Another Top 10 crypto exchange is facing big problems

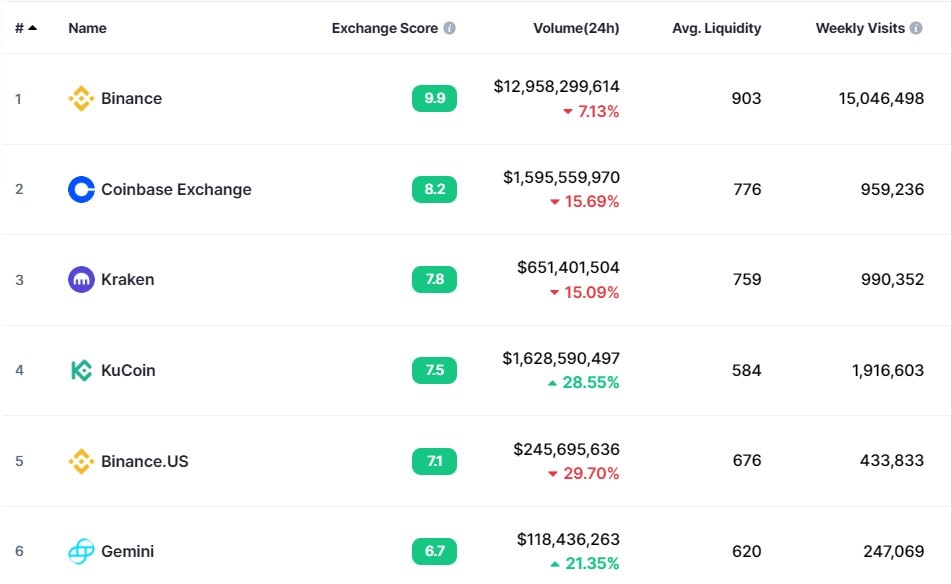

FTX is dragging its business partners down with it. This time, Genesis Global Trading, one of the biggest crypto lenders, has been hit with a liquidity deficit. It has ties with the major cryptocurrency fund Grayscale and the crypto exchange Gemini. The latter ranks sixth in CoinMarketCap's general ranking.

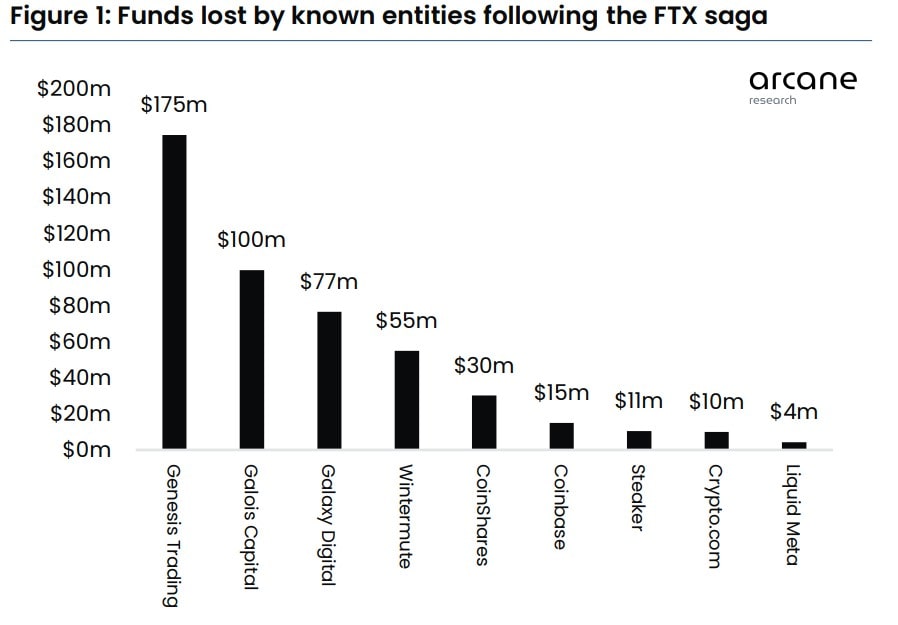

At the end of Q3, Genesis had total active credit lines of $2.8 billion. First, Three Arrows Capital's insolvency dealt a blow. In a filed lawsuit, the losses are estimated to be at $1.2 billion. Now, it has been revealed that the company acted as a key lender to FTX, providing $175 million to the crypto exchange.

FTX's collapse was the final straw. On 16 November, Genesis announced a temporary suspension of payments on loans due to insufficient liquidity.

The refusal to lend affected the Gemini crypto exchange, which is why it announced the same day that it was suspending payments on its Earn programme. Gemini Earn lets clients receive passive income for storing cryptocurrency. Last year, yields reached 8% APY.

Because a series of crypto project bankruptcies took investor anxiety to a new level, users perceived Gemini's refusal to uphold Earn as a sign of its insolvency. Clients ran for the exits. In the previous 24 hours, the net outflow has amounted to $485 million, the largest among crypto exchanges. According to CoinDesk, the total balance in Gemini crypto wallets has dropped to $1.7 billion.

The crypto exchange also experienced an overload and failures but has already reported that it's fixing the problem and resuming work. Other than freezing the Earn programme, Gemini is claiming that there are no restrictions for customers. Withdrawals are fully available.

Due to the high interconnectivity of several crypto projects, there is a risk of the chain reaction continuing. Crypto exchanges are facing a huge outflow of coins, and lenders are up against a shortage of liquidity. In these conditions, the likelihood of Bitcoin falling in the future remains high.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.