Whales join shrimps in hoarding Bitcoin

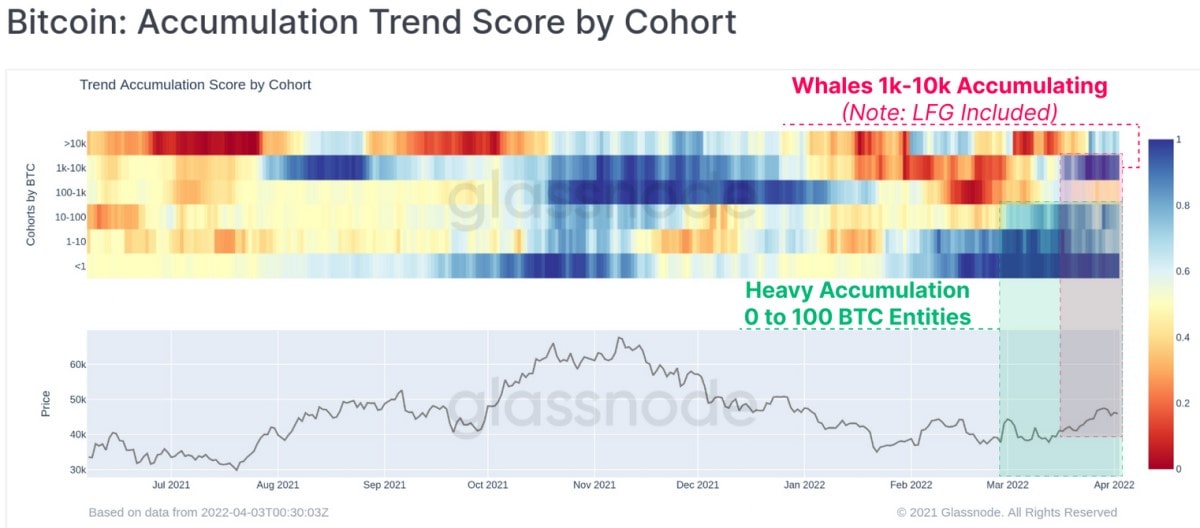

In early March, whales (>1,000 BTC) were not on the same page as minor players when it came to accumulating Bitcoin and continued to take profits. However, their expectations of a dip to $30,000 due to the worsening macroeconomic climate and global central bank monetary tightening did not come to pass. On the contrary, interest in faster, decentralised payment solutions actually increased. This led the whales to join the shrimp (<1 BTC) in late March and start accumulating coins.

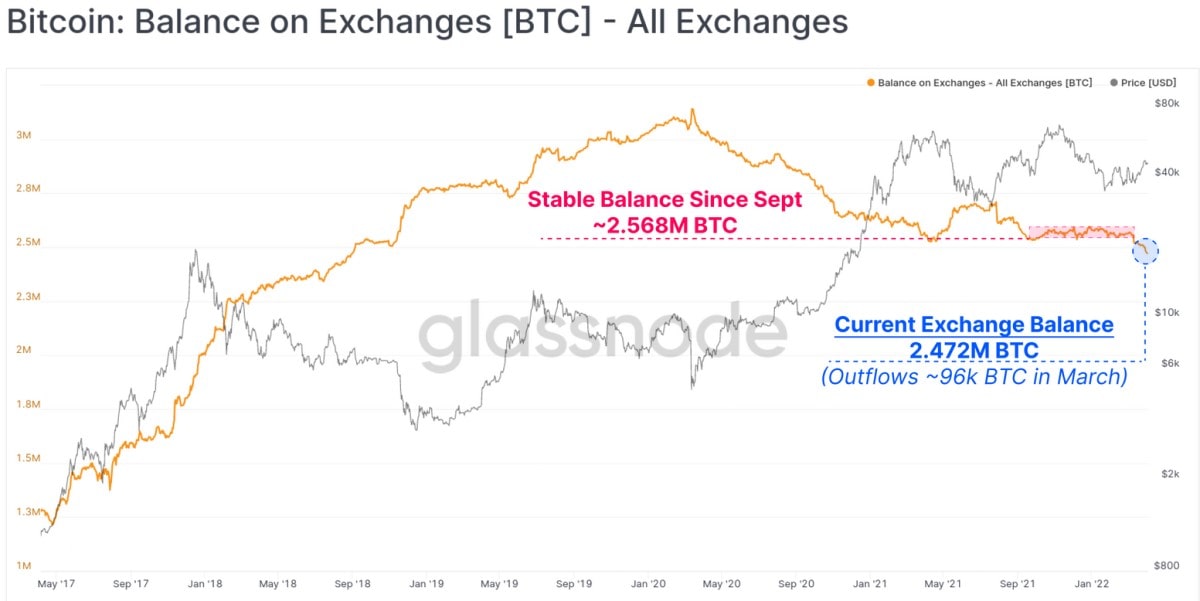

Accumulation was particularly strong last week: the total balance on crypto exchanges fell to an August 2018 low of 2.47 million BTC, with capital outflows of 96,200 BTC per month.

Over the last four months, the balance of accumulation addresses (with no history of spending) rose by 217,000 BTC, with this metric also excluding miner and crypto exchange wallets. The growth rate rose to 1800 BTC per day, which is two times the mining rate.

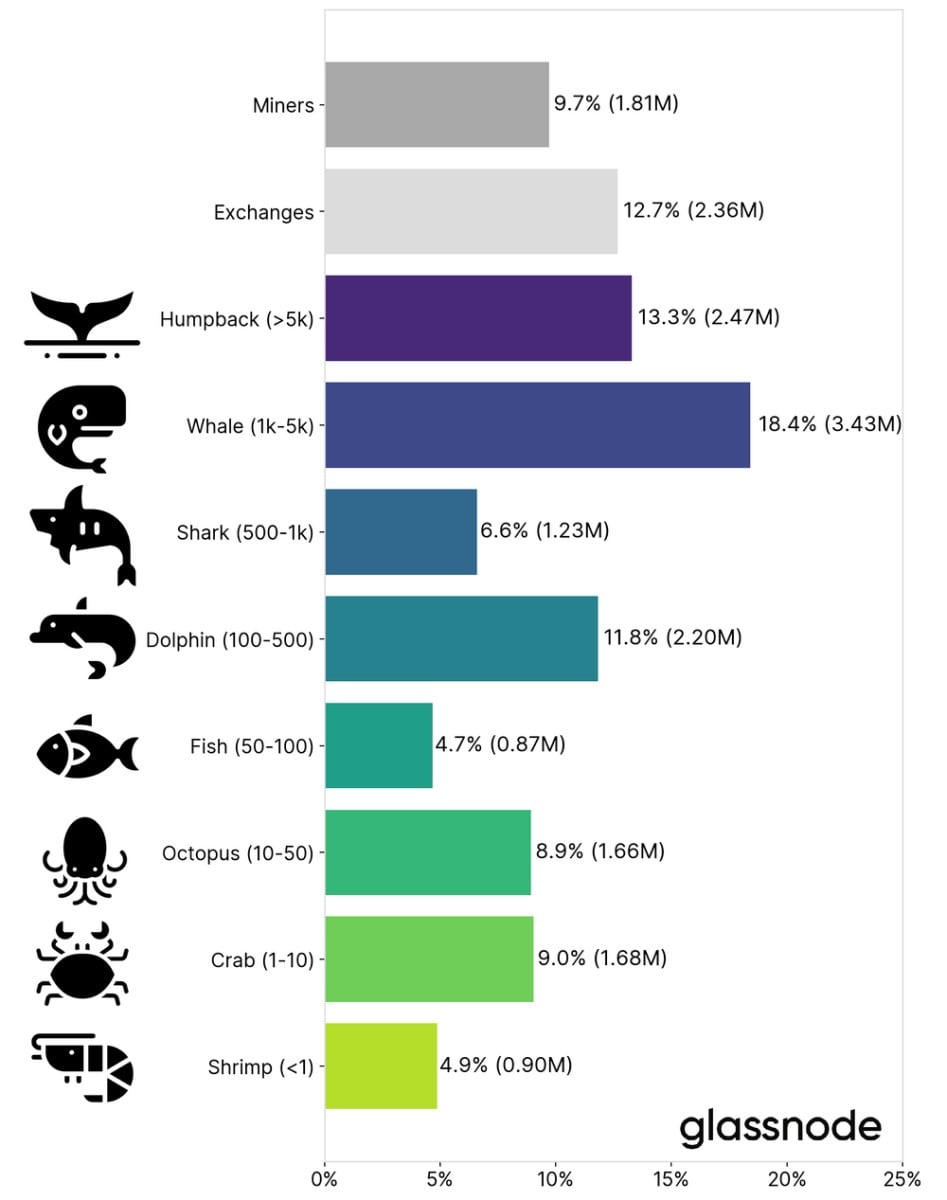

The most activity was seen among shrimps, which sucked up 0.58% of the entire Bitcoin supply, increasing their cryptofauna share to 14.3%. Whales, on the other hand, have only been accumulating coins for the last two weeks.

Amongst whales, a significant contribution to reducing supply was made by Luna Foundation Guard (LFG) and Microstrategy. Three weeks ago, LFG announced its intention to buy $3 billion worth of Bitcoin to serve as reserves for its UST stablecoin. This comes after the company already purchased 30,700 BTC worth $1.4 billion. Meanwhile, Microstrategy increased its reserves by 4,200 BTC via its subsidiary to increase its capital reserves to 129,200 BTC ($5.9 billion).

News of the nineteen-millionth Bitcoin being mined last week also had a positive impact on accumulation sentiment. Now, there are only 2 million BTC (10% of the total volume) left to be mined over the next 118 years. The acknowledgement of a coin deficit comparable to 30% of all US dollars printed over the last two years is only increasing interest in Bitcoin investment among the wider public. In a recent interview with Coindesk, Gary Kasparov called Bitcoin digital gold, adding that the technology enabled holders to protect their wealth from the dollar's devaluation.

StormGain analytical group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.