3AC owes creditors $3 billion, its founders go missing

New information is being added to the story surrounding the bankruptcy of the major cryptocurrency hedge fund Three Arrows Capital (3AC). It turns out that the fund's problems were caused not only by bad trades but also by the desire of its owners to make their money back after the May crypto crash.

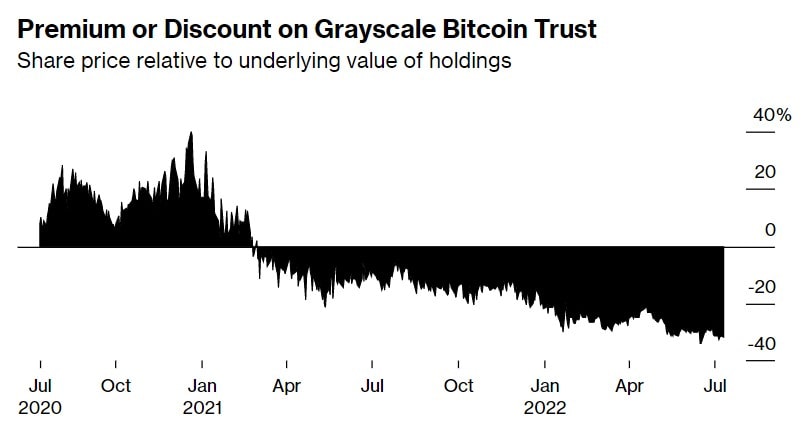

The fund was launched in 2012 by classmates Su Zhu and Kyle Davis, and its initial strategy was based on gap trading in adjacent markets. In 2021, 3AC reported an unprecedented $1 billion position in Grayscale's Bitcoin Trust since the hedge fund could buy shares at a discount in exchange for Bitcoin. For ordinary traders, the shares were already priced at a premium. But this was abandoned when the creation of a Canadian Bitcoin ETF led to Grayscale's shares losing ground against the cryptocurrency.

With good financials and extensive experience, Zhu and Davis delved deeper into the cryptocurrency sector. At its peak, the fund managed between $10 billion and $18 billion and had more than 600,000 followers on Twitter alone, according to various estimates.

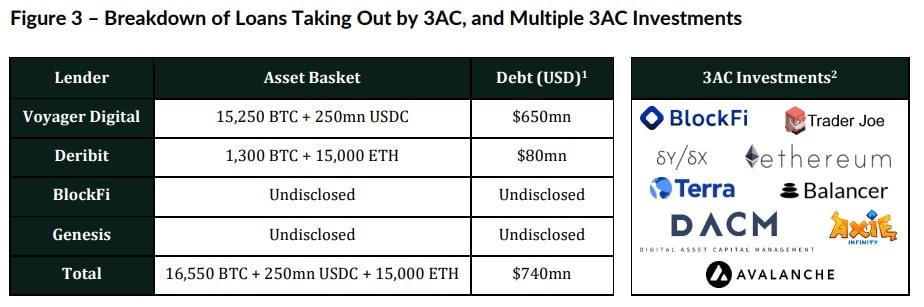

The fund invested in a wide range of tools and projects, and consequently, its success became directly dependent on the growth of the crypto market. They leveraged both depositors' funds and those they borrowed. It's no surprise that the company got into trouble if they borrowed funds in Bitcoin and stablecoins and invested in LUNA and other less liquid coins.

In 2021, LUNA saw a 130-fold price increase and broke into the Top 10 coins by market capitalisation. However, in 2022, it completely imploded. 3AC lost over $500 million on LUNA alone.

Another example is the fund's investment in stETH to earn a stable income from staking. stETH is a token that represents staked ether in Lido, which is issued by Lido Finance. All was going well until stETH lost its 1:1 peg with ETH. 3AC's founders suffered losses, too, as they sold their positions at the worst possible time, fearing a repeat of the LUNA debacle.

These extremely unsuccessful trades resulted in a liquidity crisis, and brokers announced a margin call that forced positions to be closed. Davis tried to open a new line of credit with Genesis in mid-June to cover the liabilities. Sam Callahan of BTC Savings Plan suggests that at some point, the crypto fund turned into a Ponzi scheme, as the founders resorted to seeking new investors and lenders as the losses piled up.

On 1 July, 3AC filed for bankruptcy in a New York court, with investors' total losses exceeding $3 billion. Due to the fund's inability to cover its liabilities, a number of investors have also declared bankruptcy or are close to doing so. According to the latest estimates, Genesis Asia Pacific suffered the heaviest losses, having lent 3AC $2.4 billion.

At the end of the hearings, the fund will be liquidated to cover part of its debts. This will increase pressure on the cryptocurrency market. Bearish sentiment will also be fuelled by cascading liquidations of positions by partners whose lost investments will turn into another crisis.

StormGain analytics group

(crypto trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.