Whales are dumping Bitcoin

Despite a moderate revival in the crypto market of late, major players remain sceptical. In an attempt to catch the bottom, institutional investors (companies with holdings of $1 million or more) have made a dash to the stock market, prompting the S&P 500 to recover 7% in the space of the last three days. Bitcoin, on the other hand, continues to bobble around the $30,000 mark while the number of whales in the market is falling.

The US stock market's resurgence can be attributed to major analytics agencies stating that inflation has reached its peak and that we can expect more dovish moves from the Fed, particularly when it comes to monetary policy. It is well documented that once inflation hits a ceiling, stocks usually go up, with the notable exceptions of December 1969, January 2001 and July 2008

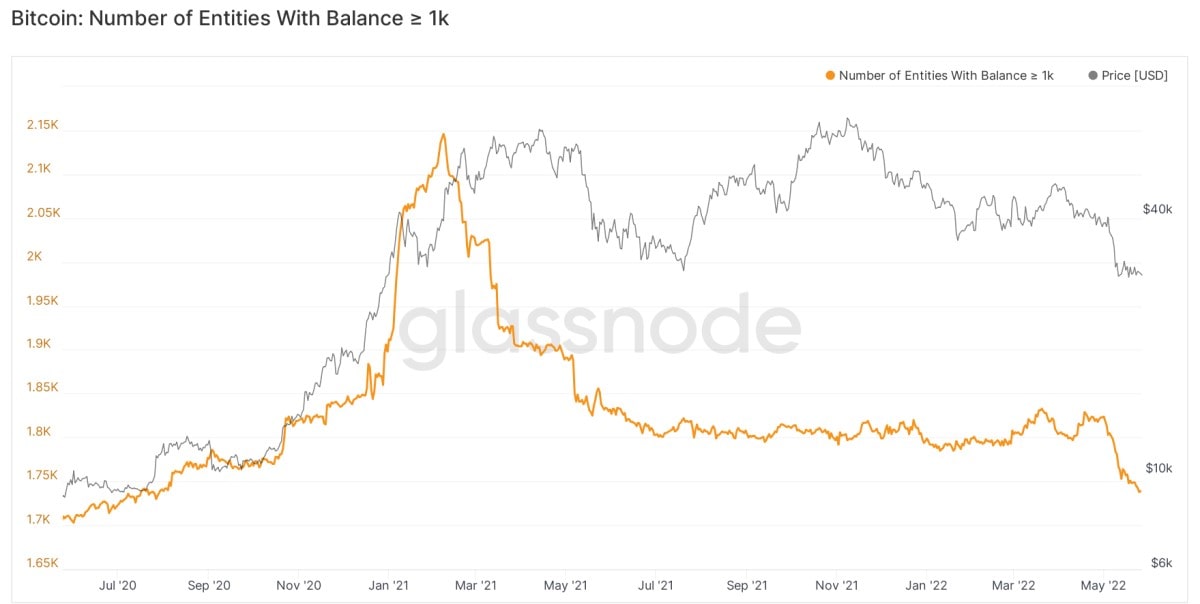

However, major investors do not believe that either Bitcoin or the stock market has reached a bottom. The biggest selling has been by whales (accounts with 1,000 BTC or more), while the total number of such participants has fallen to mid-2020 levels.

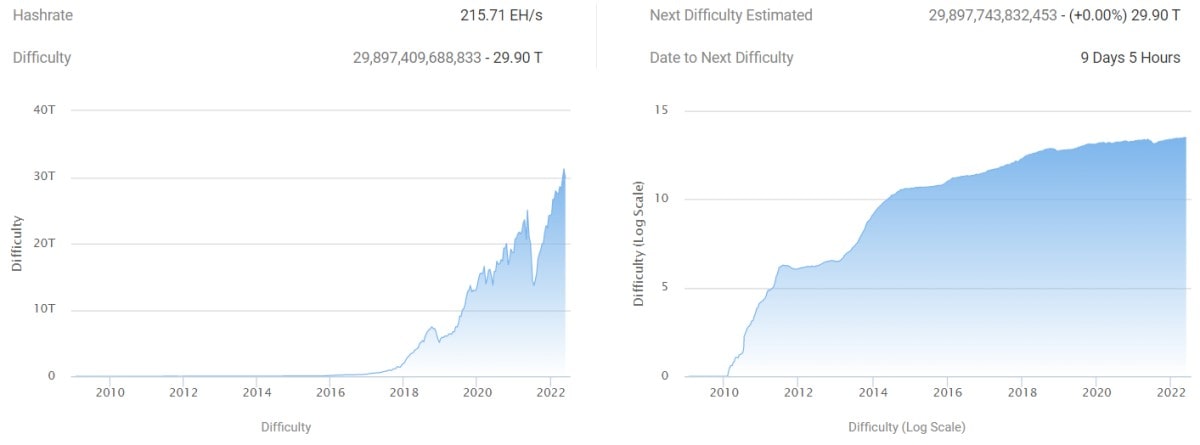

As a result of the cryptocurrency's decline, mining has become a less profitable endeavour. For the first time in 10 months, mining difficulty corrected downwards to drop by 4.3%. Miners are turning off equipment now that Bitcoin is below its breakeven point. For this reason, several major players could review their plans to increase production capacity since lower Bitcoin prices at high difficulty levels mean longer cost recovery periods.

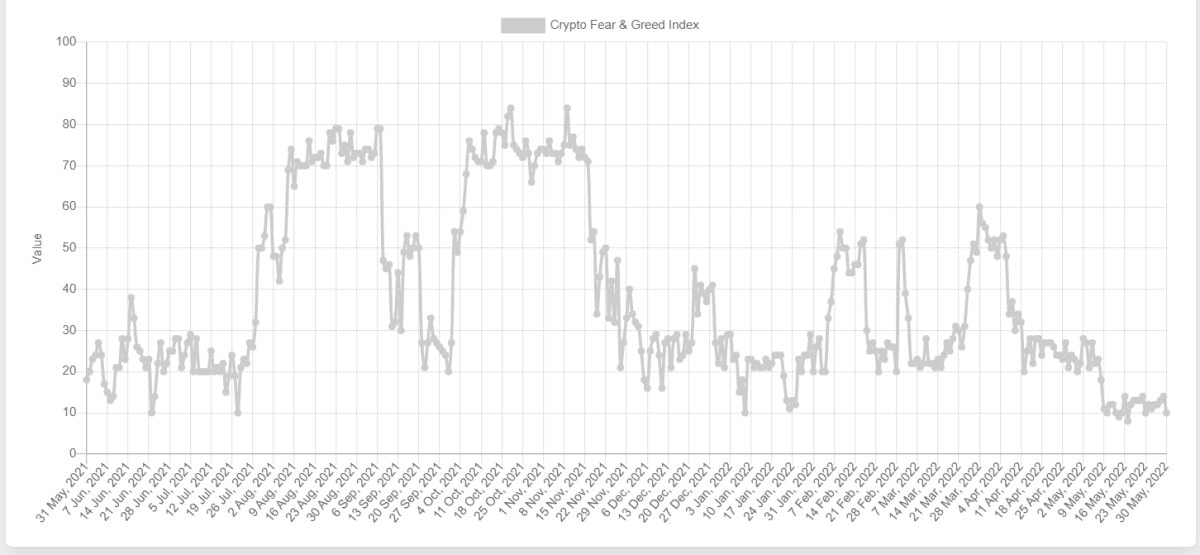

At present, the smaller players are holding Bitcoin back from further declines as the fear and greed indicator sits at severe lows.

Looking at this metric in isolation, this would represent a good zone for long positions. Clearly, speculators and minor investors think so, with margin trading seeing renewed interest. According to OKX, the margin credit ratio currently stands at 20 points, which suggests moderate bullish sentiment.

StormGain analytical group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.