Caroline Ellison: We took $10 billion of client funds out of FTX

Court hearings continue for collapsed crypto exchange FTX and CEO Sam Bankman-Fried (SBF). His close associates, FTX CTO Gary Wang and Alameda Research CEO Caroline Ellison, have pleaded guilty to fraud charges and reached a deal with the investigation. On the other hand, SBF denies all allegations, and his lawyers have focused on the unprofessionalism of his colleagues.

We've already covered the strong interconnection of Alameda and FTX. A key witness for the prosecution was Caroline Ellison, who described the depth of FTX's financial hole in great detail.

In 2021-2022, SBF set the target of actively attracting investments. The money was used for "donations" to politicians, advertising, charity, investments in various projects, purchase of luxury property and multi-million dollar bonuses to management. To attract massive investment, artificial reports of the company's financial health were created.

Sam instructed us to borrow as much money as possible.

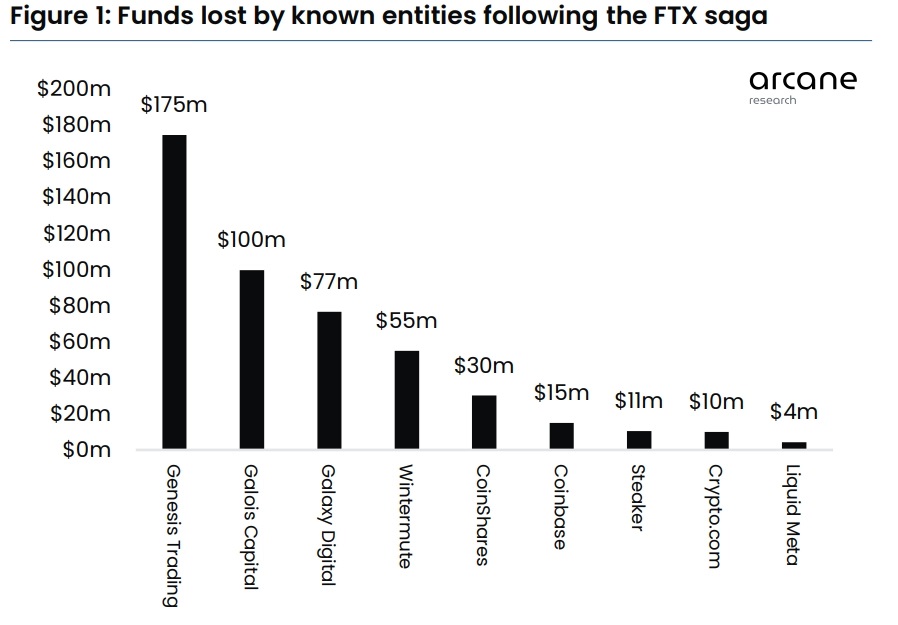

Genesis Trading was Alameda's largest investor, with the latter's debt to the former reaching several billion dollars at peak times. After Terra (Alameda was among its investors) collapsed in May 2022, the crypto industry faced a crisis and a drop in asset values.

A month later, Genesis Trading requested the return of the investments. As a result, Caroline fabricated a financial statement on the seventh attempt that was supposed to reassure the lender. However, the large share of the FTT token — the FTX crypto exchange's token — on the company's balance sheet led Genesis to become sceptical and withdraw some of its funds.

Fast-forwarding a bit, Genesis Trading was still the loss leader among investors and subsequently filed for bankruptcy.

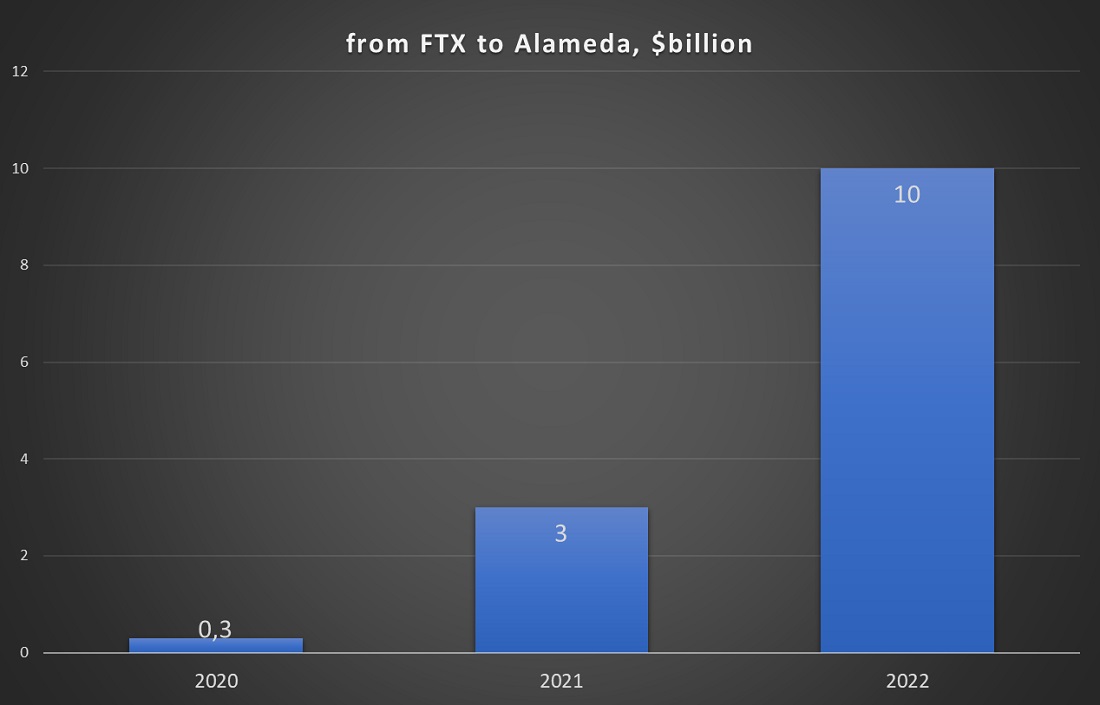

To stop investors from fleeing and cover the financial hole, SBF ordered the inflow of client funds from FTX to Alameda to be increased. That number reached $10 billion in 2022. In terms of assets share, 52% of all client funds in ETH, 44% in USDT and 25% in BTC were withdrawn from FTX. That's not including the FTT token and its fake capitalisation, which accounted for over half of Alameda's balance sheet at the time of the collapse.

Alameda was a private structure with no audits conducted. The financial reports were faked by the management, and balances were adjusted by changes in the program code. As Ellison confessed, if Alameda was a third-party market maker, its credit line would be limited to a few hundred million dollars.

The house of cards began to collapse after CoinDesk published an article in early November 2022 noting the two companies' high interconnection and questionable financials, as well as FTT making up a large part of assets. When customers began to apply for withdrawals, there wasn't enough money, and FTX and Alameda filed for bankruptcy. The SBF empire's current debt to customers and investors is estimated to be $8 billion.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

العلامات

جرب Bitcoin Cloud Miner واحصل على مكافآت تشفير إضافية بناءً على حجم التداول الخاص بك. إنه متاح على الفور عند التسجيل.

جرب Bitcoin Cloud Miner واحصل على مكافآت تشفير إضافية بناءً على حجم التداول الخاص بك. إنه متاح على الفور عند التسجيل.