Avalanche losing ground in DeFi market

Competition in the decentralised finance (DeFi) market among blockchains with smart contract support continues to intensify. Ethereum has already lost 40% of its market share since January 2021, giving way to cheaper and faster alternatives. Avalanche is now having to put every effort into maintaining interest in its network.

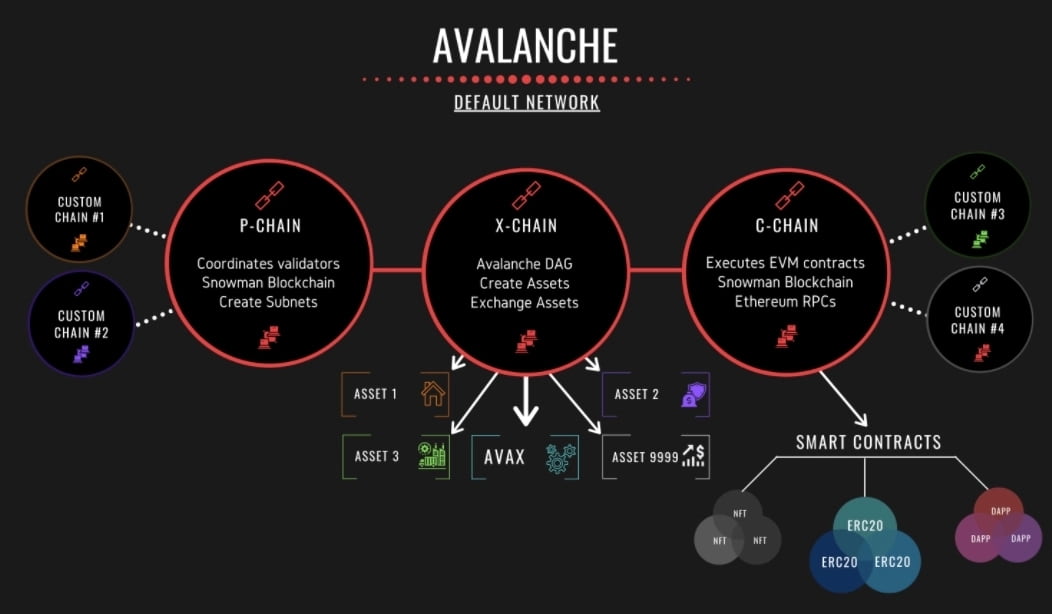

Avalanche, like the majority of other Ethereum competitors, is based on a proof of stake (PoS) protocol, but with its own unique characteristics. For example, it uses its own subnets to increase transaction speeds: X-Chain handles assets, while C-Chain is responsible for smart contracts and P-Chain coordinates validators. As a result, according to the developers' claims, Avalanche has the fastest transaction completion rate on the market – in under two seconds.

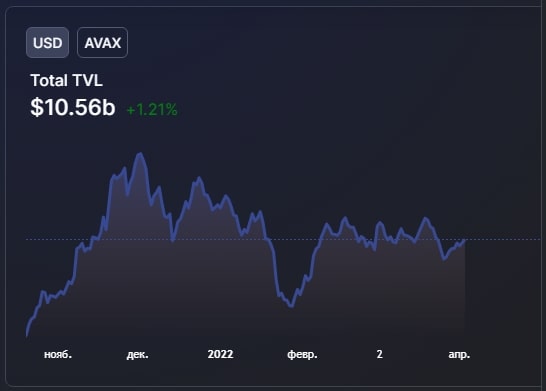

However, speed alone proved insufficient to support stable growth in the blockchain's usage. The total value locked (TVL) in DeFi is trending down: at its peak in December, this figure stood at $13.7 billion, while now it is just $10.6 billion. By way of comparison, Terra's TVL has risen by 50% to $30.7 billion over this same period. It's a similar story in decentralised apps, too, where the total number of network addresses was down by 16% in March.

Reduced demand for Avalanche solutions has led to the decline in value of its native coin AVAX. From its high in November 2021, it is now trading at a 33% discount. To put things into perspective, the above-mentioned Terra blockchain's coin, LUNA, hit new all-time highs in March.

In order to break through the negative trend, Avalanche announced last month that it was launching its own Avalanche Multiverse investment programme that would see $290 million set aside as stimulus for blockchain-based game and app development. Beyond this, some of these funds will be used to create the Defi Kingdom subnet, which will have an integrated KYC (Know Your Client) policy. The company believes that this will lead to increased interest from institutional investors. These beliefs would appear well-founded given Valkyrie Investments comments calling the Avalanche subnet with KYC "a significant step towards institutional adoption".

But what do you think, will the provision of grants for the development of new Avalanche-based apps translate to growth in the popularity of this network and its coins? Tell us in the comments section!

StormGain analytical group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.