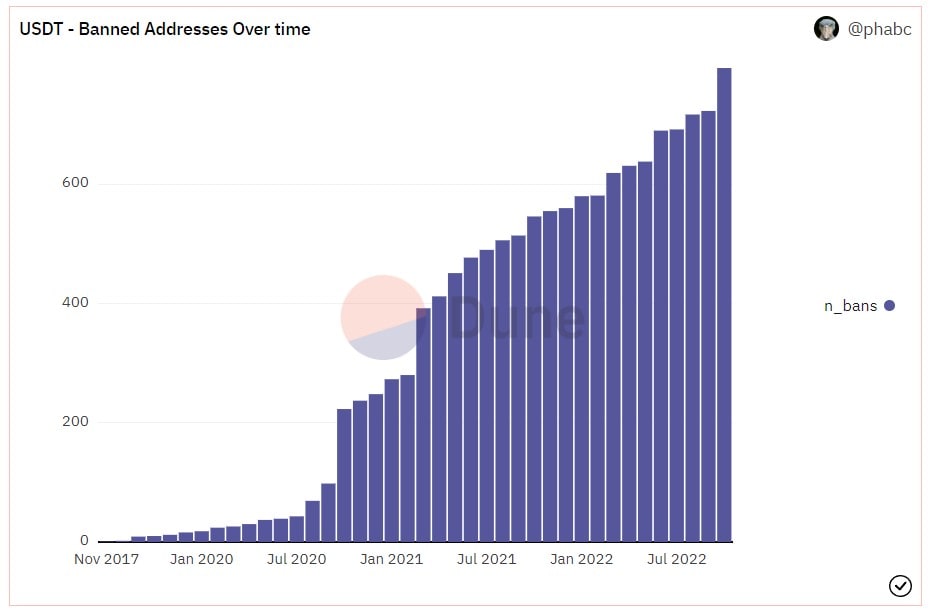

87% of Tether addresses have been blocked in the last two years

Despite being registered offshore in the British Virgin Islands, Tether Limited has been highly loyal to major financial regulators for the past two years. For this reason, addresses are blocked both at the request of intelligence services and when Tether detects activity it considers suspicious.

Whale Alert revealed that three addresses containing a total of $8.2 million were frozen on 10 October. Overall, 72 addresses have been blocked in the past 13 days. By comparison, half as many were blocked in all of 2019.

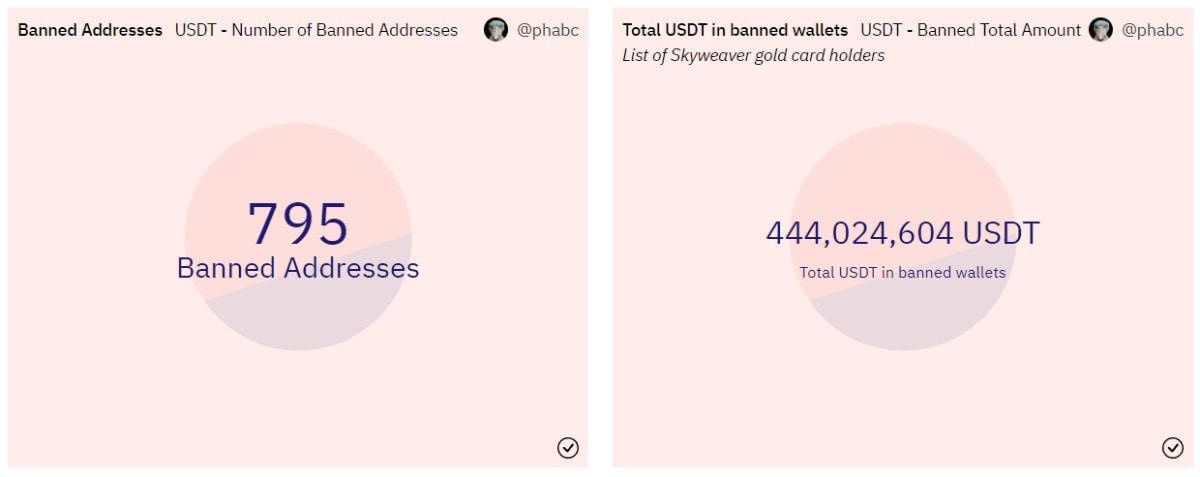

795 addresses are currently blocked. They contain a total of $444 million.

For users, this means that no transactions can be made, and in the event of a complaint, disputes are dealt with exclusively by the court in the company's place of registration.

Under the user agreement, Tether has the discretion to impose sanctions on those who violate the rules. A complete list of prohibited activities can be found on the company's website. In short, any violations of regional or international law (including sanctions of any kind) and its own regulations will be dealt with.

For its part, Tether makes no promises of any future exchanges and warns of the lack of reserve insurance and the risk of an unexpected drop in its value, with all the consequences that entails.

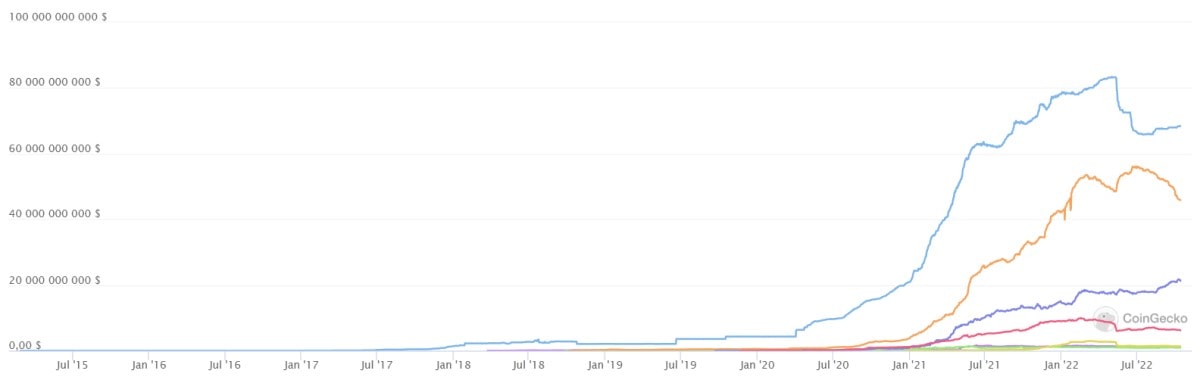

Tether's efforts to block addresses come from a desire to retain leadership and mitigate claims by financial regulators for a number of faults. USDC from Circle, a company registered in the US that exclusively uses fiat and US Treasury bonds as its reserve, is challenging the stablecoin market. Tether, on the other hand, still has commercial liabilities in its assets (printing and issuing USDT in exchange for debt receipts), and the company is under legal investigation for pumping Bitcoin.

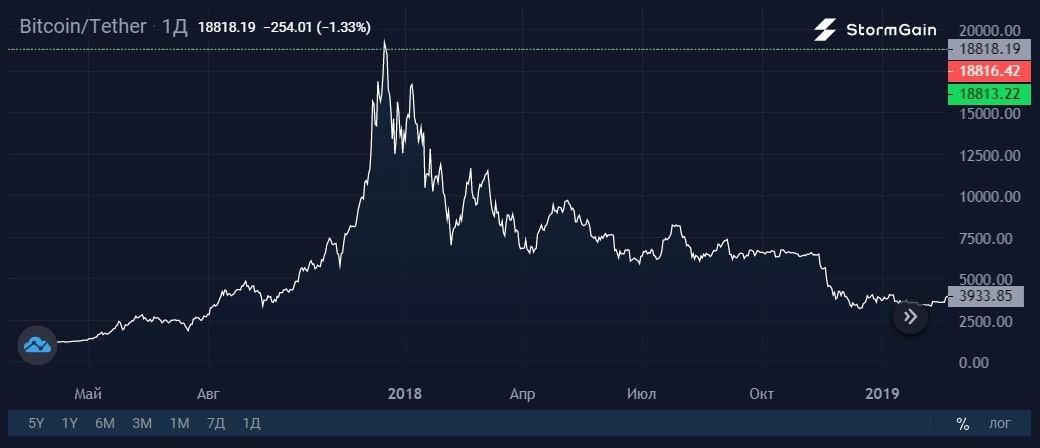

It's accused of inflating Bitcoin's price with Bitfinex in 2017 when the cryptocurrency rose from $2,300 to $19,000, and USDT's capitalisation jumped from $100 million to $2.2 billion. The plaintiffs are asking the court to prove the validity of printing such an amount of stablecoins.

On 20 September, the court demanded financial statements from the company on the movement of funds, including any cryptocurrency transactions and transfers to third parties. The lawsuit, which began back in 2019, intensified before the passage of a US law on stablecoin issuers. Things are taking a bad turn for Tether, where loyalty alone may not be enough to maintain good relations with regulators.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.