Ethereum (ETH) price prediction 2024 - 2040

Ethereum is the second-largest cryptocurrency after Bitcoin, with $20 billion in capital and $12 billion every day trading volume. It wouldn't be wrong to say that Ethereum is as well-known around the world as Bitcoin. Some people use their smart contracts and technologies to improve their business, while others use them for everyday transactions. For about one decade, the asset remains a luring investment opportunity for millions of people worldwide. Those who trade this cryptocurrency are mostly interested in getting familiar with Ethereum price predictions.

This article contains Ethereum price forecasts, technical analysis, and highlights from the Ethereum price history you should be aware of to make correct crypto investment decisions.

What is Ethereum (ETH)?

Ethereum is both a cryptocurrency and a decentralised environment that is transforming the IT industry. It was created by Vitalik Buterin and his team with one purpose: to give the world something better than Bitcoin.

Some brief information about Ethereum:

Project name | Ethereum |

Founded by | Vitalik Buterin in 2013 and launched in 2015 |

Market Capacity | $278,126,701,946 (17/09/2024) |

Market price | $2,311.84 (17/09/2024) |

Total supply | 120,341,542 ETH |

Protocol | Proof-of-stake |

Block time | 12.11 s |

Algorithm | Ethash |

GitHub stars | 43.6k |

Official website |

Ethereum main information

ETH's main feature is smart contracts. They have changed the world of business because they allow you to get rid of intermediaries and provide complete control over fulfilling obligations. The Ethereum platform allows new altcoins and tokens to be launched on its blockchain. Moreover, it provides the possibility of creating decentralised applications that have become more popular nowadays.

Finally, it is one of the most popular cryptocurrencies among traders. It is listed on 95% of exchanges and has great volumes every day. To sum up, ETH can be considered BTC's main competitor.

Ethereum overview

Ethereum is a decentralised, open-source blockchain platform that has revolutionised the way we think about digital transactions and applications. Founded in 2013 by Vitalik Buterin, Ethereum has grown to become one of the largest and most widely used blockchain platforms globally. Its native cryptocurrency, Ether (ETH), holds the position of the second-largest cryptocurrency by market capitalisation, trailing only Bitcoin. Ethereum's unique value proposition lies in its ability to facilitate smart contracts and decentralised applications (dApps), making it a cornerstone of the blockchain ecosystem.

Ethereum use cases

Ethereum's versatility extends across various industries, showcasing its potential beyond just a cryptocurrency. Here are some of the prominent use cases:

- Decentralised Finance (DeFi): Ethereum is the backbone of the DeFi movement, enabling applications for lending, borrowing, and trading without intermediaries. This has democratised access to financial services, making them more inclusive and efficient.

- Non-Fungible Tokens (NFTs): The Ethereum network is the primary platform for creating and trading NFTs. These unique digital assets represent ownership of specific items or content, ranging from art and music to virtual real estate, driving a new wave of digital ownership and creativity.

- Gaming: Ethereum is making significant inroads into the gaming industry. Decentralised gaming platforms and virtual worlds built on Ethereum offer players true ownership of in-game assets and a transparent, secure gaming experience.

- Supply Chain Management: Ethereum's blockchain technology is used to track the movement of goods and verify their authenticity in supply chains. This ensures transparency and reduces the risk of fraud, enhancing the efficiency of global trade.

- Healthcare: In the healthcare sector, Ethereum is utilised to securely store and manage medical records. It also facilitates the secure and transparent sharing of medical data, improving patient care and operational efficiency.

Ethereum (ETH) price analysis

Ethereum didn't see any excitement for a long time. It was just considered another cryptocurrency on the market. Nevertheless, its price was bound to rise for many reasons, and that's just what happened.

Historically, Ethereum price has also seen significant lows, with its minimum price reaching notable points during market downturns.

Why did it happen? Ethereum's transactions are significantly faster than Bitcoin's. Many people, therefore, migrated from the first-ever cryptocurrency. The Ethereum blockchain also provides an environment to create decentralised applications or dApps, so it became very intriguing to developers.

The rise in interest in this cryptocurrency meant that someone had to find new blocks and verify transactions. Hence, many miners directed their hash rate from BTC to ETH. They found many new blocks, which created mining difficulty and increased mining costs.

ETH's price history

The first-ever ETH tokens were created in 2014, but they were not listed on any exchange. However, during their implementation, the company got an income of $18 million. The first release of the Ethereum blockchain was in 2015. With its launch, ETH was added to some exchanges, but the price was below $1.

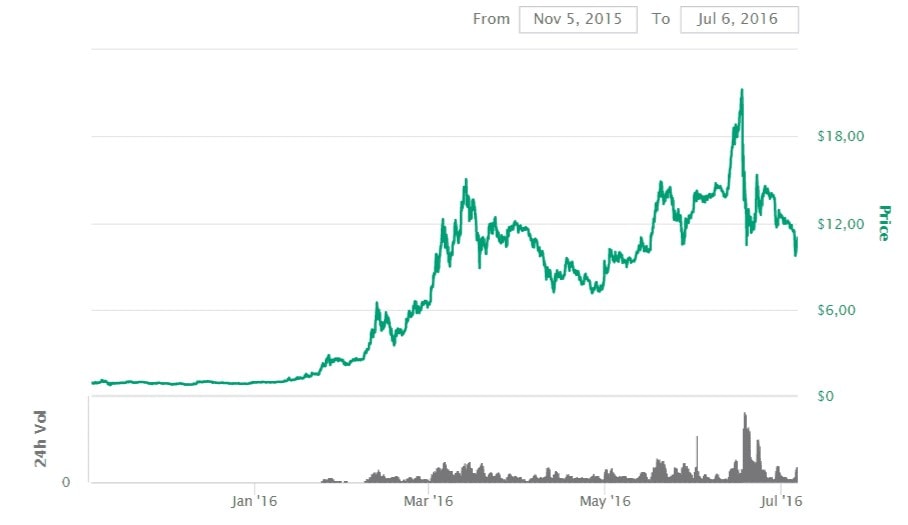

At the very beginning of 2016, it had its first growth. It was traded for $6 in the middle of February and even for $15 in the middle of March. The system was then hacked, and the company lost a third of all its capital. That is why it traded for $7.50 at the end of April 2016.

After that, the Ethereum team was able to return stolen money and upgrade their security systems. These measures had a positive effect on ETH's price, which rose to $19 on 16 June 2016. However, the next day, it went down to $12. We can conclude that this rise to $19 was just a pump.

After that, ETH held stable between $10 and $12. A hard fork took place in October 2016, which led to the emergence of Ethereum Classic. However, this situation didn't affect the price.

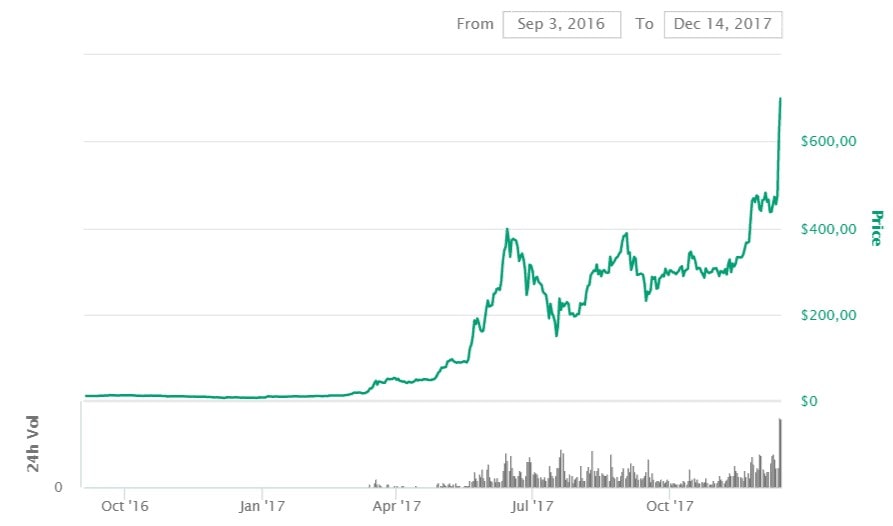

The first serious changes were made in 2017. First, in February, ETH was added to ETORO, which led to a $450 million increase in trading volume. In May, the value of ETH was $95. Within a month, it was trading for $400.

During what was once considered the biggest pump in cryptocurrency history, Ethereums's price rose to $1,352 per coin before crashing back down to $300. For over two years, the price never really made any attempt to regain old highs, and it trended downwards until 2020 into 2021. It's no news that 2021 was the acquired 'holy grail' of the crypto market, but it seems that Ethereum took that to another level. Like BTC, it not only took out its previous all-time high, but it set new ones at over 200% more than its previous yearly high.

The ETH price dropped in the first half of 2022 despite The Merge's approach and bearish cryptocurrency markets, particularly after the TerraUSD stablecoin (UST) and LUNA token collapsed in May.

After The Merge's completion, ETH's price briefly rose to $1,640 on 15 September 2022 but quickly dropped to $1,450 by 16 September 2022.

On 31 October, the news of the Google node system and overall crypto market boost influenced by Elon Musk's actions on Twitter caused ETH to trade at a high of $1,630.45 with a market cap of around $194 billion, still the second-largest cryptocurrency by capitalisation.

On 7 November, it was worth about $1,580 with a market cap of $193 billion, but by 9 November, it dropped to a low of $1,083.29. On 14 December, ETH reached a high of $1,346.17, but on 21 December, it was trading around the $1,215 mark.

In January 2023, ETH rallied to $1,563.74, remaining in the $1,500 range, breaking $1,600 on 18 January and surpassing $1,700 on 2 February 2023.

With the Shapella event, ETH surged, breaking past $2,000 on 6 April and reaching a high of $2,126.32 on 14 April. By 18 April 2023, ETH's value was around $2,110.

ETH/USDT price chart

At the end of 2023, Ethereum was forecasted to surpass the $2,000 mark by mid-2023 and rise to $2,146 by year-end. The average trading price of Ethereum over this period was estimated based on technical analysis and market predictions. The price of Ethereum experienced fluctuations over the month. It commenced at $2,343.56 on 1 January 2024, peaked at $2,619.18 on 12 January 2024, and concluded the month at $2,282.18 on 31 January 2024.

The price continued its fluctuations in February. It started at $2,303.71 on 1 February 2024, dropped to a low of $2,420.97 on 9 February 2024, and gradually increased to $2,943.72 by 20 February 2024. As of 27 February 2024, Ethereum was worth $3,185.27.

Beginning at $3,244.52 on 27 February 2024, the price of Ethereum experienced a modest rise to $3,347.69 by 1 March. However, a significant surge occurred on 6 March, propelling the price to $3,581.53. This uptrend was followed by a subsequent decline, with Ethereum's value dropping to $3,295.54 by 19 March. Nonetheless, the market rebounded swiftly, witnessing another surge in price to $3,978.69 by 23 March.

From April to September 2024, Ethereum's price experienced significant fluctuations, ranging from a high of $3,812.52 on 4 June 2024 to a low of $2,377.50 on 5 September 2024. Starting at $3,012.29 in April, the price surged to $3,760.03 in May and peaked above $3,800 in early June. However, it began a steady decline, closing July at $3,231.30, dropping further in August to $2,513.39, and continuing its downward trend into September, reflecting an overall bearish movement during this six-month period.

ETH technical analysis

When the rally began on 3 March 2020, only a scant few imagined that Ethereum would reach the highest it did, and within such a short time to boot. After years of a continuous downtrend, Ethereum finally found support at around $110. It then rose steadily but slowly for about four months before making an impulsive leg into $480. Traders took profit, and the world settled down to endure, perhaps, another long stretch of consolidation that characteristically follows crypto price swings. Ethereum's price consolidated from September into the first few days of November, after which it exploded upwards again.

On 19 January 2021, Ethereum reached its all-time high at $1,422, rejecting sharply and forming a resistance. After a few weeks of testing and prodding that resistance, the price finally broke out. At this point, every real crypto stakeholder was paying rapt attention to the crypto market, and hopes were high in the air. Ethereum never disappointed, exploding through resistance after resistance, creating an extremely bullish market structure and finding higher prices to ravage.

All good things must come to an end, and thus, on 16 November 2021, Ethereum reached $4,891.70, its all-time highest price. ETH has consistently traded lower ever since, and any attempt it has made to recover higher has been met with strong bearish pressure.

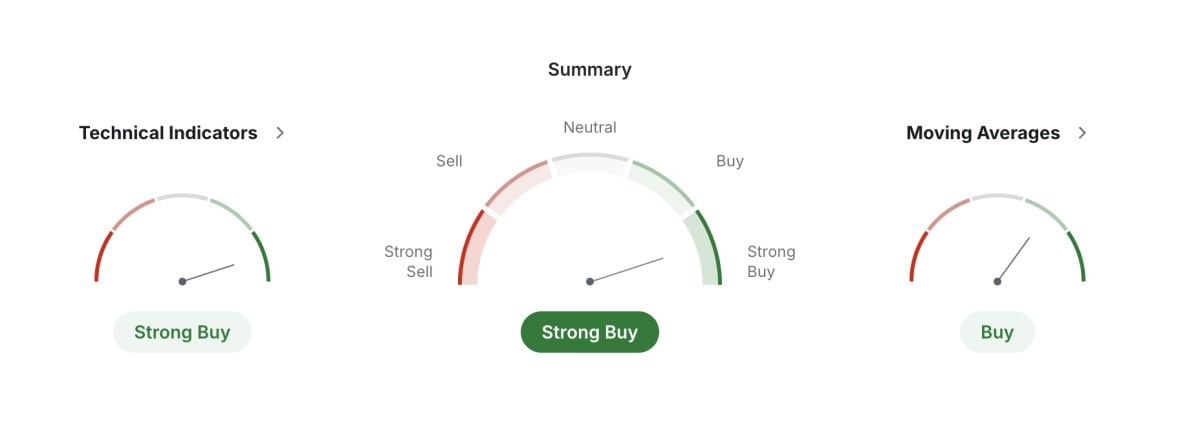

In 2024, the cryptocurrency world, particularly Ethereum, is poised for an exciting year of developments. Upon analysing Ethereum's weekly chart's technical indicators, we observe that the 50-day simple moving average (SMA) interacts with the 200-day SMA after descending to touch in Q2 2023. The previous occurrence was in late 2020 when a "golden cross" movement led ETH to ascend and achieve all-time highs (ATHs) 12 months later.

Additionally, Ethereum has broken upward out of its trading channel on the chart but encountered significant resistance at $3,000—similar to Bitcoin, which faces strong resistance at $52,000. If the ongoing rally persists and Ethereum maintains this breakout momentum, a scenario akin to that experienced in 2020–2021 could unfold with potential new all-time highs.

As of 17 September 2024, the overall outlook for Ethereum's price remains bearish. Projections indicate that the 200-day Simple Moving Average (SMA) will decrease, reaching $2,954.24 by 17 October 2024, while the 50-day SMA is expected to drop to $2,422.13 in the same timeframe. The Relative Strength Index (RSI) suggests Ethereum may be oversold. Based on the classical pivot point (P1) of $2,295.98, Ethereum's key support levels are at $2,260.60, $2,224.55, and $2,189.16, with resistance at $2,332.03, $2,367.41, and $2,403.46.

Ethereum price prediction 2018

The beginning of 2018 saw a significant rise across all cryptocurrencies, which sparked many Ethereum price predictions. Some said that cryptocurrencies were very close to replacing fiat, while others considered the surge was just a pump.

Nevertheless, experienced traders know that price prediction begins with learning about history and different factors. While making forecasts, analysts used the following information:

- ETH is essential for smart contracts.

- ETH has no issues with the number of processed transactions.

- Many countries don't recognise ETH, so its regulation isn't as good as it is for BTC.

- More and more banks are focusing on ETH.

- ETH is the second-most popular crypto on exchanges.

In addition, it was necessary to include possible risks:

- Despite fast growth, Ethereum was still liable to speculative activity.

- The possibility of hacking.

- The growing number of users may cause different technological problems.

Most issues could be resolved, so many experts predicted that Ethereum would rise by the end of 2018. The most positive forecast put ETH around $2,500; the most pessimistic saw ETH dropping by $1,500.

As we know today, they were all wrong. At the end of 2018, Ethereum's price was about $137. Moreover, in December 2018, it showed the worst value for the whole year at -$86.

Ethereum price prediction 2019

At the very beginning of 2019, ETH's price was $106. However, it experienced a fast rise, and in March, it traded for $140. Still, this wasn't the best scenario, especially considering that this asset cost almost $1,400 at the beginning of January 2018.

Although the first predictions were negative, experts analysed several factors:

- The protracted deep correction was going to end.

- ETH's price depends on BTC's, which tends to rise.

- Mining costs were on the rise.

- The following Constantinople update would improve the system.

- The functioning of smart contracts was improving.

- Buterin said that he was going to achieve a network bandwidth of 100,000 transactions/sec.

Most factors showed that Ethereum would tend to rise in the future, so the market expected it to close at $500 or more at the end of 2019. However, there were some negative factors:

- Ethereum had less capitalisation than Ripple.

- Many projects were evolving and getting closer to ETH (e.g., Tron, Dash, BCH, etc.).

- Mining became more difficult, so miners changed their priorities to other cryptocurrencies.

All these points showed that Ethereum could be very unstable. The worst ETH value prediction was that this currency could fall to $70, and people would lose interest. Nevertheless, such a scenario was almost impossible because ETH smart contracts provide many opportunities for the whole world.

Ethereum price prediction 2020

Ethereum opened around $131 and trended upward for most of January. By February, it peaked at $290 before retracing to form the yearly low in March at $90. After creating the low, ETH steadily traded high, and by the end of the year, its value had risen as high as $750.

Ethereum price prediction 2021

There weren't many predictions that ETH would grow as much as it did. The growth storm that hit the crypto market also hit Ethereum hard, as the currency was among the most profitable assets all year. It set a new all-time high record at $4,891 after increasing by more than 550% in less than a year.

Ethereum price prediction 2023

As of 5 July 2023, Ethereum was trading at $1,923.46, showing an impressive 42% increase compared to its value one year ago. After reaching its all-time high (ATH) of $4,891.70 in November 2021, ETH has experienced a significant decline, currently down by 64%. In more recent developments, ETH has seen a 20.33% decrease since its local high on 16 April 2023. Looking ahead, ETH may fluctuate between $1,100 and $2,000 for the rest of 2023.

Ethereum price prediction 2024

Based on the Ethereum price forecast and technical analysis of Ethereum prices for 2024, Ethereum's price predictions fluctuate with varying trajectories based on expert analyses. September and October foresee fluctuations between $2,189.96 and $3,562.82, then $2,189.96 and $3,004.93. November and December predict lower averages, ranging from $2,268.31 to $2,529.37 and $2,278.10 to $2,501.89, respectively.

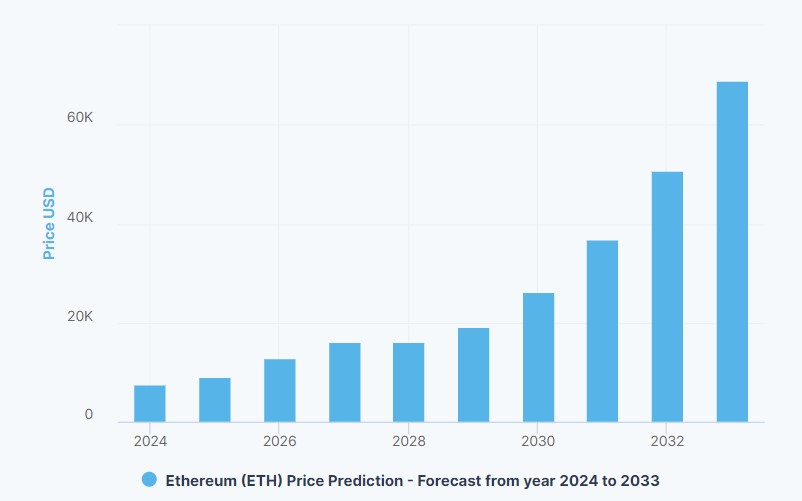

Ethereum (ETH) price prediction for 2024, 2025, 2030 and 2040

The cryptocurrency market is very volatile, so it's not easy to provide accurate forecasts for many years. However, many analysts have some thoughts about popular cryptocurrencies like Ethereum. Here are some Ethereum price predictions from experts, highlighting a positive long-term outlook for the coin.

Trading Beasts Ethereum price prediction for 2024, 2025, 2030 and 2040

At the close of 2024, the forecasted average price is $2,301.239, which is the projected minimum price for Ethereum in 2024. Moving into 2025, Ethereum is expected to have an average price of $2,300, with a minimum price of $1,955. In 2028, Ethereum is anticipated to trade between $2,324 and $2,867, with an average cost expected at approximately $2,536 annually.

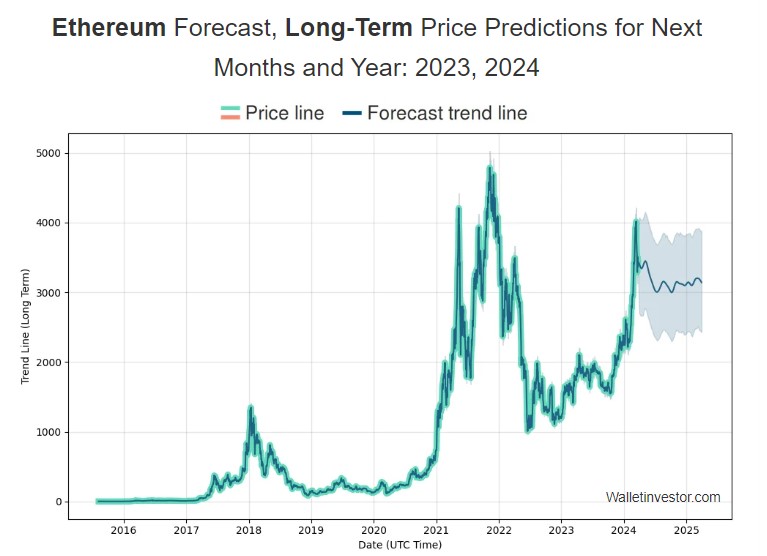

WalletInvestor Ethereum price prediction for 2024, 2025, 2030 and 2040

According to WalletInvestor, Ethereum's price is predicted to reach $2,718 by the end of 2024. Ethereum price forecast reflects a steady growth trajectory based on current market trends. By the end of 2025, WalletInvestor expects Ethereum's price to rise to $3,565. Looking further ahead, WalletInvestor forecasts that Ethereum could reach $6,539 by the end of 2029. This long-term prediction assumes sustained growth and adoption of Ethereum's technology.

Long Forecast Ethereum price prediction for 2024, 2025, 2030 and 2040

Long Forecast's Ethereum price predictions are quite pessimistic. They predict that ETH's price will drop to $1,910 by the end of 2024. The crypto will start 2025 at the $1,720 value and close the year, priced at $3,555. As for the Ethereum price prediction for 2027, the ETH price will fall from $3,499 (early 2027) to $3,058 by the end of the year.

DigitalCoinPrice Ethereum price prediction for 2024, 2025, 2030 and 2040

DigitalCoinPrice provides a positive Ethereum price prediction for the next 10 years. They believe that the coin may end 2024 at over $4,842.20 and that its value in 2026 could be as high as $8,180.28. By the end of 2032, the token's price is forecasted to skyrocket to $32,872.37.

Ethereum (ETH) overall future price predictions

Just as Bitcoin is the first-ever cryptocurrency, Ethereum is the first-ever project to create smart contracts. That is why this cryptocurrency probably won't crash in the future. Its position is very strong today, and many people from the cryptocurrency community continue to believe in ETH and Ethereum's future as a platform for decentralised financial applications driven by network upgrades and fee-burning mechanisms.

Today, this system has many issues, so the value of Ethereum will be volatile in the short term. Everything will depend on the ETH team. If they solve the main issues, ETH will gain a foothold. If not, the cryptocurrency's value will dip into double digits.

How high can Ethereum go?

The cryptocurrency community knows that the Ethereum team is very talented, so they predict the best results. On forums, most people say that ETH will be the #1 platform for smart contracts.

However, some experts think that Ethereum smart contracts are losing their positions. Developers are out of ideas about improving the system without refusing the main principles of the ETH blockchain, and projects like Solana are hot on the heels of Ethereum. With time and continued support of other promising projects, Ethereum may eventually bow out into irrelevance.

However, its price doesn't just depend on the development team. There are many other factors, like news, Bitcoin trends, altcoin activity, and more. Ethereum is a very interdependent project, so there will be many obstacles.

How far can ETH go? It has all the chances of breaking through the $14,000 level, as predicted by WalletInvestor some months ago. While the market isn't bullish, the asset still has good support. If this situation stabilises, we may see it hit $4,000 again and even higher.

In the following years, ETH may hit a maximum of $6,000. The only way to reach higher is through a pump. However, as we know, the bigger the pump, the bigger the correction will be. So, we should be realistic and predict that ETH won't reach a stable $10,000 until at least 2025.

ETH price prediction today

Ethereum faced many problems varying from technical to fundamental, such as political news or the community's sentiment. That's why it's very hard for this cryptocurrency to break out of each resistance level.

However, two things are obvious: ETH won't crash, and it won't lose its #2 ranking on CoinMarketCap for quite some time, if ever. Therefore, its price won't fall too far in the near future. What do you think?

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.