Ethereum faces another threat in 2024

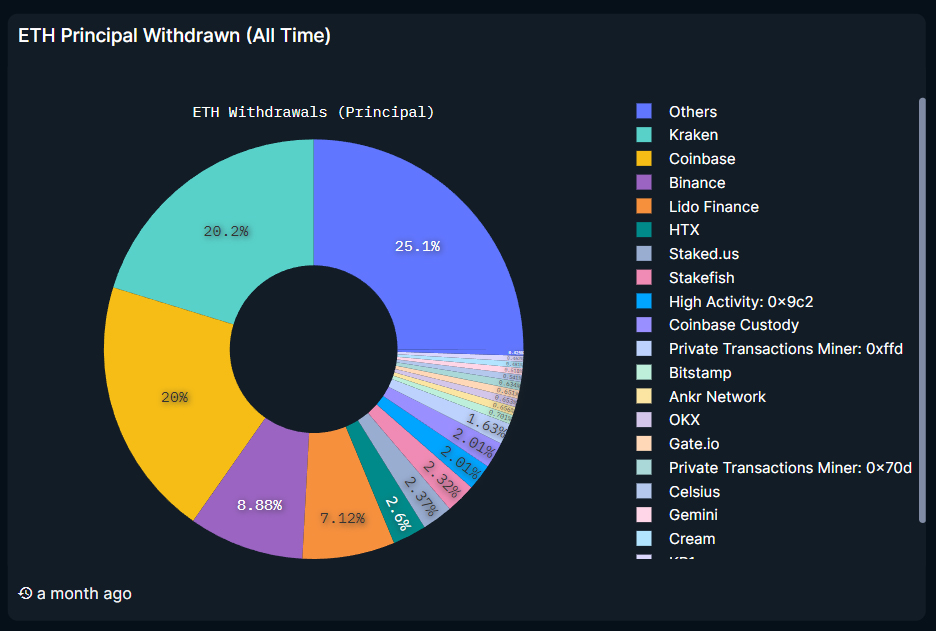

After transitioning to PoS, the second-largest cryptocurrency faced a series of new challenges, the key one among them being the SEC's active enforcement policy. American crypto exchanges, which collectively accounted for more than a third of staked ETH, received pre-enforcement action notifications. Most of them agreed to the deal, which resulted in them closing off access to staking for retail investors. Kraken and Coinbase saw combined withdrawals of 40% or 2 million ETH (about $4.5 billion).

The drop in Ethereum's attractiveness as an investment for Americans made it weaker compared to both other altcoins and Bitcoin. In 2023, it lost 28% to Bitcoin, which is usually characteristic of a bear market.

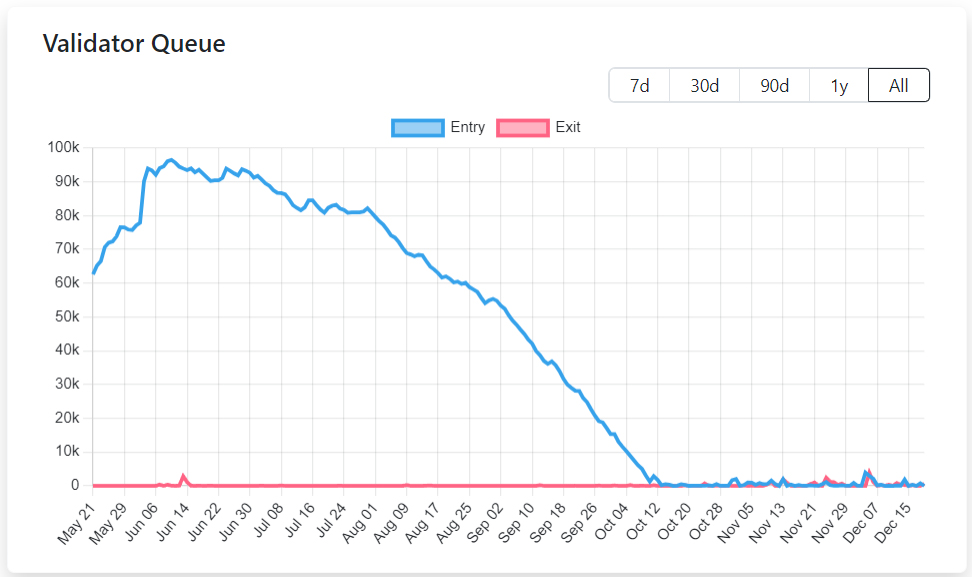

This serious lag couldn't be compensated for with the staking programme, the annual yield of which isn't even 4%. As a result, the queue of those wishing to stake ETH has sharply decreased. Now, the wait time to connect is less than one day.

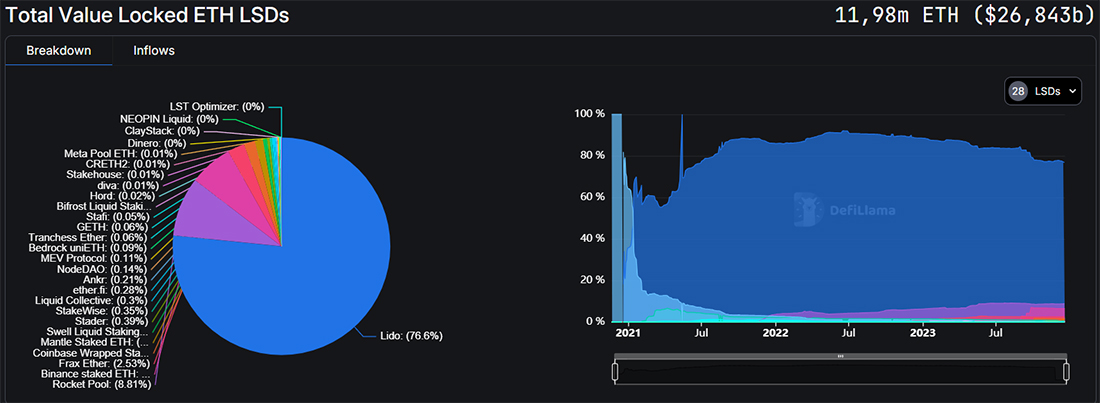

Another problem stemming from the transition to PoS is the network's growing centralisation. The Lido Finance platform now accounts for 32% of all staked funds and an impressive 77% in the liquid staking derivatives market. Liquid stakes are a programme that provides one's own token to replace staked ETH. Lido issues stETH, which is freely quoted in the cryptocurrency market.

For Ethereum, stETH's significant weight poses a systemic risk, as the collapse of the token will likely lead to turbulence among all interrelated assets. As a result, it's worth focusing on LDO, the parent token from Lido.

On 17 December, private investors in LDO filed a class action lawsuit against Lido Finance in the United States District Court for the Northern District of California's San Francisco Division. Their suit claims that they suffered losses as a result of the company's policies. The claim boils down to the fact that the token was released to the market at large after LDO was distributed to developers and early institutional investors. Two months after being listed on crypto exchanges, the token collapsed from $3 to $0.60.

The plaintiffs are asking for LDO as a security as the company acted out of "the expectation of profit from the actions of the management team." This is one of the points of the Howey Test that the SEC uses to determine the status of an asset. The lawsuit also notes that retail investors are unable to influence decisions since 64% of tokens are concentrated in the hands of developers and early investors.

If the court sides with the plaintiffs in 2024, the consequences for Lido could be very unfavourable. This, in turn, will negatively impact Ethereum.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.