FTX case: Client deposits were used to repay loans

In November 2022, FTX, one of the largest crypto exchanges, went bankrupt. Until his arrest, CEO Sam Bankman-Fried (SBF) spent the last year giving interviews in his defence, trying to convince the public that there were no evil intentions. He also assured that Almeda Research, which acted as a market maker for the crypto exchange, was independent. But court testimony says otherwise.

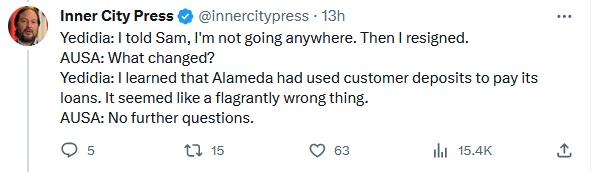

Adam Yedidia, SBF's classmate and FTX programmer

Adam Yedidia testified in court that he had written a program to transfer clients' funds from FTX to Alameda. From its launch, the crypto exchange had difficulties opening a bank account. Some funds were sent directly to Alameda. They were seen as liabilities to FTX that reached $8 billion by mid-2022.

The same year, Yedidia discovered that part of the funds were used to cover loans to third parties, as Almeda's trading activities were causing losses. The exploration of shocking facts about using the clients' funds forced him to resign in November 2022.

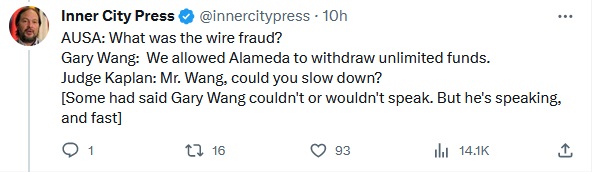

Zixiao 'Gary' Wang, co-founder of the companies and CTO

Gary Wang confessed to committing financial crimes with Nishad Singh, Caroline Allison and SBF.

He testified that "We allowed Alameda to withdraw an unlimited amount of clients' funds."

Privileges were encrypted in the programme code. Alameda could also hold positions with a negative balance in FTX without a forced closure.

Wang also revealed that he owned 10% of Alameda's assets, with 90% owned by SBF.

"If there were disagreements in the company, Sam always had the last word."

SBF's defence position

The first thing SBF's attorneys noted was that the witnesses' testimony was given in exchange for a deal with the prosecution, hinting that they're interested in exposing SBF as a villain. The attorneys also cited SBF's 10-hour work days starting in 2021 and his high workloads:

"The business was growing too fast. He didn't have time to make sound decisions."

During the speech, the defence highlighted the unprofessionalism of Alameda CEO Caroline Ellison and the negative impact of Binance when the competitor refused to sell FTT (FTX's token) directly to Alameda.

"Being the CEO of a bankrupt company isn't a crime."

According to his lawyers, FTX had the right to lend funds to Alameda as part of a business partnership with a market maker, and SBF's strong involvement in the company's activities was due to his ownership of a stake in Alameda.

Impact on the market

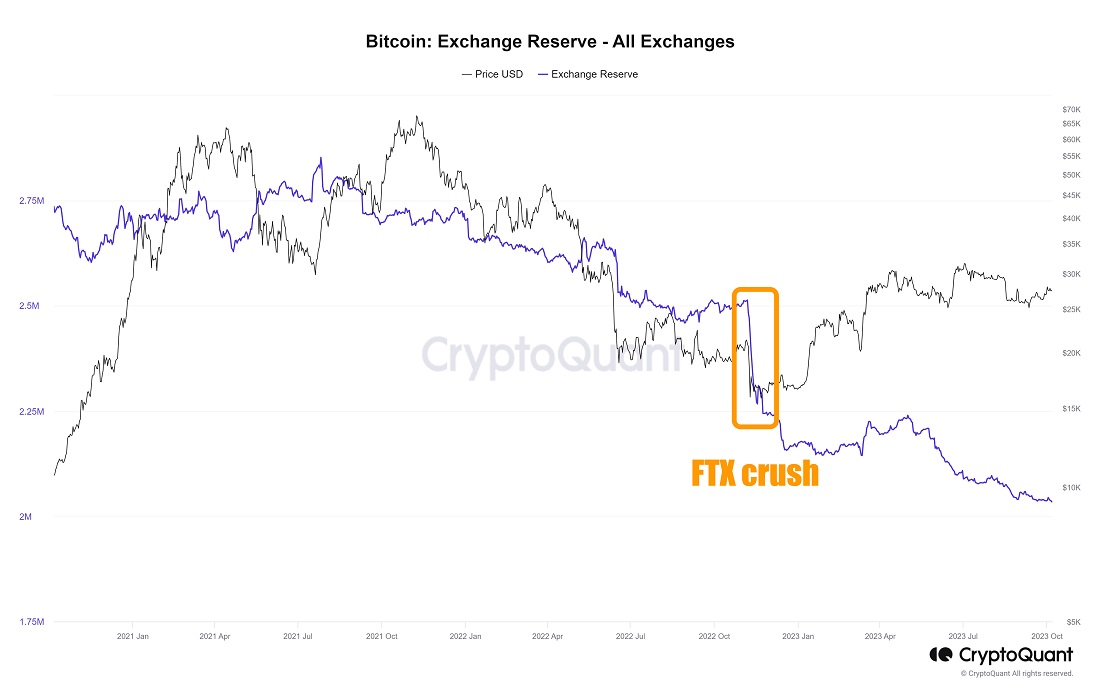

FTX's collapse led to a crypto market crash. Among the Top 10 coins by market capitalisation, Solana was hardest hit. The network had several business projects with SBF, and $1.2 billion worth of SOL is still held in the crypto exchange's accounts.

Trust in centralised market participants also suffered significantly. In the week after FTX's collapse, 10% of crypto exchange reserves held in Bitcoin were withdrawn to cold wallets.

The court case continues, but the defence's weak position and evidence of misuse of clients' funds leave little chance of SBF getting out of hot water.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.