Americans are heavily investing in Bitcoin

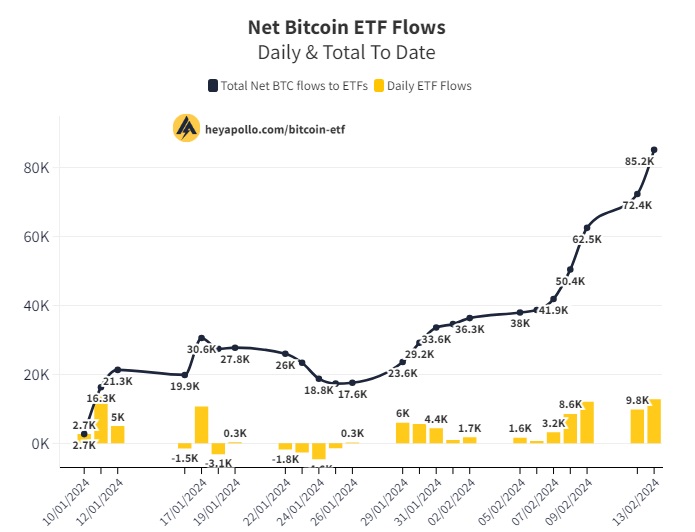

American investors' demand for Bitcoin is outpacing even the most optimistic forecasts. According to CryptoQuant, spot ETFs are responsible for 71% of all investments received in recent weeks. The inflow of funds pushed the cryptocurrency above $50,000 per BTC.

It's also noteworthy that the rate of inflow in the ETFs is gaining momentum. Over the past four days, more was invested than in the first 20 days. That's 43,000 BTC versus 42,000 BTC, respectively.

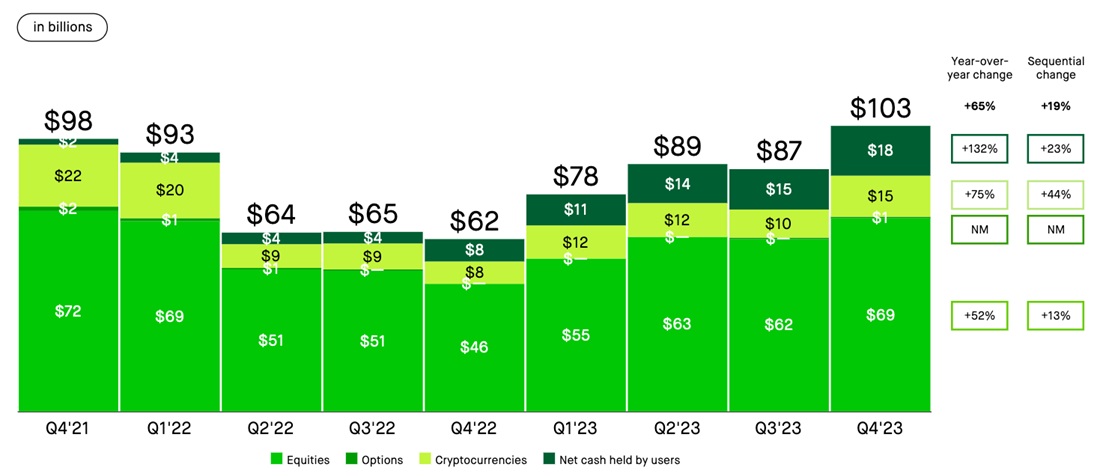

Apart from spot ETFs, US trading platforms recorded a strong influx of interest in cryptocurrency. Reporting on its Q4 results, Robinhood stated that the volume of cryptocurrency trading grew by 89% compared to the previous period. At the same time, with the emergence of ETFs, interest in spot trading hasn't decreased. Only 5% of volume was related to ETFs, while the remaining 95% came from the direct exchange of Bitcoin.

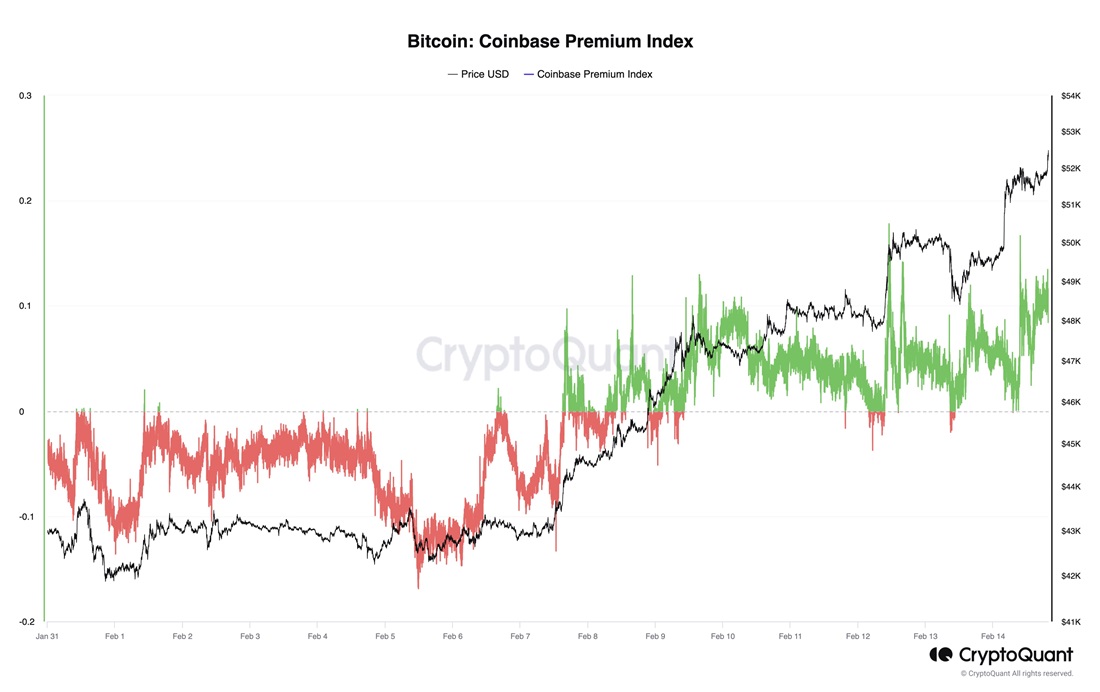

Coinbase has a similar story, doubling its volume in Q4 and posting a profit of $0.02 per share instead of the projected loss of $0.01. Increased demand for Bitcoin is also evidenced by the rising premium on the cryptocurrency exchange.

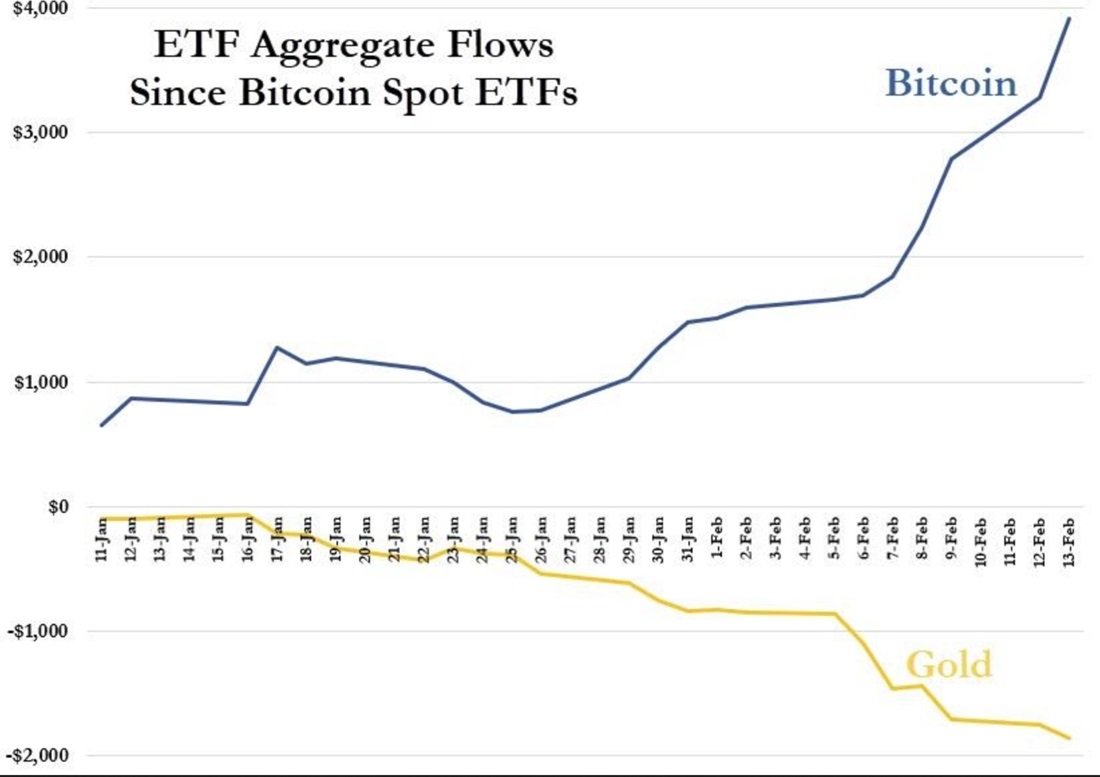

A curious trend is the outflow of investments from gold ETFs. At the moment, there's no clear evidence that the money is going out of gold ETFs and into Bitcoin ones, but the chart hints at the existence of such a correlation. In 2024, outflows from gold funds totalled $2.4 billion, with the BlackRock-managed fund alone accumulating over $5 billion in investments.

If the momentum of investment inflows into Bitcoin products continues, it could take Bitcoin's price to the six-figure mark as early as this year.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.