Litecoin's prospects for a rally in 2023

Litecoin was created in 2011 to process transactions faster and cheaper. Blocks on its chain are created four times faster, and transaction speed reaches 56 transactions per second (TPS) compared to Bitcoin's 7 TPS. The coin must be mined, its emission is technically limited, and its mining reward regularly decreases. When comparing the two cryptocurrencies, Bitcoin is referred to as gold, and Litecoin is silver.

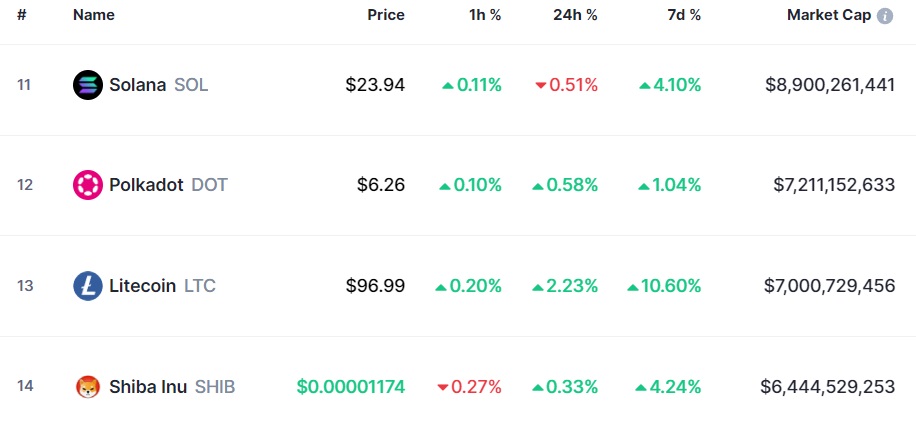

Despite some similarities with Bitcoin, future market developments, including the emergence of super-fast networks powered by smart contracts, have led to Litecoin's drop from 2nd place by market capitalisation to 13th. If the coin is 'silver', it really is quite undervalued and has strong arguments for a potential rally in 2023.

Crypto market recovery

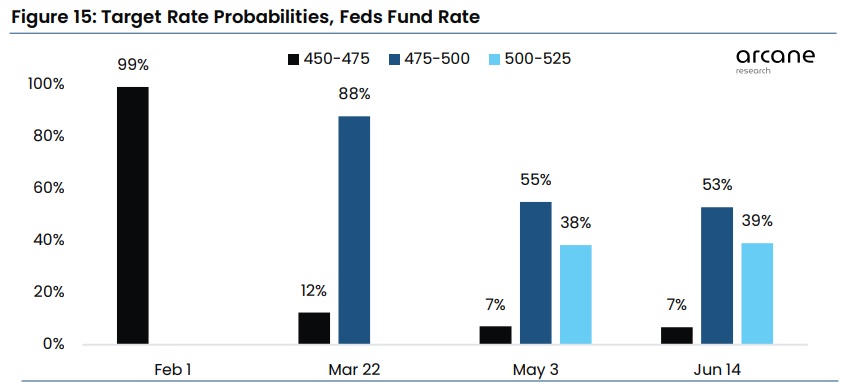

Last year's market downturn was caused by the US Federal Reserve's monetary policy tightening, which led to an outflow of liquidity from risky assets. This, in turn, exposed a number of crypto projects' failures and breaches of trust. Most of those caught up in these misfortunes have already left the market or are going through bankruptcy proceedings.

But this year, the pendulum is ready to swing in the opposite direction. Many economists believe that February and March could be the last months we'll see an interest rate hike from the Fed. A future pause and even an interest rate drop could lead to heightened demand for risky financial instruments. This is especially true amidst relatively high inflation.

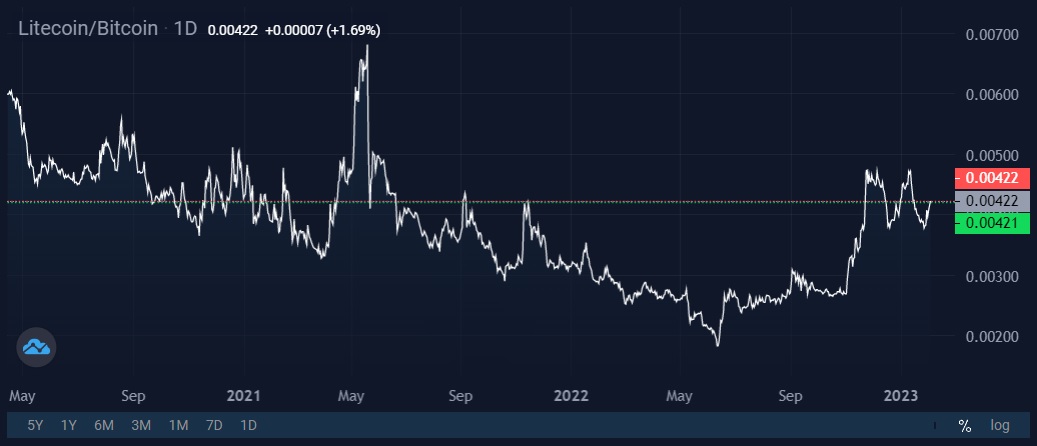

With the crypto market's overall rise, altcoins are outpacing Bitcoin. This trend was also seen in the 2017 and 2021 crypto rallies. Below is a chart of Bitcoin's market share relative to altcoins.

Litecoin was no exception. It had gained on Bitcoin before China issued a prohibition on financial organisations performing crypto-related operations in May 2021.

Regulatory guillotine

Litecoin could get some unexpected support from a change in status from a digital currency to a security on a Proof-of-Staking protocol. The head of the SEC announced such plans the day that Ethereum switched to its PoS algorithm. If the regulator succeeds in this regard, the largest crypto exchanges will likely refuse to support such coins.

If stablecoins and PoS coins are excluded from the overall ratings, Litecoin could find itself in third place behind Bitcoin and Dogecoin. Ripple is excluded from the ratings because the SEC has similar plans for it.

Halving

Halving is a deflationary mechanism that aims cut block mining rewards by half. In the long term, this leads to a coin's value. In 2023, Litecoin will be the first major PoW network to conduct halving, reducing its mining reward from 12.50 LTC to 6.25 LTC. This will happen around 3 August.

The bottom line

The facts laid out above indicate the high likelihood that the altcoin will outperform Bitcoin if the cryptocurrency market continues to recover. It also points to Litecoin rising significantly in the overall ratings if coins switch to PoS status.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

العلامات

جرب Bitcoin Cloud Miner واحصل على مكافآت تشفير إضافية بناءً على حجم التداول الخاص بك. إنه متاح على الفور عند التسجيل.

جرب Bitcoin Cloud Miner واحصل على مكافآت تشفير إضافية بناءً على حجم التداول الخاص بك. إنه متاح على الفور عند التسجيل.