Crypto challenges: Silvergate's liquidation, the Fed's ramp-up and a $1 billion Bitcoin sell-off

The macroeconomic headwinds are putting serious pressure on the cryptocurrency market. Bitcoin had just recovered from the FTX crash, climbing above $21,000, before one of the largest cryptocurrency banks, Silvergate, first warned of financial difficulties and now announced its voluntary liquidation.

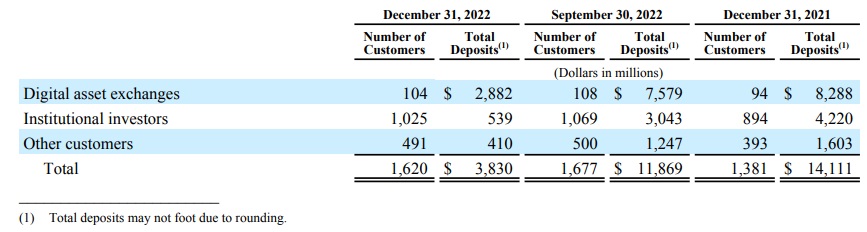

The role of crypto banks is hard to overestimate since they're the link between traditional financial institutions and the crypto world. Silvergate had over 1,600 digital asset customers, including major figures such as Coinbase, Circle, Paxos, Galaxy Digital, Gemini, Bitstamp, Wintermute and others. In the previous quarter, digital asset turnover on SEN, its own platform, amounted to $117 billion.

The close ties to the crypto sector were both the reason for the bank's rise and demise. In Q4 2022, losses incurred amounted to $1 billion because of FTX's collapse. Deposit volumes over the same period fell by 52.4% to $6.3 billion, while annual fee income from operations with digital assets fell from $35.8 million to $32.2 million.

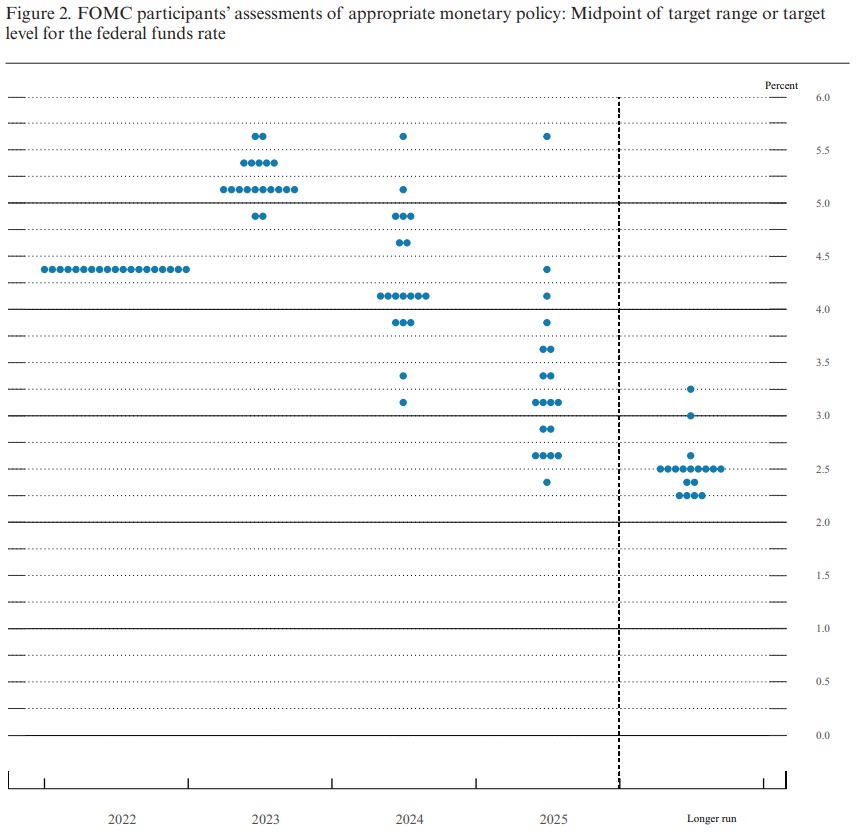

On the day Silvergate announced its liquidation, Fed Chairman Jerome Powell addressed members of the United States Congress. He called on Congress to raise the public debt limit because, otherwise, the Fed would be unable to protect the US economy. He also indicated the likelihood of a more aggressive rate increase (the last hike was 0.25%) because of persistently high inflation. Powell also warned that the peak rate would be higher than expected.

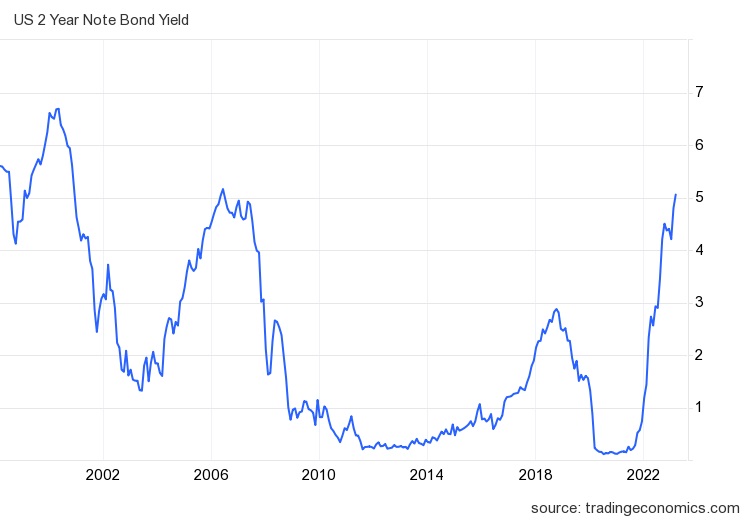

High interest rates cause a natural outflow of capital from high-risk assets to defensive assets such as US Treasury Bonds. Yields on two-year US Treasury Bonds are already at their highest in 15 years, with a rate of 5%. A further rate hike will make defensive assets even more attractive for investment.

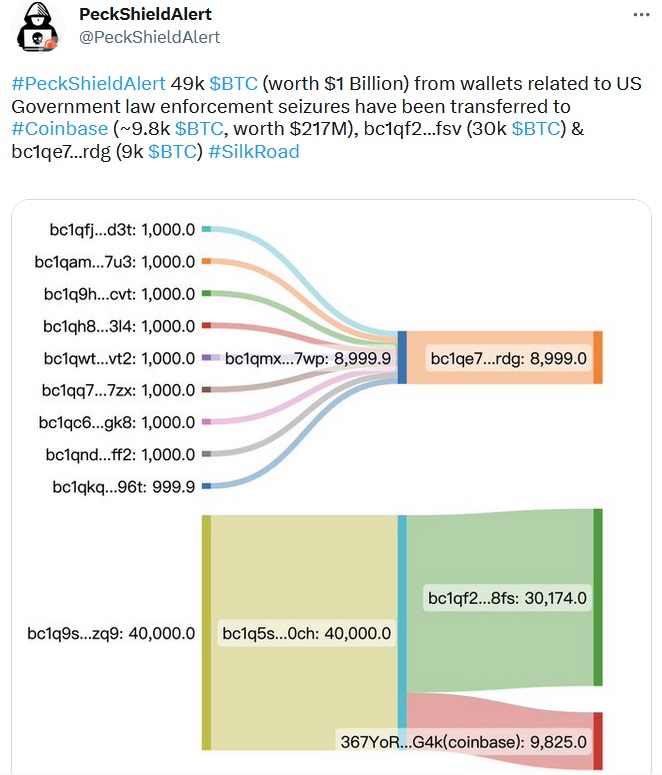

A third negative factor for Bitcoin is the risk of the US government selling $1 billion worth of coins confiscated in the Silk Road black market raid. The other day, 9,800 BTC (~$213 million) were sent from government addresses to the Coinbase exchange.

Sending the funds to the exchange indicates that the coins will be sold on the open market without any auction procedure. The amount isn't that significant, but combined with other negative factors, it could trigger a new round of Bitcoin declines in the medium term.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.