Why should I trade Crypto options?

Greater volatility

Perhaps the main appeal when it comes to trading crypto options is that they provide a much higher level of volatility. The higher volatility translates into higher potential profits at a higher risk. The options model price structure makes it so that changes in the price of the underlying asset are multiplied to result in the option’s value. Therefore, crypto options result in much steeper price swings when it comes to the value of the option compared to the underlying asset itself.

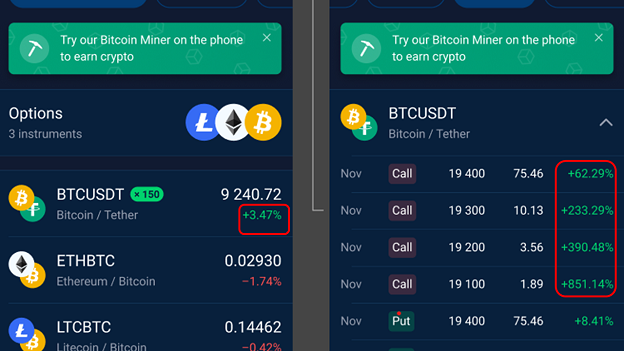

Much higher volatility on Crypto options compared with the underlying asset.

In the example above, you can see that Bitcoin is up 3.47% for the day. Notably, the corresponding price changes for the various Crypto options linked to Bitcoin range from 62.29% to 851.15%. This translates to price changes that are approximately 20 and 280 times greater.

More exposure

Crypto options allow you to take larger positions with the same amount of capital. The reason for this is that the price of options contracts tends to be significantly lower than those of the underlying asset. For example, a call option on Bitcoin may be around $100 dollars depending on your strike price. Let’s say for example that Bitcoin is trading near $10,000. In essence, you can trade the price changes of Bitcoin at a fraction of Bitcoin’s actual cost.

Example

Let’s stick with the Bitcoin example more. Say you think the price of Bitcoin will go up. If you were to buy Bitcoin itself for $10,000, and it jumps to $11,000, you would make $1,000 minus any associated transaction fees to successfully close out your position for a nice 10% return.

Let’s now imagine that you’ve invested the same amount to buy 1,000 call crypto options on Bitcoin, each costing $10, for a total of $10,000. The same $1,000 change in Bitcoin from $10,000 to $11,000 can easily multiply the price of crypto options by 8 to 10 times. While this does occur occasionally, let’s use a more conservative figure and assume that the price of the options increases by 5 times. In this example, if you were to close your position and sell your 1,000 crypto options at the new price of 50 (5 x 10), you would get 50,000 (1,000 x $50) (minus transaction fees). Therefore, you would have realised a 40,000 profit with the same 10,000 investment for a (40,000 / 10,000) * 100 = 400% return.

The above example serves to show the potential returns that crypto options can generate compared to investing directly in the crypto asset itself. While this example could be the case, the reverse is also true to a certain extent. With crypto options, you only stand to lose your initial investment. For example, if the price of Bitcoin falls dramatically after you purchased the $10,000 worth of calls, the most you would lose, no matter how much Bitcoin falls, would be $10,000 - the original price of the investment.

Therefore, it is advisable to invest only an amount that you are willing to lose and manage your risk by using an appropriate Stop Loss level.

Avoid some costs

Another interesting point about trading crypto options is that with them, you are not using overnight swaps. This serves to reduce overall trading costs, and could be particularly important in mid and long-term trading.

Now that you have a better understanding of the advantages and disadvantages for using crypto options, it’s now time to learn about some of the best strategies you can use with them.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.