Tether changes its reserves amid storm of criticism

The collapse of Terra's UST project has led many to reassess the value of other similar stablecoins. Well before this recent crisis, Tether's USDT had already come under fire on account of its not keeping its promises regarding the composition of its reserves. As a consequence, the market capitalisation of the world's biggest stablecoin fell by 12% within the space of two weeks.

Tether had initially pledged to back every single USDT issued with $1 on its bank account, a promise it failed to keep. In 2018, the company printed almost $1 billion to provide as a loan to Bitfinex when the crypto exchange found itself faced with a liquidity crisis.

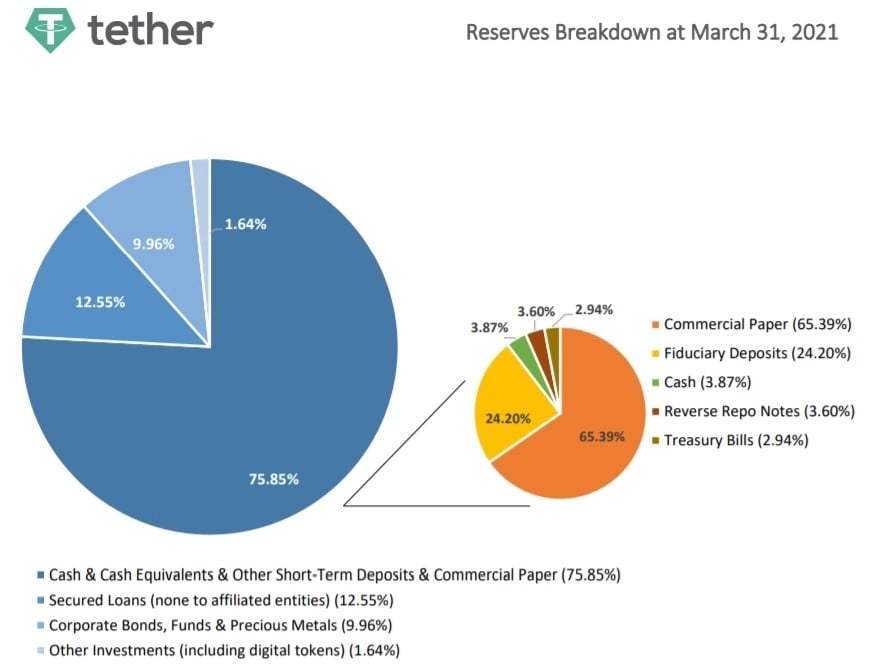

The truth came out when the New York District Attorney's office conducted its own audit. As part of an out-of-court settlement, Tether was ordered to pay a fine of $18.5 million, also accepting a requirement to publish regular reports of its reserves. It was thus revealed that Tether's reserves are made up of less than 5% fiat currency, with over half consisting of corporate securities. After the audit, Tether removed the reference to "dollar reserves" in its fund safeguarding statement, adding crypto assets and credit income in its place.

LUNA's dramatic decline and the loss of parity of Terra's UST stablecoin have once again brought the issue of Tether's liquidity to the fore. On 12 May, the USDT exchange rate dipped to $0.94, and the panic even spread to Bitcoin, leading the original cryptocurrency to fall to $25,000.

Tether managed to bring the situation under control, though the associated capital outflows coupled with insufficient reserves could lead to a repeat of the same, only with worse consequences.

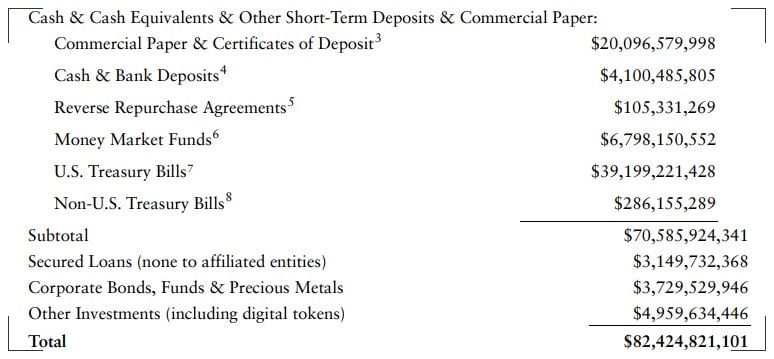

As of 2022, the company has been actively trying to rebalance its reserves, as is detailed in a report (from 31 March) recently published by Cayman Islands-based MHA Cayman. Consequently, its total consolidated assets slightly exceed the requirements, coming in at $82.4 billion. Out of these, corporate securities account for around a quarter, or $20.1 billion, while in Q4 2021, this value stood at $24.2 billion. Tether promises to reduce these by another 20% in Q2 2022.

As the portion of corporate securities has fallen, the amount of reserves held in US Treasury notes has risen from $34.5 billion to $39.2 billion.

It's important to note that this report is not an audit but is rather classified as financial information on the basis of accounting records. MHA Cayman is very clear that its assessment of Tether's assets is based on their current status and does not take into account any potential large-scale market correction or the default of any of its major debtors.

StormGain analytical group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.