Bitcoin briefly breaks $30K following false rumour of spot ETF approval

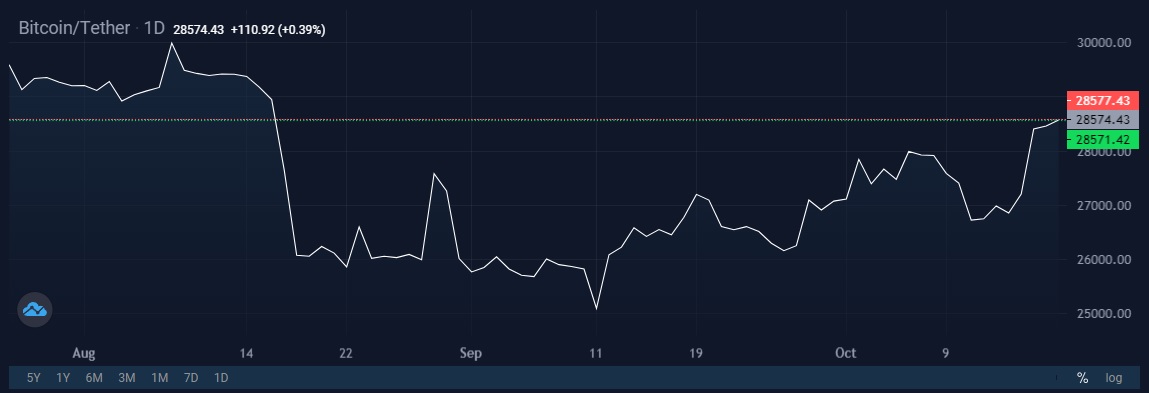

Bitcoin (BTC) experienced a sudden and significant price surge, briefly rising past $30,000 on Monday. The reason behind this surge was a false report suggesting that the US Securities and Exchange Commission (SEC) had granted approval for the first spot Bitcoin ETF by BlackRock.

In a tweet that has since been deleted, the crypto-focused news outlet Cointelegraph erroneously announced on Twitter: "BREAKING: SEC APPROVES ISHARES BITCOIN SPOT ETF." This referred to the iShares ETF brand owned and operated by investment giant BlackRock. Consequently, Bitcoin's value swiftly increased by over 10%, reaching a high of $30,000. However, these gains swiftly dissipated after a spokesperson from BlackRock informed Bloomberg that the company's application for a spot Bitcoin ETF was still undergoing review by the SEC.

In response to the misinformation, Cointelegraph issued a follow-up tweet, stating: "We apologise for a tweet that led to the dissemination of inaccurate information regarding the BlackRock Bitcoin ETF. An internal investigation is currently underway." On Monday, the outlet also issued an article clarifying how the misunderstanding came about. But the crypto market had already been rocked by the rumour, with many traders being caught off-guard and losing their leveraged positions. Data from CoinGlass revealed that $81 million worth of short positions (bets against higher prices) were liquidated on the move to $30,000.

As a result of these developments, Bitcoin rolled back some of its gains, now showing an approximate 3% increase and hovering slightly above the $28,000 mark. During the dump, about $31 million in long positions (bets on higher prices) were also liquidated. Although brief, the volatility introduced by the social media rumour shows just how suddenly dramatic price swings can be re-introduced to the crypto market after the relatively quiet summer period.

Error shows just how impactful the spot ETF approval could be

This episode of heightened Bitcoin price volatility underscores the expectations that investors have maintained concerning the SEC's approval of a spot Bitcoin ETF. While the agency has previously sanctioned Bitcoin futures ETFs, it has repeatedly either denied or postponed applications for Bitcoin spot ETFs over recent years. Nevertheless, hope has been rekindled with the entry of major asset management firms like BlackRock and Fidelity, both of whom submitted their own Bitcoin ETF applications.

Additionally, the optimism for a Bitcoin spot ETF received a boost following a court ruling in favour of Grayscale Investments. The court determined that the SEC's rejection of Grayscale's application to convert its Bitcoin trust fund into a spot Bitcoin ETF was unfounded. Recent media reports have indicated that the SEC does not plan to appeal this decision, which has given investors renewed hope of an imminent approval for a spot Bitcoin ETF. Notable figures, including Cathie Wood from Ark Invest, have expressed their belief that the SEC is making progress towards granting such approvals, potentially for a group of Bitcoin ETFs.

At present, the SEC is reviewing more than 10 spot Bitcoin ETF applications, signifying the significant interest and anticipation surrounding the potential approval of these investment vehicles.

Although the recent BTC price swings were based on a false rumour, sooner or later, the SEC will make its decision, and traders should be prepared to profit from the crypto volatility that will follow. To trade BTC and other cryptos with the best conditions on the market, make sure to use StormGain to maximise your profits.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.