Binance under siege, plus record outflows in 2023

Regulators began the new year with a massive strike against the cryptocurrency market. Kraken, which was (essentially) banned from providing staking services, was the first crypto exchange to suffer a blow. Paxos, which is responsible for issuing USDP, PAXG and the Binance BUSD stablecoin, was next up.

The SEC sent Paxos a Wells Notice (pre-enforcement action notification) despite regular audits and a licence from the New York Department of Financial Services (NYDFS), which has also initiated an investigation against the company. No details have been disclosed yet, but the claims are likely due to Paxos' partnership with Binance, a potential criminal case against the cryptocurrency exchange's management, the existence of an unsecured BUSD duplicate on the BEP-20 token standard and the possible recognition of stablecoin as a security.

Upon receiving the notice, Paxos announced that it would stop minting BUSD (an ERC-20 token) from 21 February. Support for existing coins will remain in place until at least February 2024. In other words, only one-way exchanges remain, and the stablecoins coming to Paxos will be burned.

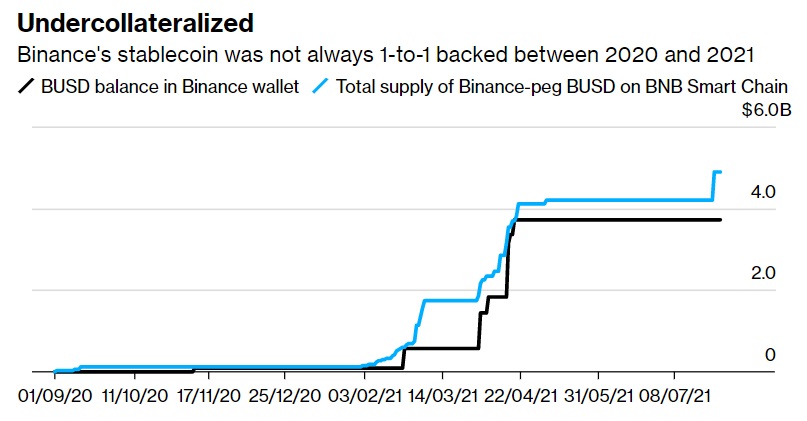

It's worth noting that Binance independently issues BUSD in the form of the BEP-20 token since it is the token's sole guarantor. Meanwhile, in 2021, supply exceeded collateral by more than $1 billion, and client funds were sometimes mixed with reserves. In a warning to consumers, NYDFS directly pointed to the lack of connection of Paxos and regulators with the BEP-20 duplicate, thereby hinting at its attitude to what is happening.

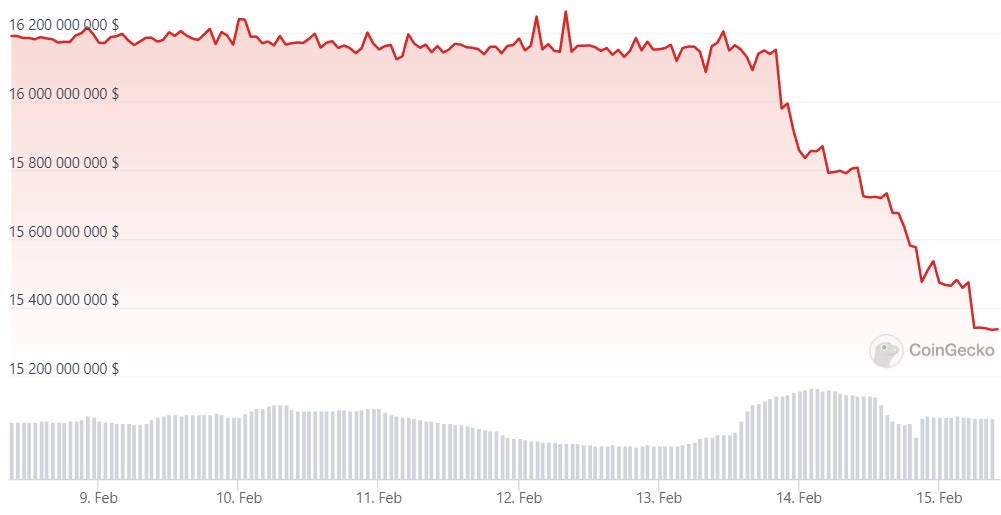

Paxos ending support for BUSD led to a significant outflow of funds from the stablecoin. Users rushed to exchange BUSD for USDT, resulting in BUSD's capitalisation falling by 6% to $15.3 billion in two days.

Anticipating possible shocks and liquidity difficulties, some users rushed to leave the crypto exchange. In the previous 24 hours, the net outflows from Binance totalled $831 million, a record high since FTX's collapse.

The shocks impacted the value of the native coin, as well, with BNB down 6% to $297 in the same period.

According to Bloomberg, a complaint against Binance to the NYDFS about under-secured BUSD was filed by Circle last year. This is a continuation of the undeclared war between stablecoin issuers, which escalated with the introduction in September 2022 of the automatic conversion of some stablecoins, including USDC, to BUSD on Binance.

Tensions between companies don't justify lapses in financial management, and increased industry oversight threatens to lead to further claims against market participants.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.