best movement. Meanwhile, Bitcoin’s turnover has gone down from the peak of $64 billion it saw in June to $46 billion in September. According to JPM, this confirms the hyped nature of the bull run of the last three days. A rising price and decreasing volumes create the risk of a price correction because the growth is not backed by public interest.

If the statistics prove to be stronger than investor sentiment, Bitcoin could turn south in the middle of the month. However, traders don’t have to worry because exchanges offer both long and short positions.

The StormGain Analytical Group

(a platform for trading, exchanging and safeguarding cryptocurrencies)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.