What is Proof of Stake?

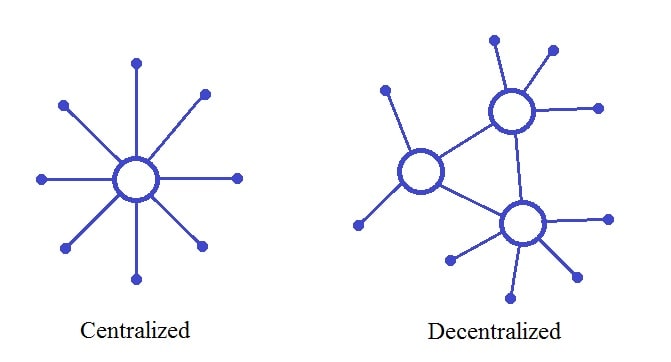

Blockchain is a distributed system with several thousand participants. The blockchain lacks central authority to check and update the ledger with new transactions due to its decentralised nature. Therefore, network members have to decide on an equal footing on which transactions should be added to the blockchain. To solve this problem, a mechanism called the consensus algorithm was created.

The consensus algorithm is a set of mathematical rules and functions that allow an agreement to be reached among all participants in the blockchain network, thus ensuring its performance. Consensus algorithms are designed to ensure the reliability of a network that includes a fraction of untrusted nodes. There are currently many different blockchain consensus algorithms, one of the most well-known and popular of Proof of Stake (PoS).

In this article, we'll discuss "What is proof of stake and proof of work?" and "What are proof of stake coins?" We'll also consider proof of stake advantages and disadvantages and several proof of stake examples.

Proof of Stake explained

What is the proof of stake? The idea of the Proof of Stake consensus algorithm was first proposed in 2011 as an alternative to the Proof of Work (PoW) algorithm. The first implementation of the PoS algorithm was introduced in 2012 in the cryptocurrency PPCoin, now known as PeerCoin.

How Does Proof of Stake Work?

Proof of Stake is a consensus algorithm in which the chance to add a new block to the blockchain and receive a reward for this is proportional to the number of coins the user (validator) holds and reserves for this purpose as a stake. The age of the stake and other indicators that confirm the user's interest in developing the network can be considered. It's worth noting that block validators in blockchains using the PoS algorithm are usually called forgers, not miners.

Proof of Work vs Proof of Stake

The Proof of Stake algorithm was created to solve the problems inherent in the Proof of Work algorithm. In PoW blockchains, transactions are verified by miners who use the computing power of special mining hardware to solve complex mathematical puzzles. The first miner to solve the puzzle adds a new block to the blockchain and receives a reward in the form of a cryptocurrency for this. Although the process of solving these puzzles consumes a large amount of electricity, these calculations serve no useful purpose other than determining who will add the next block.

Proceeding with our proof of work vs proof of stake discussion, it's worth noting that PoS-based blockchains do not need to consume large amounts of electricity to form new blocks. Thanks to the algorithm's energy efficiency, the network participants' costs for maintaining the network are significantly reduced. This, in turn, removes the need to create new coins as a reward for adding a new block and allows the network to pay only transaction fees for doing so.

Apart from this, mining is still subject to the problem of centralisation. More than 70% of Bitcoin's hashrate is currently located in one country, China. Given the Chinese government's unfriendly view of cryptocurrencies, this situation creates risks for the Bitcoin network. For a cryptocurrency based on the Proof of Stake algorithm, the process of generating new blocks is not tied to either the owners of large amounts of expensive equipment or to regions with cheap electricity.

Another important advantage is that, although it is easier to commit a 51% attack in PoS cryptocurrencies, doing so would be pointless since the attackers would need to accumulate 51% of the cryptocurrency. That means they would only be harming themselves with the attack.

Masternode vs Proof of Stake

Some cryptocurrencies use masternodes, which are servers on a cryptocurrency network used to perform functions not available to regular nodes. These functions may include anonymising transactions, confirming them and participating in network management. Generally speaking, to create a masternode, collateral in a certain amount of the network's cryptocurrency is required. In this case, the network periodically pays a reward to the owner of the masternode.

Comparing masternodes and the Proof of Stake algorithm is not entirely correct. Masternodes are an additional tool used both in PoS-based and PoW-based cryptocurrencies and those that use hybrid variants. But, from the point of view of making money on cryptocurrencies, there's still room for some comparison. As such, when compared with staking, although much more expensive, installing a masternode still brings higher, more stable income.

Criticism of the Proof of Stake algorithm

Despite the obvious advantages of Proof of Stake, there are several concerns about it. Here's why proof of stake is bad:

- Proof of Stake provides additional incentives to hoard funds, which can lead to network centralisation.

- In addition, if a small group of people with enough funds band together, they can impose their own rules for how the cryptocurrency should function, something most minor users without control over forging would disagree with.

- Another problem with the PoS algorithm is the initial distribution of coins. To stake coins, you first need to generate them in some way. To get around this problem, PoS-based cryptocurrencies have to use various methods for the initial distribution of coins, for example, a Proof of Work algorithm.

Advantages and disadvantages of the Proof of Stake algorithm

Advantages | Disadvantages |

Energy efficiency | The incentive to hoard coins |

No need for powerful, expensive mining equipment | A small group of major coin holders can dictate their rules to the entire network |

The ability to effectively counter centralisation | The initial coin distribution problem |

The pointlessness of a "51% attack" |

Best Proof of Stake coins

Here is a list of the best Proof of Stake crypto coins at the moment.

Best Proof of Stake (PoS) coins list

Name | Description |

TRON (TRX) | The coin for a decentralised entertainment content-sharing platform |

Tezos (XTZ) | The token for an open-source platform for assets and applications |

VeChain (VET) | The token for a product labelling and logistics platform |

Qtum (QTUM) | The token for a smart contract blockchain platform and value transfer protocol |

Decred (DCR) | A cryptocurrency with a focus on community input and open governance |

Cardano (ADA) | The cryptocurrency of a multi-level blockchain platform designed to create decentralised applications based on smart contracts |

Cosmos (ATOM) | The cryptocurrency of a platform designed to solve the problem of blockchain scalability |

Ethereum and Proof of Stake

The developers of the second-most-popular cryptocurrency in the world, Ethereum, have long announced their intention to switch to the Proof of Stake algorithm. The date of this transition to the PoS algorithm was repeatedly postponed, but finally, on 1 December 2020, "Phase 0" began. The newly created Beacon Chain, a Proof of Stake blockchain, will act as the central coordination hub of Ethereum 2.0. Currently, the date of the full transition to the PoS is unknown, but it is assumed that it will take place in 2021.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What does proof of stake mean in crypto?

Crypto proof of stake, often called PoS, is a consensus mechanism many cryptocurrencies utilise. In this system, cryptocurrency owners can stake their coins to gain the privilege of verifying new blocks of transactions and appending them to the blockchain. The proof of stake crypto technique offers an alternative to proof of work, the initial consensus mechanism created for cryptocurrencies. Due to its superior energy efficiency, proof of stake has gained popularity amid growing concerns about the environmental impact of crypto mining.

Is proof of stake decentralised?

Proof of Stake (PoS) is a decentralised consensus mechanism utilised in blockchain technology. In PoS, network participants, known as validators, stake a certain amount of cryptocurrency. They are then randomly chosen to validate and propose new blocks to the blockchain. This random selection encourages maximum node participation and contributes to the network's decentralisation.

The degree of decentralisation may vary based on specific PoS implementations and how stakes are distributed among validators. Consider the following proof of stake example. Ethereum's planned Casper update aims to enhance decentralisation by transitioning from Proof of Work (PoW) to a PoS consensus mechanism.

Which crypto uses proof of stake?

Consider the following proof of stake cryptocurrency examples:

- BitDAO (BIT) is a decentralised autonomous organisation (DAO) focused on decentralised finance (DeFi) with strong support from industry figures like Peter Thiel.

- Cardano (ADA). Known for its research-driven approach, scalability, and energy-efficient crypto proof of stake consensus algorithm.

- Solana (SOL) gains traction for its fast and scalable network, offering high staking rewards for validators.

- Algorand (ALGO) is one of the best proof of stake crypto examples for its pure PoS consensus algorithm, partnerships, and high transaction throughput.

- Polkadot (DOT) offers interoperability and scalability through sharding, with significant staking rewards.

- Tezos (XTZ) emphasises governance and community-driven decision-making, attracting adoption for its self-amending protocol.

- Polygon (MATIC) focuses on interoperability, allowing seamless asset transfer between blockchain networks.

- Binance Coin (BNB), created by the Binance exchange, is used for trading fees and launching new projects with high staking rewards.

- Ethereum 2.0 (ETH) transitioned from proof of work (PoW) to PoS, offering staking opportunities and significant adoption.

Why is proof of stake bad?

Certain implementations of proof of stake may render blockchains more susceptible to attacks than proof of work, such as low-cost bribe attacks. This increased vulnerability diminishes the overall security of the blockchain. In a proof-of-stake system, validators who possess substantial amounts of a blockchain's token or cryptocurrency could wield disproportionate influence.

Is proof of stake secure?

There are specific proof of stake advantages and disadvantages that investors should consider. PoS is commonly regarded as secure but has potential risks and vulnerabilities similar to any consensus mechanism. In PoS, validators lock up a certain amount of cryptocurrency as their "stake" and are randomly selected to validate and propose new blocks. If they improperly validate data, they may face penalties such as losing some or all of their stake. This setup encourages honest behaviour from validators.

Let's consider another proof of stake example. A validator holding a large amount of the cryptocurrency could wield a disproportionate influence on the network. Moreover, submitting bad data or fraudulent transactions could result in punishment through "slashing", leading to the loss of staked coins.