UST: the number one decentralised stablecoin

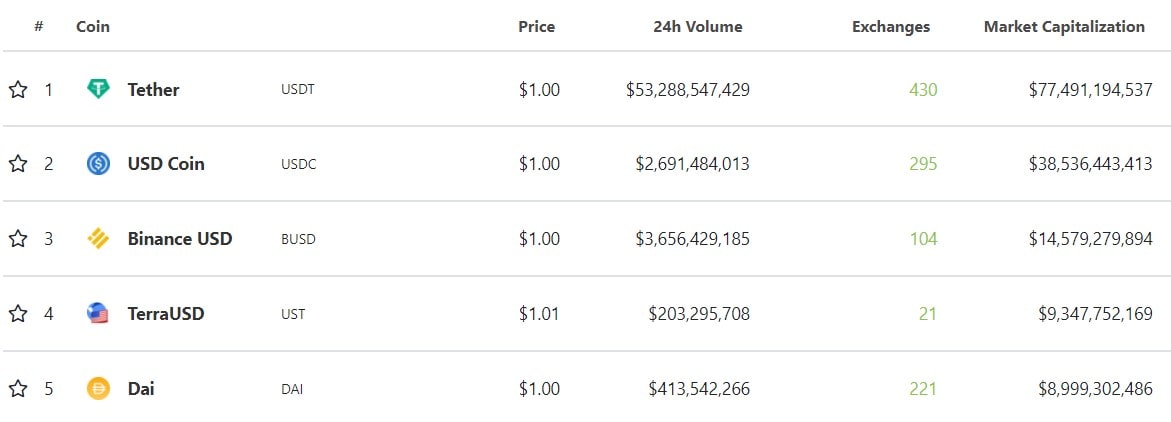

The top three stablecoins by market cap consist of the centralised coins Tether, USDC and Binance USD. "Centralised" means that a single company is responsible the issue of tokens. This entails specific risks for both investors and the industry as a whole.

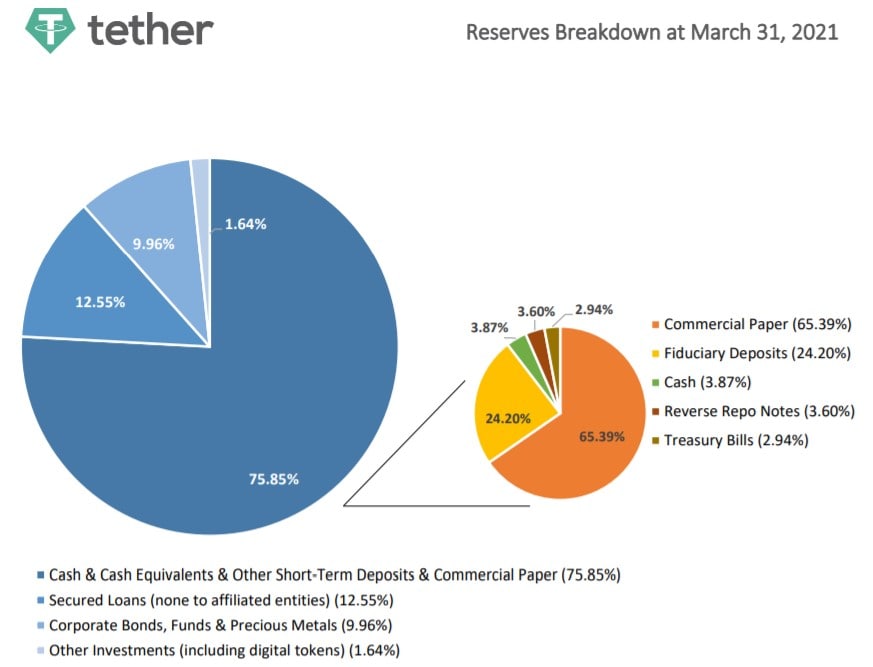

Tether, for example, pledged that it would hold a corresponding amount of US dollars on its bank accounts for every USDT it issues, thus ensuring liquidity is maintained. However, following an investigation by the State of New York Attorney General's, it came to light that USDT is not "fully backed by dollar reserves", but in fact supplemented by "crypto assets and credit income". Then, in March, a court-ordered audit revealed that around half of all USDT was actually backed by undisclosed debt obligations. In other words, the tokens issued by Tether in fact go to fund other crypto companies. So, if a critical mass of users decided to exchange their Tether for USD all at the same time, the market would not have enough liquidity to meet demand. This could then threaten to destabilise the 1:1 exchange rate, bringing with it a raft of consequences.

If you wish to avoid the risk of such an abuse of trust, you can make the move to decentralised stablecoins whose issue is controlled by an algorithm and not in any way influenced by the issuer. This month, Terra's UST project overtook Maker's DAI to take first place among these stablecoins.

The algorithm responsible for controlling the money supply maintains a 1:1 exchange rate between UST and USD using its own LUNA coin as a floating peg. To put it in simple terms, when there is a surplus of UST supply, a portion of LUNA is burned. When there is a deficit of UST, validator compensation is raised. The strong potential of this project saw Luna rise 1,500 times this year. Meanwhile, it even managed to outperform Binance in the DeFi sector, trailing only to Ethereum.

The Terra project has ambitious goals and plans to become a leading intermediary blockchain between traditional finance and cryptocurrencies. The spread of decentralised apps and the predicted metaverse boom will spur LUNA on to continued growth in 2022, while UST could enter the TOP-3 stablecoins by market capitalisation.

StormGain analytics team

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.