Volume of accumulated Bitcoin hits a new high

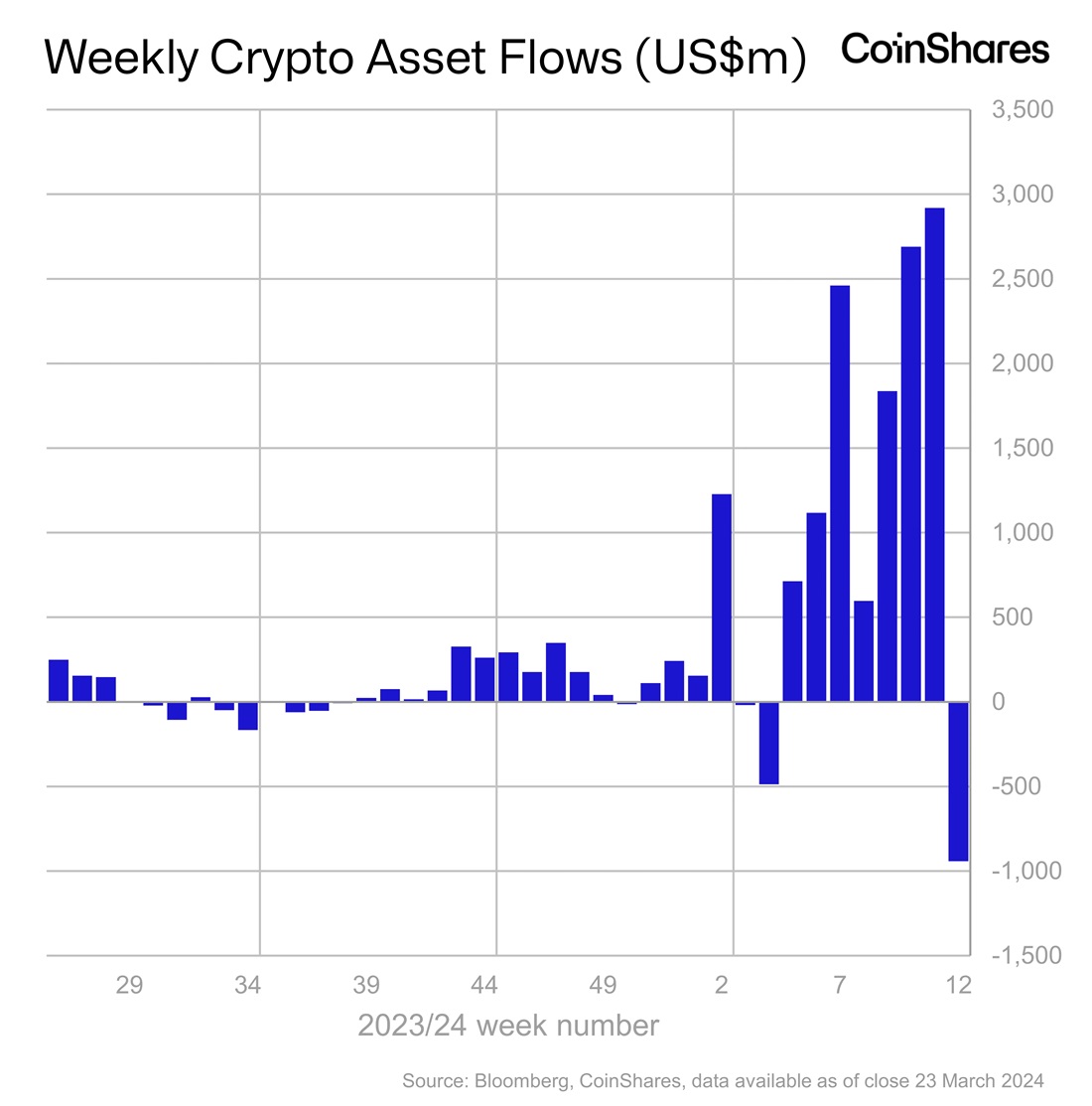

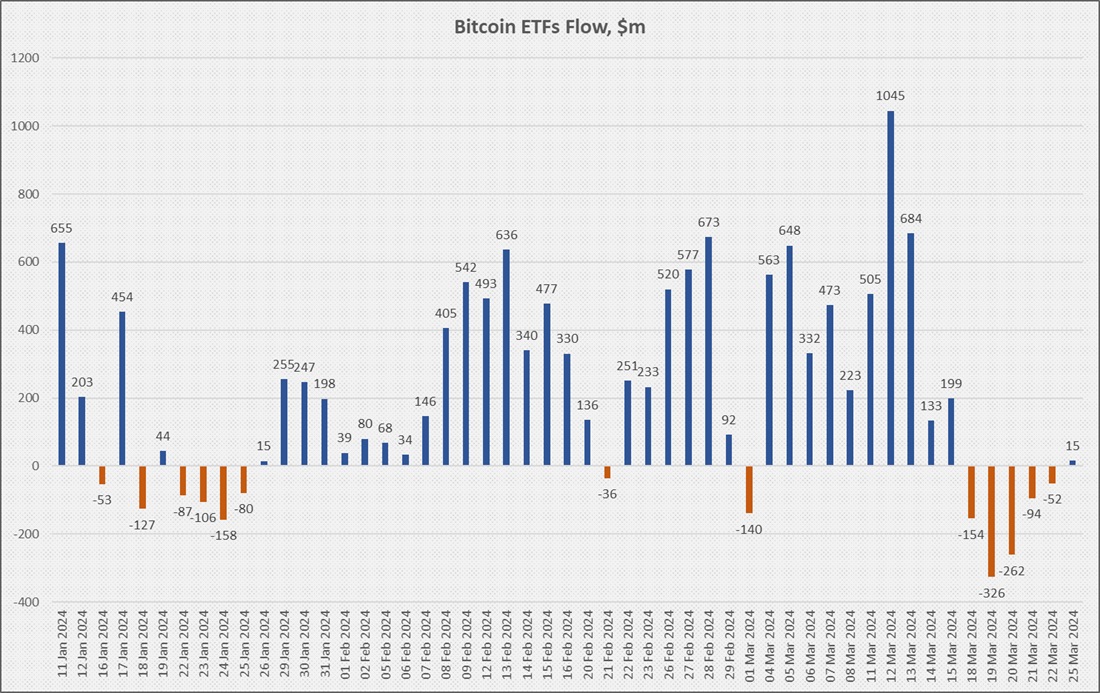

Last week saw a record net outflow of $942 million from ETFs, with Bitcoin accounting for 96% of those funds. In a note to investors on 21 March, analysts at JPMorgan noted the cryptocurrency was overbought and risked a continued correction.

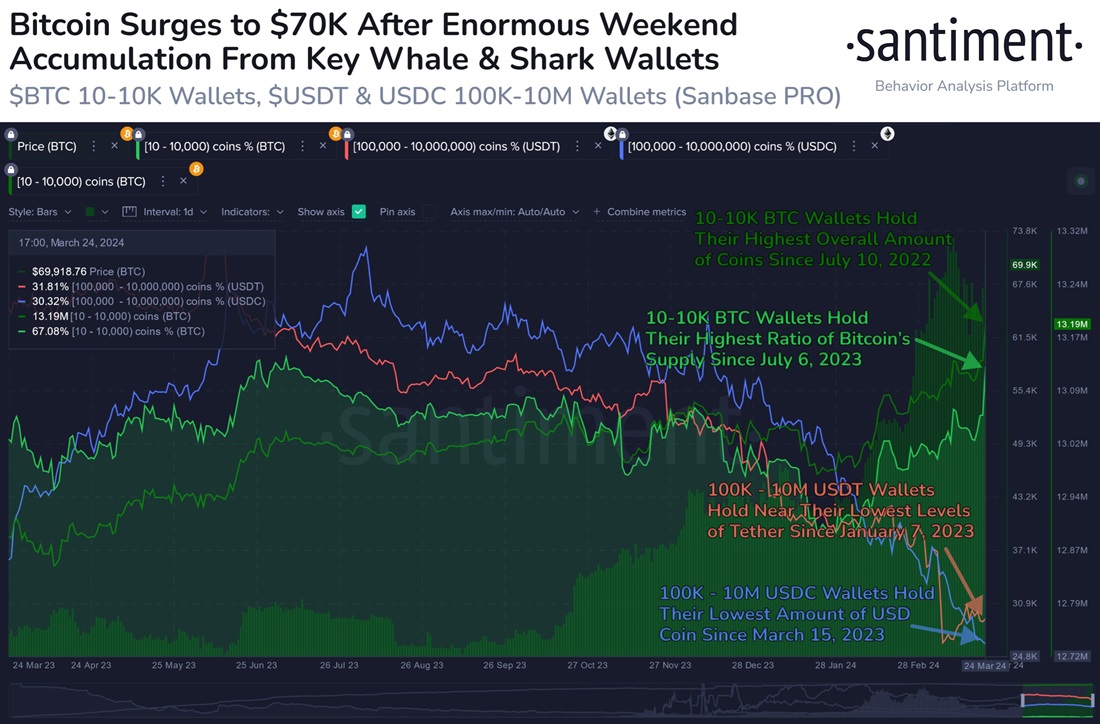

Investors' decision to sell was influenced by the desire among long-term holders, whales and miners to take profits in March after hitting a new record high for Bitcoin.

However, by the end of last week, the mood had dramatically changed, and while crypto funds continued to show cumulative outflows, cryptocurrency exchanges saw an increased withdrawal of coins to cold wallets. This is one of the signs that market participants are unwilling to part ways with coins at current prices.

The outflow from Coinbase sharply accelerated in March, shrinking the crypto exchange's reserves to 344,900 BTC (excluding institutional assets). This is a level last seen in 2015. The total reserves across all crypto exchanges also dropped after rising earlier in the month. That figure is now 1.98 million BTC.

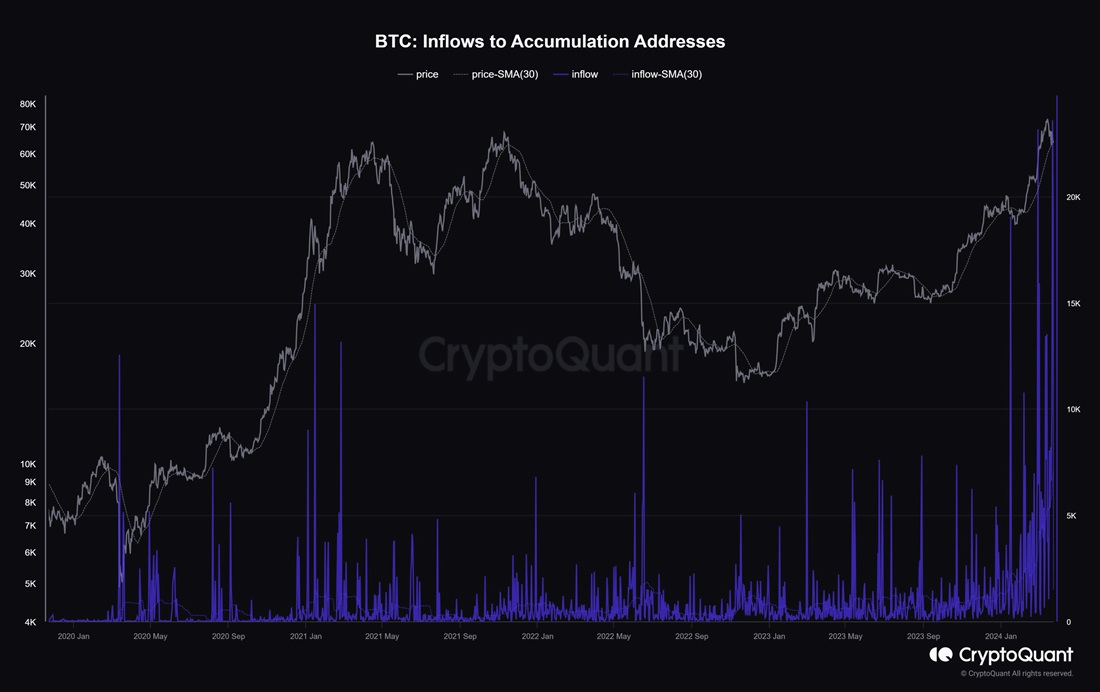

However, a tendency to hodl was most clearly seen in accumulation addresses, which set an inflow record on 22 March of 25,300 BTC. The signs of an accumulation address (miner and crypto exchange addresses are excluded) include:

- The absence of outgoing transactions

- More than two incoming transactions

- The latest activity taking place within the past seven years

- A balance of over 10 BTC.

If we break down cohorts into groups, whales and sharks have moved back to accumulating Bitcoin. They're responsible for the significant loss seen in stablecoins' reserves.

In February, BTC's price was boosted by significant inflows into spot ETFs, which faded by mid-March. However, there was no significant sell-off since other market participants quickly moved from taking profits to accumulating coins.

Despite the price 'prematurely' reaching an all-time high, most crypto enthusiasts believe that Bitcoin is very likely to keep going higher. Anthony Scaramucci, the founder of Skybridge Capital, give investors an interesting piece of advice on how to keep their nerves at bay with the sharp price changes:

Act like you're dead with your bitcoin and don't sell your bitcoin.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.