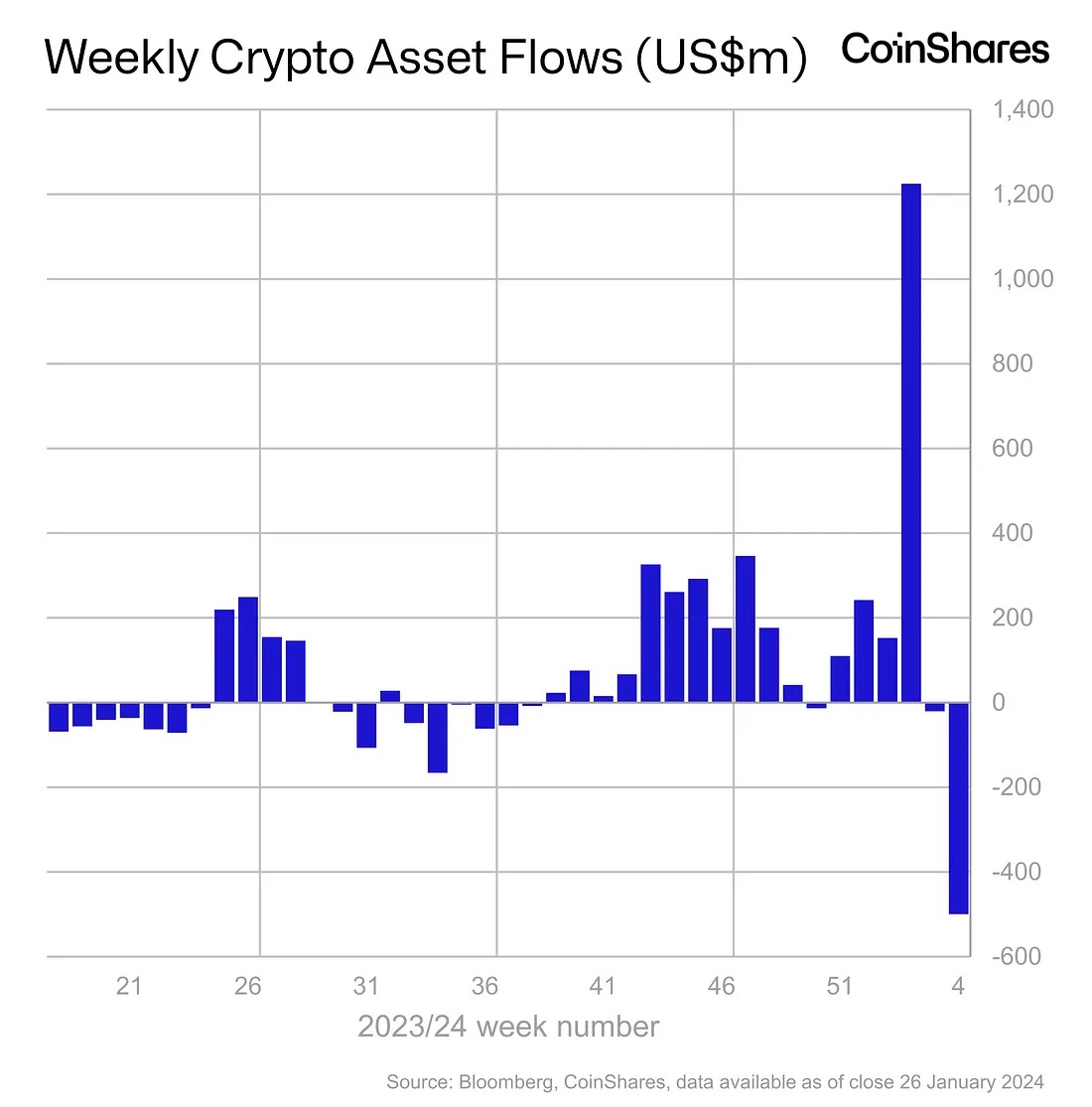

Last week's net outflow from Bitcoin ETFs amounted to $0.5 billion

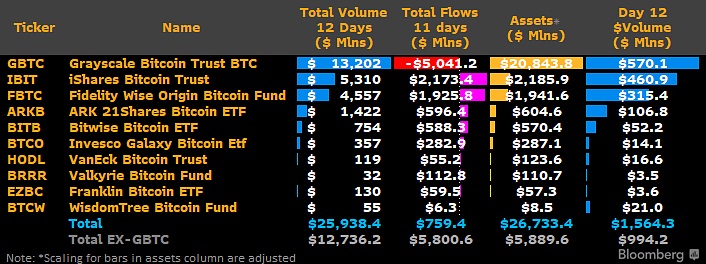

Last week, the outflow of investors from Grayscale reached $2.2 billion, which other Bitcoin crypto funds couldn't compensate for. The net weekly amount was a $478.9 million outflow.

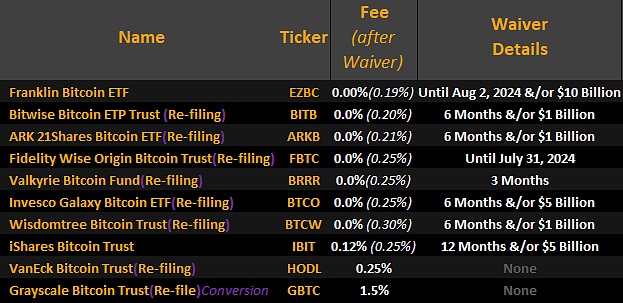

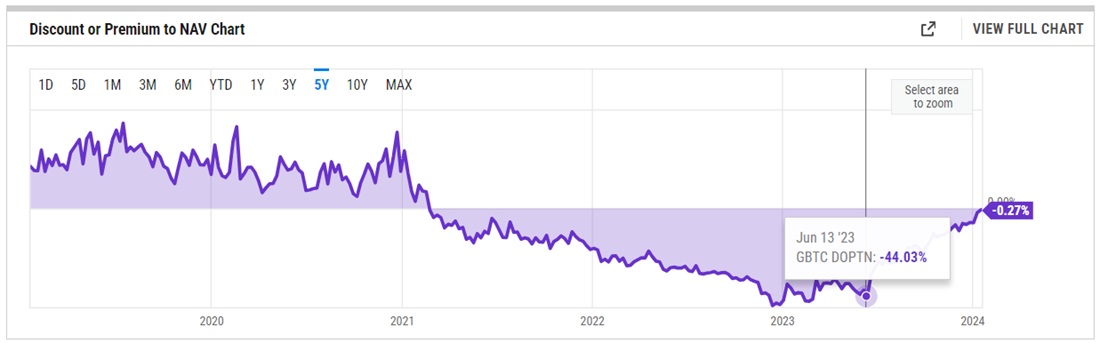

Investors are fleeing GBTC for two reasons: some are locking in profits from the gains on the fund's stock in 2023 when it traded at an over 40% discount to the underlying asset. Others are angry about the relatively high fund management fees. Grayscale has a 1.5% fee, while other funds have gone as low as 0.2-0.3%.

Invesco, which initially charged a fee of 0.39%, lowered it to 0.25% yesterday. Competition is so fierce that a tenth of a per cent is enough to risk serious underinvestment despite Grayscale's reputation and its hefty $1.5 trillion in assets under management. The updated table of fees is as follows:

BlackRock continues to lead the list of newly created ETFs (Grayscale's fund was converted from a trust fund) with $2.2 billion. Fidelity is about to surpass the $2 billion threshold. WisdomTree comes in last with $6.3 million.

There have been $760 million in net inflows since spot Bitcoin ETFs launched.

Grayscale is bleeding $5 billion primarily because of the discount that emerged in 2023. Investors who are unhappy with high fees will simply migrate to competitors. The pressure on Bitcoin will ease.

The overall inflow of investments into ETFs, on the other hand, will strengthen as soon as the market digests the current correction. The correction was brought on both by Grayscale and the desire to lock profit by short-term holders and miners. Miners have sent over 360,000 BTC (about $15 billion) to crypto exchanges since the ETFs launched.

The emergence of spot ETFs is positively affecting direct investments in the cryptocurrency and increasing its reputation. Even the sharp cryptocurrency opponent, the SEC, recognises Bitcoin as a good and an investment asset.

Larry Fink, the head of BlackRock, the largest investment company in the world in terms of assets under management, was sceptical about the cryptocurrency back in 2021. Since then, he's changed his mind, calling himself a Bitcoin "supporter" two years later.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Теги

Спробуйте наш хмарний майнер Bitcoin і отримуйте додаткові криптовалютні винагороди на основі вашого обсягу торгівлі. Він стає доступним одразу після реєстрації.

Спробуйте наш хмарний майнер Bitcoin і отримуйте додаткові криптовалютні винагороди на основі вашого обсягу торгівлі. Він стає доступним одразу після реєстрації.