2024 could be the best year ever for Ethereum

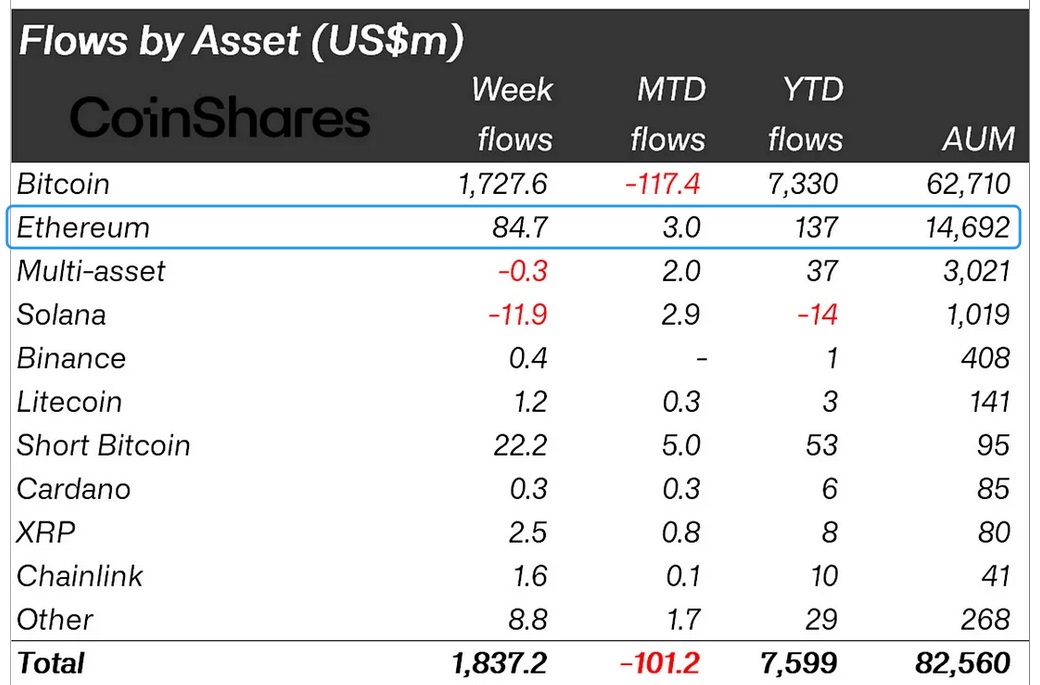

Bitcoin has had a landmark year in 2024, with institutional and retail investors now enjoying easier access to the cryptocurrency. However, the year could become more significant for Ethereum thanks to upcoming changes. Investment inflows into crypto ETFs have started to increase again, suggesting a shift in sentiment towards the altcoin.

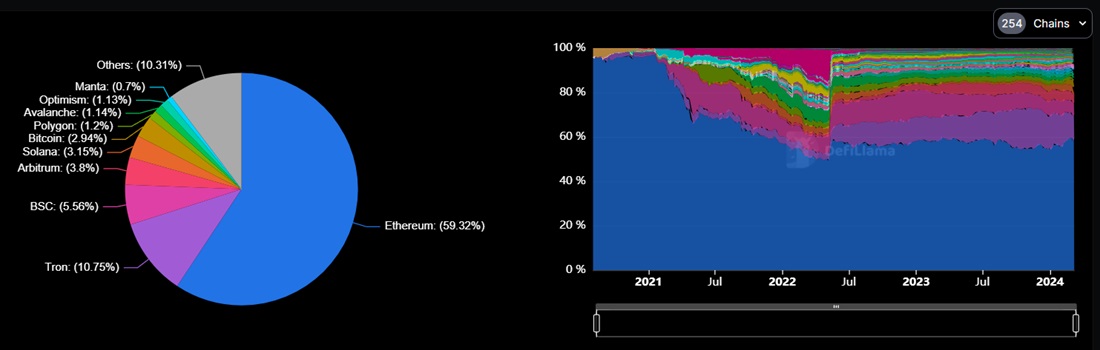

Ethereum is the most trusted environment for executing smart contracts. The network is backed by around 1 million active validators and has a 59% or $54.3 billion share of the decentralised finance sector. The closest competitor, Tron, has just $9.8 billion.

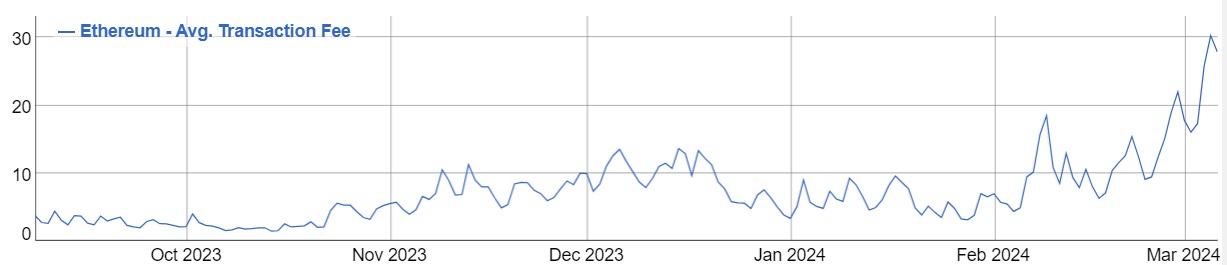

The downside to high reliability is low speeds and high network fees. This year, the average user cost has risen from $5 to $29, which is making it harder to adopt new projects directly on Ethereum or attract a wider audience.

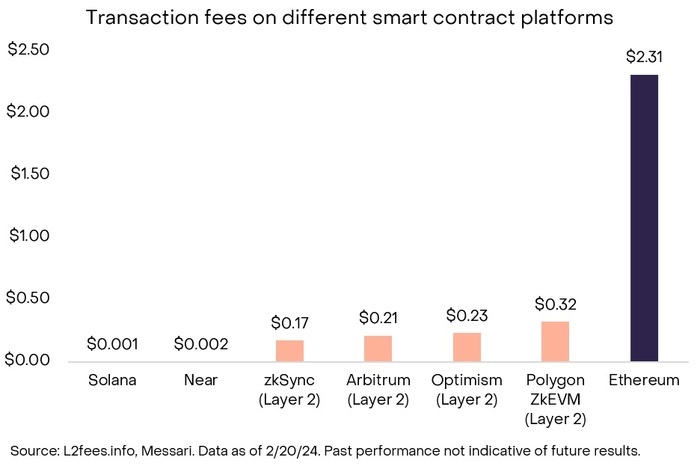

However, the development of Layer-2 (L2) networks that use Ethereum as a guarantor of reliability and security offers a way out. Simply put, by conducting fast, cheap transactions within the network, L2s commit them to L1 in a more compressed form.

Ethereum now has 44 L2s with a total staked amount of $36.8 billion. Arbitrum holds the first place with a 42% share. The average commission at Arbitrum is over $0.20, which is still a lot compared to competitors like Solana or Avalanche.

However, the situation will change significantly with the Dencun hard fork, which is scheduled to roll out on 13 March. The update will allow transaction data to be packaged even more densely, resulting in a 5-10x cost reduction for L2. L2's low expenses will attract new projects, which will eventually affect demand in L1, as well.

Another positive change for Ethereum is the increased likelihood that it will no longer be seen as a security. Recent litigation shows how hard it is for the US Securities and Exchange Commission (SEC) to defend the status, and there are contradictions with the Commodity Futures Trading Commission (CFTC).

If the SEC persists in labelling Ethereum a security, it will make it hard for the CFTC to deal with entities that trade Ethereum futures. At a Congressional hearing on 6 March, CFTC Chairman Rostin Behnam said that both Bitcoin and Ethereum are commodities.

At the same time, the recognition of the altcoin as a commodity will put the SEC in an awkward position since a number of organisations have already received fines (e.g., Kraken) for working with this "security", while others are still awaiting court hearings (e.g., Coinbase). However, it's still easier for the regulator to take a step back than to continue to stick to its line.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.